Warren Buffett Dumps Bank Of America, Loads Up On Skyrocketing Consumer Brand

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Warren Buffett Dumps Bank of America, Loads Up on Skyrocketing Consumer Brand: A Smart Move or a Gamble?

Oracle of Omaha Makes Headlines with Significant Portfolio Shifts

Warren Buffett, the legendary investor and CEO of Berkshire Hathaway, has once again sent shockwaves through the financial world. Recent SEC filings reveal a significant shift in Berkshire's portfolio, with a complete divestment from Bank of America and a substantial increase in holdings of an unnamed, rapidly growing consumer brand. This unexpected move has sparked intense speculation and analysis among market experts and individual investors alike.

The sale of Bank of America stock, a long-held position for Berkshire, marks a notable departure from Buffett's typically conservative investment strategy. While Bank of America remains a financially sound institution, the decision signals a potential reevaluation of the banking sector's future prospects within Buffett's investment philosophy. Analysts are pointing to rising interest rates and potential economic headwinds as possible contributing factors to this divestment. [Link to article on rising interest rates]

The Mystery Consumer Brand: A High-Stakes Bet?

The far more intriguing aspect of Berkshire's recent activity is the significant investment in a currently unidentified, rapidly expanding consumer brand. This move represents a departure from Berkshire's traditional focus on established, blue-chip companies. The secrecy surrounding the brand's identity has fuelled market speculation, with various consumer goods companies being touted as potential candidates. The significant increase in Berkshire's stake suggests Buffett sees immense potential for growth in this particular sector.

Several factors could be driving this bold investment strategy. The explosive growth of e-commerce and the shift in consumer preferences toward direct-to-consumer brands may be key elements in Buffett’s decision. This new investment may represent a calculated attempt to capitalize on these emerging trends and tap into a younger demographic.

What This Means for Investors

Buffett's actions always carry significant weight in the investment world. This dual move – exiting a long-held position in a stalwart financial institution and embracing a seemingly riskier bet on a fast-growing consumer brand – highlights a willingness to adapt to a changing market landscape.

Key takeaways for investors:

- Diversification is crucial: Buffett's moves underscore the importance of diversification within a portfolio. No single sector or stock is guaranteed to perform consistently.

- Adaptability is key: Even legendary investors adjust their strategies in response to evolving market dynamics.

- Due diligence is paramount: Before making any investment decisions, conduct thorough research and assess your own risk tolerance.

While the specific details regarding the mystery consumer brand remain undisclosed, the overall impact of these portfolio shifts is undeniable. It signals a potential paradigm shift in Berkshire Hathaway's investment approach, indicating a willingness to embrace newer, faster-growing companies within the consumer sector. This development will undoubtedly be closely monitored by market analysts and individual investors in the coming months.

Call to Action: Stay informed about the latest market trends and investment strategies. Consider seeking advice from a qualified financial advisor before making any significant investment decisions. [Link to relevant financial planning resources]

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Warren Buffett Dumps Bank Of America, Loads Up On Skyrocketing Consumer Brand. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

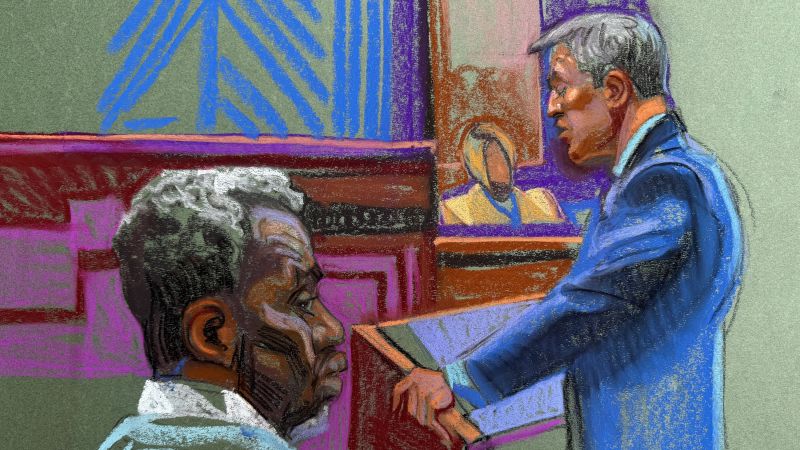

Latest News And Updates On The Sean Combs Trial

Jun 04, 2025

Latest News And Updates On The Sean Combs Trial

Jun 04, 2025 -

Ukraines Drone Offensive What It Means For Russia And Western Allies

Jun 04, 2025

Ukraines Drone Offensive What It Means For Russia And Western Allies

Jun 04, 2025 -

Death Of Jonathan Joss Remembering The King Of The Hill Star

Jun 04, 2025

Death Of Jonathan Joss Remembering The King Of The Hill Star

Jun 04, 2025 -

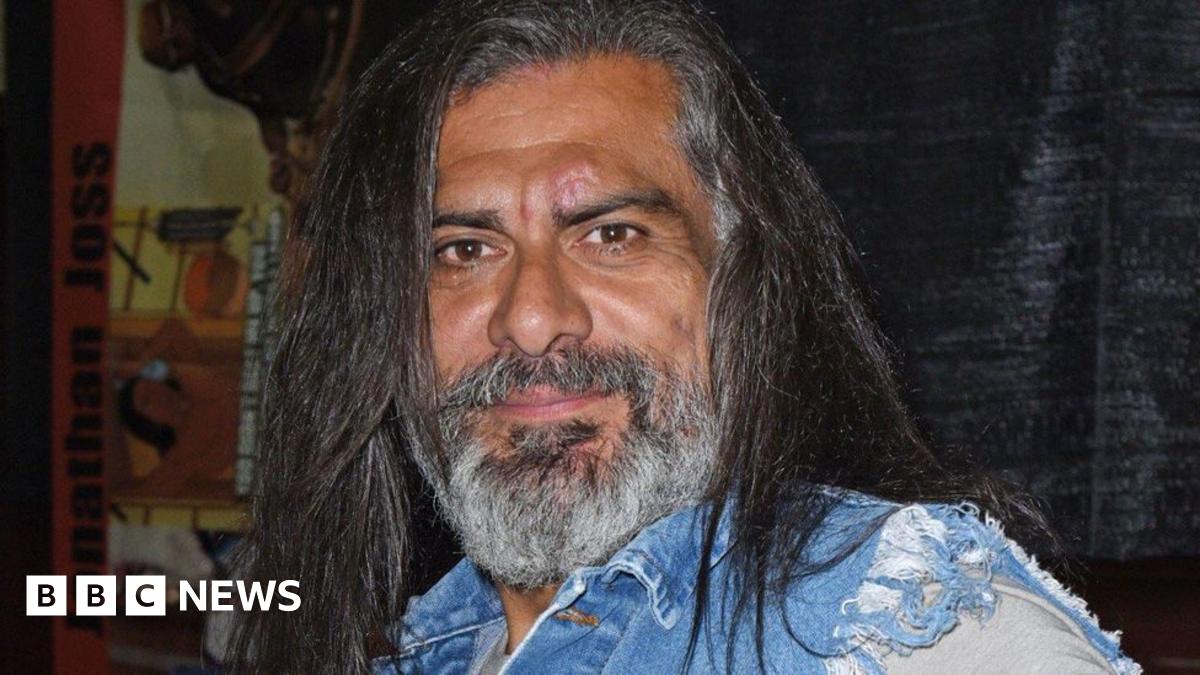

Death In The Dolomites Grieving Family Announces Passing Of Aziz Ziriat

Jun 04, 2025

Death In The Dolomites Grieving Family Announces Passing Of Aziz Ziriat

Jun 04, 2025 -

Day 8 French Open 2025 Complete Match Results And Highlights

Jun 04, 2025

Day 8 French Open 2025 Complete Match Results And Highlights

Jun 04, 2025

Latest Posts

-

Steve Guttenberg On Playing A Killer In Lifetimes New Movie

Jun 06, 2025

Steve Guttenberg On Playing A Killer In Lifetimes New Movie

Jun 06, 2025 -

Dallas Stars Future Uncertain After Coaching Change Announcement

Jun 06, 2025

Dallas Stars Future Uncertain After Coaching Change Announcement

Jun 06, 2025 -

Maxwell Anderson Found Guilty Milwaukee Jury Announces Verdict

Jun 06, 2025

Maxwell Anderson Found Guilty Milwaukee Jury Announces Verdict

Jun 06, 2025 -

Rain Doesnt Stop Teens Queuing For New Ni Release

Jun 06, 2025

Rain Doesnt Stop Teens Queuing For New Ni Release

Jun 06, 2025 -

Steve Guttenbergs Killer Role In Lifetimes Kidnapped By A Killer

Jun 06, 2025

Steve Guttenbergs Killer Role In Lifetimes Kidnapped By A Killer

Jun 06, 2025