Warren Buffett Dumps Long-Held US Investments: A Detailed Analysis

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Warren Buffett Dumps Long-Held US Investments: A Detailed Analysis

The Oracle of Omaha's surprising move sends shockwaves through the market. Warren Buffett's Berkshire Hathaway recently announced a significant reduction in its holdings of several long-held US equities, a decision that has left investors and analysts scrambling for answers. This unexpected shift in strategy marks a notable departure for the legendary investor, known for his buy-and-hold approach. But what prompted this dramatic change? Let's delve into a detailed analysis of Buffett's recent divestments and their potential implications.

Key Takeaways:

- Berkshire Hathaway significantly reduced its stakes in several major US companies.

- The move contrasts with Buffett's traditional buy-and-hold investment strategy.

- Analysts are speculating on the reasons behind this strategic shift, considering factors ranging from economic uncertainty to sector-specific concerns.

- The impact on the affected companies' stock prices and the broader market remains to be seen.

Which Stocks Did Buffett Sell?

The recent filings revealed significant decreases in Berkshire Hathaway's positions in companies like [mention specific companies and percentage reductions - link to SEC filings if available]. These divestments are particularly noteworthy given Berkshire's long-standing investments in these businesses. For example, [mention a specific company and its history with Berkshire Hathaway, adding details like the length of the investment and any previous positive statements made by Buffett about the company]. The scale of the sell-off indicates a potential reevaluation of Berkshire's portfolio strategy.

Why the Change? Speculation and Analysis

Several theories are circulating among market analysts to explain this surprising shift.

-

Economic Uncertainty: The current economic climate, characterized by [mention relevant economic factors like inflation, interest rate hikes, recessionary fears], may have prompted Buffett to reduce exposure to certain sectors deemed more vulnerable. This aligns with his famously cautious approach to market volatility.

-

Sector-Specific Concerns: Some analysts suggest that the divestments might reflect concerns about the long-term prospects of specific sectors. For instance, [mention potential sector-specific concerns, referencing relevant news articles or reports].

-

Strategic Portfolio Rebalancing: Another possibility is that the move represents a strategic portfolio rebalancing, with Buffett shifting investments towards other sectors he deems more promising for future growth. This could include increased allocations to [mention potential sectors Buffett might be shifting towards, e.g., energy, technology].

Impact on the Market and Future Implications

The impact of Buffett's decisions is already being felt in the market. The affected companies experienced [mention the impact on the stock prices - positive or negative]. However, the long-term consequences are still unfolding. This move underscores the importance of diversification and the dynamic nature of even the most seasoned investors' strategies.

What does this mean for investors? Buffett's actions serve as a reminder that even the most successful investors adapt their strategies based on evolving market conditions. It highlights the need for continuous monitoring of your portfolio and a willingness to adjust your investment approach accordingly. While mimicking Buffett's every move is not advisable, studying his decisions can provide valuable insights into navigating market uncertainties.

Disclaimer: This article provides general information and analysis and does not constitute financial advice. Always conduct thorough research and consult with a financial advisor before making any investment decisions. The views expressed are based on publicly available information and are subject to change.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Warren Buffett Dumps Long-Held US Investments: A Detailed Analysis. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Analysis Proposed Republican Retirement Cuts And Their Effect On The 30 40 Age Group

Jun 04, 2025

Analysis Proposed Republican Retirement Cuts And Their Effect On The 30 40 Age Group

Jun 04, 2025 -

Planning For College Unlock The Potential Of A 529 Plan

Jun 04, 2025

Planning For College Unlock The Potential Of A 529 Plan

Jun 04, 2025 -

Carl Nassib Biography Achievements And Impact On Lgbtq Inclusion In Sports

Jun 04, 2025

Carl Nassib Biography Achievements And Impact On Lgbtq Inclusion In Sports

Jun 04, 2025 -

Lawsuit Update Blake Lively Dismisses Two Claims Against Justin Baldoni

Jun 04, 2025

Lawsuit Update Blake Lively Dismisses Two Claims Against Justin Baldoni

Jun 04, 2025 -

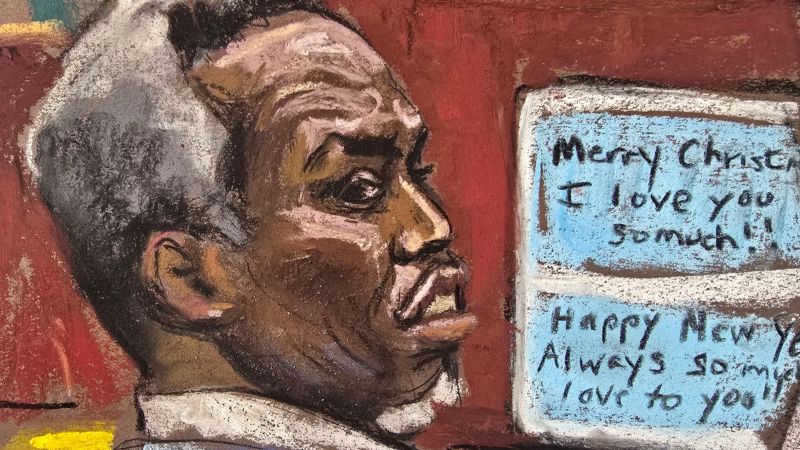

Inside The Sean Diddy Combs Trial Key Witnesses And Legal Arguments

Jun 04, 2025

Inside The Sean Diddy Combs Trial Key Witnesses And Legal Arguments

Jun 04, 2025

Latest Posts

-

Wwii Unexploded Bomb Forces Large Scale Cologne Evacuation

Jun 06, 2025

Wwii Unexploded Bomb Forces Large Scale Cologne Evacuation

Jun 06, 2025 -

Jessie J Announces Breast Cancer Diagnosis A Personal Journey

Jun 06, 2025

Jessie J Announces Breast Cancer Diagnosis A Personal Journey

Jun 06, 2025 -

Patriot League Welcomes Villanova As Associate Member For Football Beginning 2026

Jun 06, 2025

Patriot League Welcomes Villanova As Associate Member For Football Beginning 2026

Jun 06, 2025 -

Major Rescue Operation 22 Crew Members Saved From Burning Car Carrier

Jun 06, 2025

Major Rescue Operation 22 Crew Members Saved From Burning Car Carrier

Jun 06, 2025 -

Car Carrier Fire In North Pacific 22 Crew Members Rescued

Jun 06, 2025

Car Carrier Fire In North Pacific 22 Crew Members Rescued

Jun 06, 2025