Warren Buffett Sells Major US Holdings: What It Means For Investors

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Warren Buffett Sells Major US Holdings: What It Means for Investors

Oracle of Omaha's moves always send shockwaves through Wall Street, and his recent divestment from major US holdings is no exception. The news that Berkshire Hathaway, Warren Buffett's investment behemoth, has significantly reduced its stakes in several prominent companies has left investors scrambling to understand the implications. This article delves into the details of these sales, explores the potential reasons behind them, and offers insights into what this could mean for your portfolio.

Berkshire Hathaway's Recent Sell-Offs:

The recent flurry of activity from Berkshire Hathaway has focused on several key holdings. While the specific reasons behind each sale remain largely undisclosed, the sheer scale of the divestments has sparked considerable speculation. Some of the most notable reductions include:

- Significant reduction in Bank of America shares: This move is particularly noteworthy given Berkshire's long-standing investment in the financial giant.

- Decreased stake in other major financial institutions: Details on the exact banks and the extent of the reductions are still emerging but have added fuel to the market's speculation.

- Adjustments to other portfolio holdings: While not as substantial as the banking sector reductions, Berkshire has also adjusted its positions in various other companies across different sectors.

Why the Sell-Off? Deciphering Buffett's Strategy:

Understanding the rationale behind Warren Buffett's investment decisions is never easy. However, several factors are frequently cited by analysts:

- Market Valuation: Some believe Buffett might be taking profits from investments that he feels have reached, or exceeded, their intrinsic value. High valuations can make it less attractive to hold onto assets.

- Sectoral Shifts: The financial sector has faced increasing regulatory scrutiny and changing economic conditions, potentially prompting adjustments to Berkshire's portfolio allocation. This sector-specific analysis is key to understanding Buffett's decisions.

- Strategic Rebalancing: Berkshire Hathaway might be reallocating capital to other investment opportunities it deems more promising, perhaps within emerging sectors or undervalued companies.

- Unforeseen Circumstances: While less likely, unforeseen circumstances within the specific companies could have influenced the decision. Detailed analysis of each company's performance is crucial to fully grasp the possible reasons.

What It Means for Investors:

Buffett's actions rarely go unnoticed. His recent sell-offs could have several ripple effects:

- Impact on Stock Prices: The immediate impact is often seen in the stock prices of the companies Berkshire Hathaway has sold shares in. While these stocks might initially experience a downturn, the long-term effects are less predictable.

- Sectoral Trends: These actions could influence investor sentiment toward specific sectors. A reduction in holdings in the financial sector, for example, might signal a cautious approach towards this area.

- Re-evaluation of Investment Strategies: Investors might use this as an opportunity to re-evaluate their own portfolios, considering the potential implications of shifts in the market.

Conclusion:

Warren Buffett's recent decisions to sell major US holdings are complex and require careful consideration. While his reasoning isn't always immediately clear, understanding the potential drivers—market valuations, sectoral shifts, and strategic rebalancing—can help investors make informed decisions about their own portfolios. It's crucial to conduct thorough research and potentially seek professional financial advice before making any major investment changes. Staying informed on market trends and analyzing the performance of individual companies is more important than ever. Remember, this is just one piece of the investment puzzle; don't base your decisions solely on the actions of one investor, no matter how influential.

(Disclaimer: This article is for informational purposes only and does not constitute financial advice. Consult a qualified financial advisor before making any investment decisions.)

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Warren Buffett Sells Major US Holdings: What It Means For Investors. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

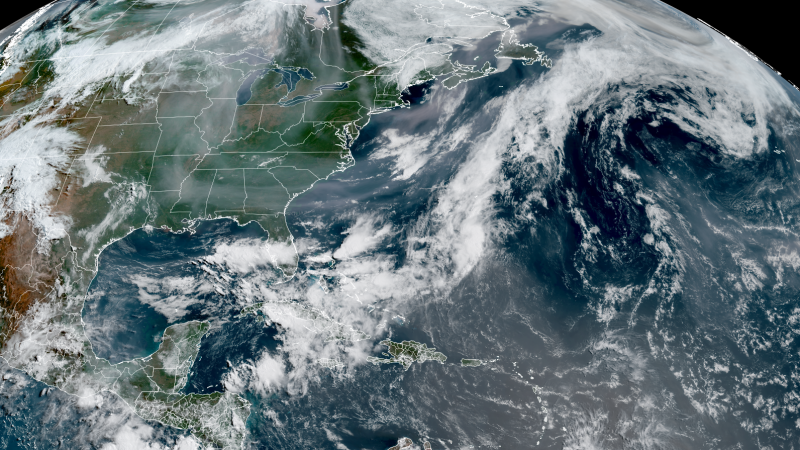

Southern Us Faces Air Pollution Crisis Wildfire Smoke Meets African Dust Plume

Jun 04, 2025

Southern Us Faces Air Pollution Crisis Wildfire Smoke Meets African Dust Plume

Jun 04, 2025 -

Tyler Perry Faces Legal Action She The People Founder Alleges Copyright Violation

Jun 04, 2025

Tyler Perry Faces Legal Action She The People Founder Alleges Copyright Violation

Jun 04, 2025 -

Dior Names Jonathan Anderson As Its New Creative Director

Jun 04, 2025

Dior Names Jonathan Anderson As Its New Creative Director

Jun 04, 2025 -

Binge Worthy And Hilarious Netflix Comedy Leaves Viewers Wanting More

Jun 04, 2025

Binge Worthy And Hilarious Netflix Comedy Leaves Viewers Wanting More

Jun 04, 2025 -

Conquer Nyt Spelling Bee Strands June 3rd Hints And Solutions

Jun 04, 2025

Conquer Nyt Spelling Bee Strands June 3rd Hints And Solutions

Jun 04, 2025

Latest Posts

-

Paige De Sorbos Summer House Journey Ends After Seven Seasons

Jun 06, 2025

Paige De Sorbos Summer House Journey Ends After Seven Seasons

Jun 06, 2025 -

David Quinn Back In Blue A Look At His New Position On The Penguins Coaching Staff

Jun 06, 2025

David Quinn Back In Blue A Look At His New Position On The Penguins Coaching Staff

Jun 06, 2025 -

Washington State Police Investigating Death Of Three Girls Father Missing

Jun 06, 2025

Washington State Police Investigating Death Of Three Girls Father Missing

Jun 06, 2025 -

Investigation Underway Into Cardiac Surgery Fatalities At Nhs Hospital

Jun 06, 2025

Investigation Underway Into Cardiac Surgery Fatalities At Nhs Hospital

Jun 06, 2025 -

Winter Fuel Payment Government Reverses Course Affecting Millions

Jun 06, 2025

Winter Fuel Payment Government Reverses Course Affecting Millions

Jun 06, 2025