Warren Buffett Dumps Bank Of America, Buys Big Into This Consumer Brand

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Warren Buffett Dumps Bank of America, Buys Big into This Consumer Brand: A Shift in Investment Strategy?

Oracle of Omaha Warren Buffett's Berkshire Hathaway recently made some significant portfolio adjustments, sparking intense speculation within the financial world. The most notable changes? A complete divestment from Bank of America (BAC) and a substantial increase in holdings of a prominent consumer brand: Coca-Cola (KO). This unexpected move has sent ripples through the market, prompting analysts to re-evaluate Buffett's investment strategy and the future outlook for both companies.

The news of Berkshire Hathaway's sale of its entire stake in Bank of America, a position held for years, came as a surprise to many. While BAC remains a fundamentally strong institution, Buffett's decision suggests a potential shift in his outlook on the financial sector, particularly concerning the potential impact of rising interest rates and economic uncertainty. This move highlights the dynamic nature of even the most seasoned investor's portfolio, underscoring the importance of adaptability in the ever-evolving market landscape.

<h3>The Coca-Cola Boost: A Classic Buffett Play?</h3>

In contrast to the Bank of America divestment, Berkshire Hathaway significantly increased its stake in Coca-Cola. This isn't entirely unexpected; Buffett has long been a vocal admirer of Coca-Cola's enduring brand power and consistent profitability. This renewed investment underscores Buffett's continued belief in the long-term potential of established consumer staples, even amidst economic headwinds.

- The Power of Brand Recognition: Coca-Cola's global brand recognition and loyal customer base represent a significant asset in the face of economic uncertainty. Consumers often gravitate towards familiar brands during times of economic stress, making Coca-Cola a relatively safe bet.

- Defensive Investment Strategy: This move could be interpreted as a defensive investment strategy, focusing on stable, predictable revenue streams in a potentially volatile market. Consumer staples like Coca-Cola typically exhibit greater resilience during economic downturns compared to more cyclical sectors.

- Long-Term Value Proposition: Buffett's investment philosophy centers on identifying companies with strong long-term value propositions. Coca-Cola's consistent track record of profitability and its ability to adapt to changing consumer preferences align perfectly with this philosophy.

<h3>What Does This Mean for Investors?</h3>

Buffett's actions often serve as a significant market indicator. While not a direct recommendation, his decisions can influence investor sentiment and trading activity. The divestment from Bank of America might signal a cautious approach to the financial sector in the near term, while the increased investment in Coca-Cola reinforces the perceived stability and enduring appeal of established consumer brands.

For individual investors, this news underscores the importance of diversification and a long-term investment strategy. It's crucial to conduct thorough due diligence and consider your own risk tolerance before making any investment decisions. Remember to consult with a qualified financial advisor for personalized guidance.

This shift in Berkshire Hathaway's portfolio offers valuable insights into the current market sentiment and potential future trends. While only time will tell the full implications of these moves, one thing is certain: Warren Buffett's decisions continue to shape the narrative of the financial world.

Further Reading:

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investment decisions should be based on your individual circumstances and risk tolerance.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Warren Buffett Dumps Bank Of America, Buys Big Into This Consumer Brand. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Villanovas Caa Football Exit Official Statement Released

Jun 05, 2025

Villanovas Caa Football Exit Official Statement Released

Jun 05, 2025 -

420 000 Less In Retirement Examining The Republican Plans Effect On Those In Their 30s

Jun 05, 2025

420 000 Less In Retirement Examining The Republican Plans Effect On Those In Their 30s

Jun 05, 2025 -

How The Republican Retirement Plan Impacts 30s Savings 420 000 Explained

Jun 05, 2025

How The Republican Retirement Plan Impacts 30s Savings 420 000 Explained

Jun 05, 2025 -

Update Blake Lively Withdraws Two Claims In Lawsuit Against Justin Baldoni

Jun 05, 2025

Update Blake Lively Withdraws Two Claims In Lawsuit Against Justin Baldoni

Jun 05, 2025 -

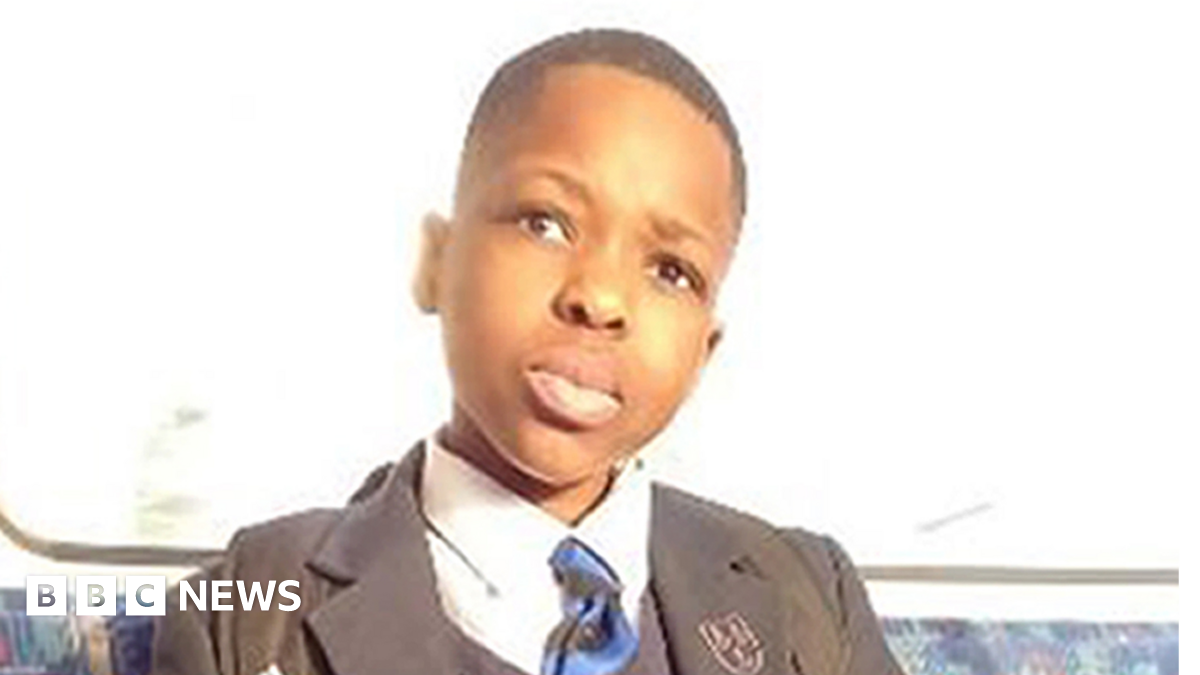

Daniel Anjorin Murder Case Prosecution Presents Evidence Against Marcus Monzo

Jun 05, 2025

Daniel Anjorin Murder Case Prosecution Presents Evidence Against Marcus Monzo

Jun 05, 2025

Latest Posts

-

Ryo Otas Eighth Bases Loaded Grand Slam Narrows The Gap

Aug 17, 2025

Ryo Otas Eighth Bases Loaded Grand Slam Narrows The Gap

Aug 17, 2025 -

Orixs Nakagawa Delivers Two Run Blast Sixth Inning Comeback

Aug 17, 2025

Orixs Nakagawa Delivers Two Run Blast Sixth Inning Comeback

Aug 17, 2025 -

Inflations Impact Tracking The Shifting Prices Of Everyday Groceries

Aug 17, 2025

Inflations Impact Tracking The Shifting Prices Of Everyday Groceries

Aug 17, 2025 -

Experiencing The Blues A Mississippi Delta Towns Rich Musical Heritage

Aug 17, 2025

Experiencing The Blues A Mississippi Delta Towns Rich Musical Heritage

Aug 17, 2025 -

Oregon Why Its Ranked The Worst State To Relocate To

Aug 17, 2025

Oregon Why Its Ranked The Worst State To Relocate To

Aug 17, 2025