Warren Buffett's Berkshire Hathaway Dumps Bank Of America Stock, Invests In Soaring Consumer Brand

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Warren Buffett's Berkshire Hathaway Sheds Bank of America, Embraces a Consumer Goods Giant

Oracle of Omaha makes a surprising shift in investment strategy, signaling a potential change in market sentiment.

Warren Buffett's Berkshire Hathaway, a titan of the investment world, has sent ripples through the financial markets with its recent moves. The company, known for its long-term, value-oriented approach, has revealed a significant reduction in its Bank of America holdings while simultaneously increasing its stake in a rapidly growing consumer brand. This strategic shift has sparked considerable speculation about the future direction of Berkshire Hathaway's investment strategy and the broader market outlook.

Berkshire Hathaway's Bank of America Sell-Off: A Sign of the Times?

Berkshire Hathaway's 13F filing, which details the company's equity holdings, revealed a substantial decrease in its Bank of America (BAC) stock. While the exact reasons remain unconfirmed, analysts point to several potential factors. The recent rise in interest rates, impacting bank profitability, could be one contributing element. Furthermore, a potential shift in Buffett's overall assessment of the banking sector's long-term prospects cannot be ruled out. This move, although significant, isn't entirely unprecedented; Buffett has adjusted his holdings in financial institutions before, demonstrating his adaptability to changing market conditions. [Link to SEC 13F filing]

The Rise of a Consumer Brand: A Strategic Countermove?

The counterpoint to the Bank of America divestment is Berkshire Hathaway's increased investment in [Name of Consumer Brand - replace with actual brand name]. This rapidly expanding company, operating in the [Industry - e.g., food and beverage, personal care] sector, has demonstrated exceptional growth and market share gains in recent years. Their innovative products and strong brand recognition seem to align perfectly with Buffett's preference for established, resilient businesses with durable competitive advantages. This investment signifies a vote of confidence in the company's future performance and potentially indicates a broader belief in the strength of the consumer sector.

What This Means for Investors:

Buffett's actions are always closely scrutinized by investors worldwide, serving as a significant market indicator. This particular move highlights a few key takeaways:

- Diversification is Key: Even a legendary investor like Buffett diversifies his portfolio, adjusting his holdings based on market dynamics and long-term projections.

- Growth Opportunities Exist Beyond Traditional Sectors: The investment in [Name of Consumer Brand] showcases the appeal of strong consumer-facing businesses within a growing market.

- Market Volatility Demands Adaptability: Buffett's adjustments reflect the need for flexibility and responsiveness in navigating the complexities of the modern financial landscape.

Looking Ahead:

The implications of Berkshire Hathaway's recent portfolio adjustments are far-reaching. While the exact reasoning behind these shifts might remain partially shrouded in mystery, the moves provide valuable insights into the evolving market landscape and suggest a potential shift toward greater emphasis on consumer-centric growth sectors. Only time will tell if this represents a temporary adjustment or a significant alteration of Berkshire Hathaway's long-term investment strategy. However, one thing is certain: the Oracle of Omaha’s moves continue to capture the attention – and influence the decisions – of investors globally.

Keywords: Warren Buffett, Berkshire Hathaway, Bank of America, BAC stock, investment strategy, consumer brands, [Name of Consumer Brand], 13F filing, stock market, financial news, market analysis, investment trends.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Warren Buffett's Berkshire Hathaway Dumps Bank Of America Stock, Invests In Soaring Consumer Brand. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Reverse Discrimination Suits Supreme Courts Impact On Legal Strategy

Jun 05, 2025

Reverse Discrimination Suits Supreme Courts Impact On Legal Strategy

Jun 05, 2025 -

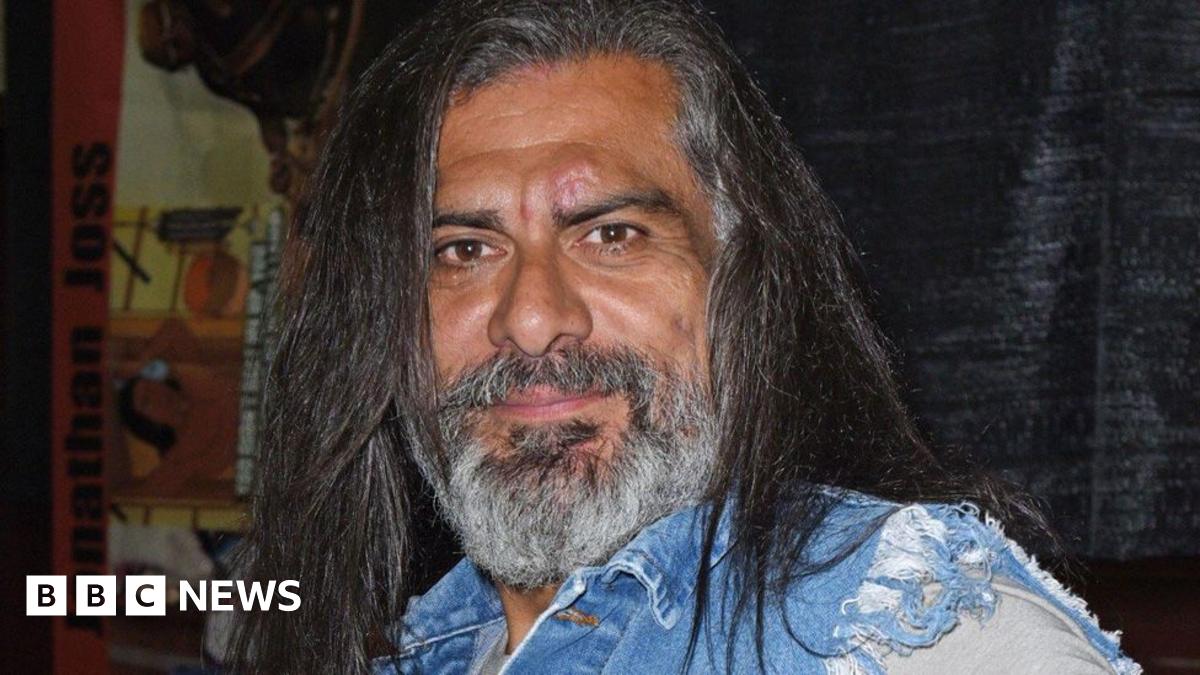

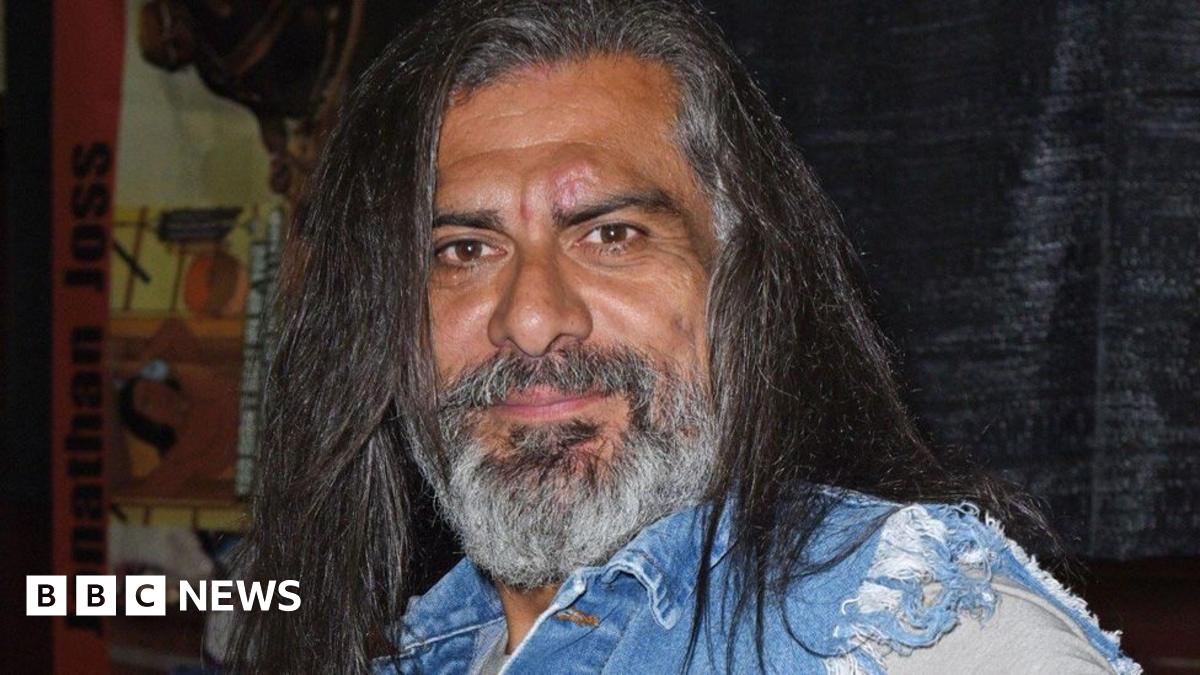

Tragedy Strikes Jonathan Joss Actor Known For King Of The Hills John Redcorn Dies

Jun 05, 2025

Tragedy Strikes Jonathan Joss Actor Known For King Of The Hills John Redcorn Dies

Jun 05, 2025 -

The Great Exodus How Trumps Influence Is Driving Americans Overseas

Jun 05, 2025

The Great Exodus How Trumps Influence Is Driving Americans Overseas

Jun 05, 2025 -

Police Probe Into Multiple Deaths Following Heart Operations At Nhs Trust

Jun 05, 2025

Police Probe Into Multiple Deaths Following Heart Operations At Nhs Trust

Jun 05, 2025 -

Tragic News Jonathan Joss Known For King Of The Hill Role Dies In Shooting

Jun 05, 2025

Tragic News Jonathan Joss Known For King Of The Hill Role Dies In Shooting

Jun 05, 2025

Latest Posts

-

Gunman Opens Fire On Police Outside Reno Casino Bodycam Video Shows Incident

Aug 17, 2025

Gunman Opens Fire On Police Outside Reno Casino Bodycam Video Shows Incident

Aug 17, 2025 -

Taylor Swifts Evolving Style From Country Star To Showgirl Icon

Aug 17, 2025

Taylor Swifts Evolving Style From Country Star To Showgirl Icon

Aug 17, 2025 -

Alaskas Divided Response To Trump And Putins Joint Visit

Aug 17, 2025

Alaskas Divided Response To Trump And Putins Joint Visit

Aug 17, 2025 -

Proposed Changes To Nba Prop Bet Rules Gain Union Support

Aug 17, 2025

Proposed Changes To Nba Prop Bet Rules Gain Union Support

Aug 17, 2025 -

Social Media Buzz Peter Krauses Uncommon Instagram Update Excites 9 1 1 Fans

Aug 17, 2025

Social Media Buzz Peter Krauses Uncommon Instagram Update Excites 9 1 1 Fans

Aug 17, 2025