Warren Buffett's Berkshire Hathaway: Bank Of America Stake Reduced, Major Consumer Brand Acquisition

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Warren Buffett's Berkshire Hathaway Adjusts Portfolio: Reduced Bank of America Stake, Major Consumer Brand Acquisition Shakes Up the Market

Omaha, Nebraska – Warren Buffett's Berkshire Hathaway, the investment conglomerate renowned for its long-term investment strategies, has made significant moves in its portfolio this week, sending ripples throughout the financial world. The company announced a reduction in its stake in Bank of America (BAC) alongside a surprising acquisition of a major consumer brand, signaling a potential shift in Berkshire's investment philosophy.

This dual announcement has sparked considerable speculation amongst analysts and investors, prompting questions about Berkshire's future investment strategies and the overall market outlook. Let's delve into the specifics of these impactful decisions.

Berkshire Hathaway Trims Bank of America Holding

Berkshire Hathaway disclosed a reduction in its holdings of Bank of America common stock, shedding a substantial portion of its previously significant investment. While the exact details regarding the sale's timing and motivations remain somewhat opaque, typical explanations include portfolio rebalancing, profit-taking, or a shift in investment priorities. This move comes as the banking sector faces ongoing regulatory scrutiny and economic uncertainty. The decreased stake still leaves Berkshire Hathaway with a considerable investment in Bank of America, however, highlighting its continued belief in the long-term prospects of the financial institution. For detailed financial reporting on the transaction, refer to Berkshire Hathaway's official SEC filings.

This decision contrasts with Berkshire's historically long-term, buy-and-hold approach, fueling discussions about evolving market conditions and the adaptability of even the most seasoned investors. [Link to a relevant financial news source discussing the Bank of America stock performance].

Major Consumer Brand Acquisition: A Strategic Shift?

The second, and arguably more impactful, announcement involved Berkshire Hathaway's acquisition of [Name of Acquired Company], a prominent player in the [Industry Sector] industry. While the exact purchase price remains undisclosed, sources suggest a multi-billion dollar transaction. This acquisition represents a significant departure from Berkshire's typical investments in established financial institutions and represents a foray into the fast-moving consumer goods (FMCG) sector. This move indicates a potential diversification strategy and highlights Buffett's ongoing search for value and long-term growth opportunities.

The acquisition of [Name of Acquired Company] offers Berkshire Hathaway several key advantages:

- Established Brand Recognition: [Name of Acquired Company] boasts a strong brand presence and a loyal customer base.

- Market Dominance: The company holds a significant market share in the [Specific Market Segment] sector.

- Growth Potential: The [Industry Sector] industry is experiencing continued growth, offering significant expansion opportunities.

This acquisition signifies a strategic shift for Berkshire Hathaway, demonstrating a willingness to venture into new markets and invest in brands with significant growth potential. [Link to the company's website].

What Does This Mean for Investors?

These recent moves by Berkshire Hathaway underscore the dynamic nature of the investment landscape and the constant need for adaptation. While the reduction in the Bank of America stake might suggest a cautious approach in certain sectors, the significant consumer brand acquisition speaks volumes about Berkshire's confidence in the long-term growth prospects of this particular market. It remains to be seen how these decisions will impact Berkshire's overall performance in the coming quarters. However, the moves highlight the company's ongoing commitment to identifying undervalued assets and capitalizing on strategic investment opportunities.

For investors, this serves as a reminder that even the most successful investment strategies require continuous evaluation and adaptation to changing market conditions. Stay tuned for further updates as this story unfolds. Are you following Berkshire Hathaway's investment moves closely? Share your thoughts in the comments below!

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Warren Buffett's Berkshire Hathaway: Bank Of America Stake Reduced, Major Consumer Brand Acquisition. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

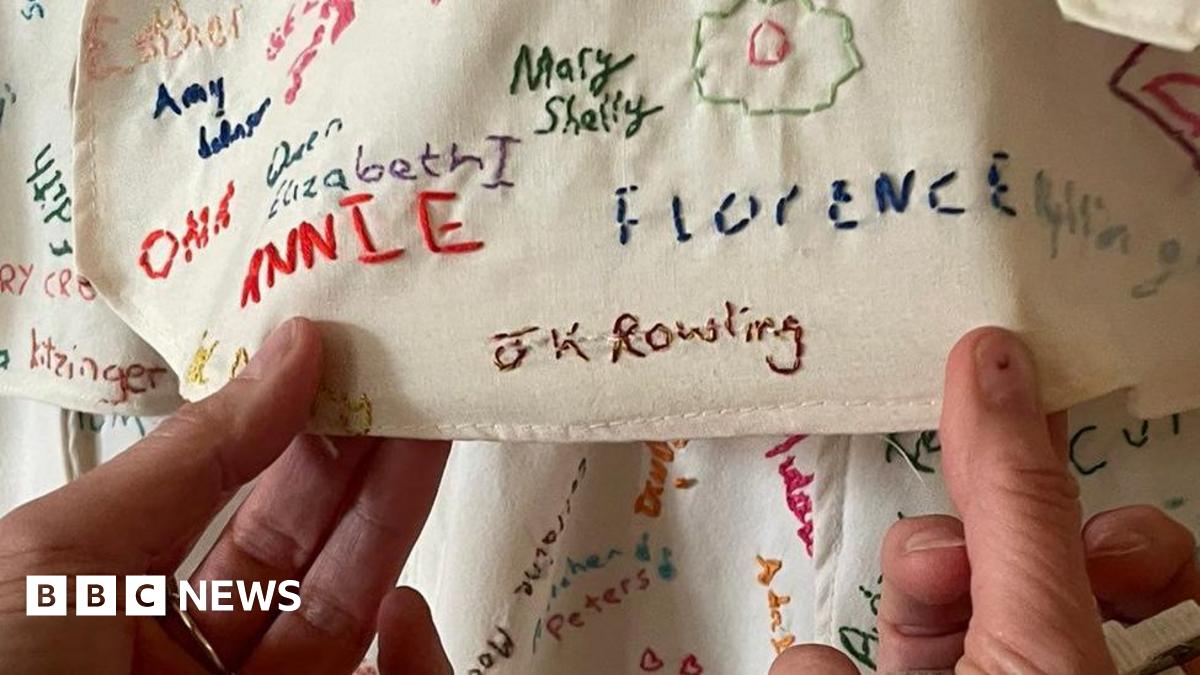

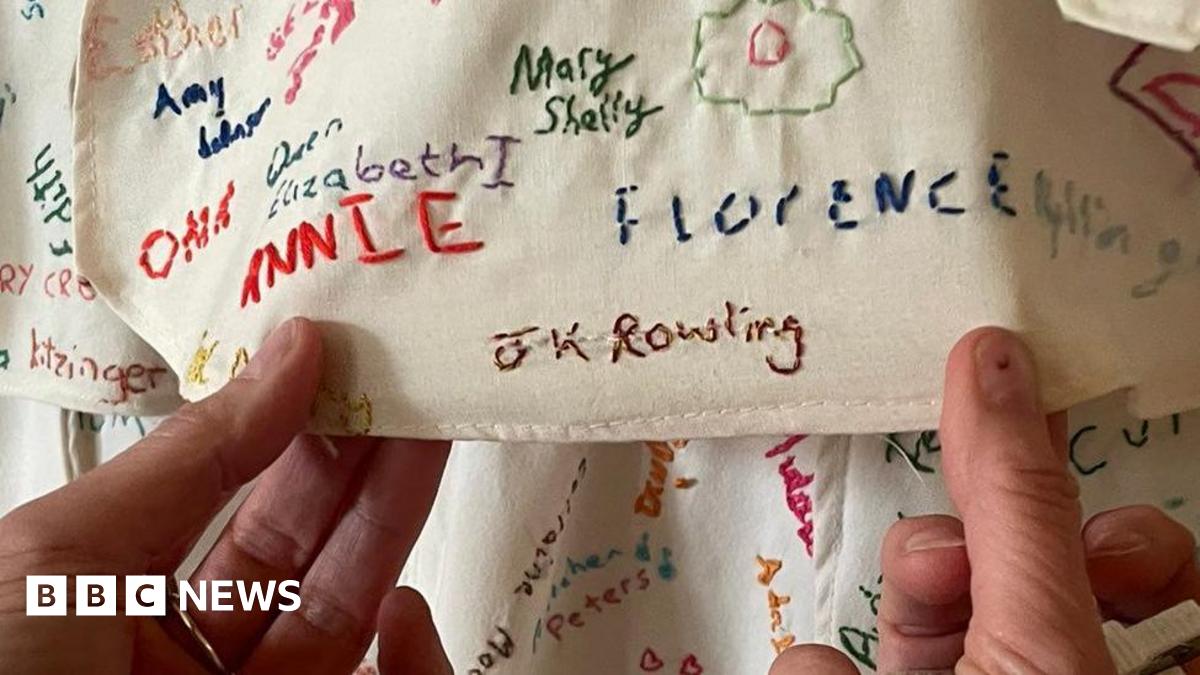

Investigation Launched Damaged Artwork Featuring J K Rowling At Derbyshire National Trust Site

Jun 05, 2025

Investigation Launched Damaged Artwork Featuring J K Rowling At Derbyshire National Trust Site

Jun 05, 2025 -

French Open 2025 Quarter Finals Bubliks Unexpected Path To Sinner

Jun 05, 2025

French Open 2025 Quarter Finals Bubliks Unexpected Path To Sinner

Jun 05, 2025 -

National Trust Addresses Tampered J K Rowling Artwork In Derbyshire Estate

Jun 05, 2025

National Trust Addresses Tampered J K Rowling Artwork In Derbyshire Estate

Jun 05, 2025 -

From Success To Controversy Harry Enten On Mike Lindell And My Pillows Journey

Jun 05, 2025

From Success To Controversy Harry Enten On Mike Lindell And My Pillows Journey

Jun 05, 2025 -

Reverse Discrimination Suits Supreme Court Sides With Plaintiff In Landmark Case

Jun 05, 2025

Reverse Discrimination Suits Supreme Court Sides With Plaintiff In Landmark Case

Jun 05, 2025

Latest Posts

-

Over 4 000 Additional Us Troops Deployed To Latin American Waters Combating Drug Cartels

Aug 17, 2025

Over 4 000 Additional Us Troops Deployed To Latin American Waters Combating Drug Cartels

Aug 17, 2025 -

Ryo Otas Grand Slam Extends Orixs Hope In Late Inning Comeback

Aug 17, 2025

Ryo Otas Grand Slam Extends Orixs Hope In Late Inning Comeback

Aug 17, 2025 -

Stalker 2 Roadmap Engine Upgrade Ps 5 And Potential Ps 5 Pro Release Date

Aug 17, 2025

Stalker 2 Roadmap Engine Upgrade Ps 5 And Potential Ps 5 Pro Release Date

Aug 17, 2025 -

Topshops Second Act Challenges And Opportunities In The Fashion Industry

Aug 17, 2025

Topshops Second Act Challenges And Opportunities In The Fashion Industry

Aug 17, 2025 -

Northwests Low Livability Score Sparks Debate

Aug 17, 2025

Northwests Low Livability Score Sparks Debate

Aug 17, 2025