Warren Buffett's Investment Strategy: Bank Of America Sell-Off And A Massive Consumer Brand Bet

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Warren Buffett's Investment Strategy: Bank of America Sell-Off and a Massive Consumer Brand Bet

The Oracle of Omaha makes headlines again, with a surprising Bank of America move and a significant bet on a major consumer brand. Warren Buffett's Berkshire Hathaway recently announced a significant reduction in its Bank of America stake, sparking considerable speculation. Simultaneously, a massive investment in a leading consumer brand reveals a shift in the legendary investor's strategy. This article delves into the details, analyzing the implications and providing context for these high-profile moves.

The Bank of America Downturn: A Strategic Retreat?

Berkshire Hathaway, a long-time investor in Bank of America (BAC), significantly reduced its holdings in the financial giant. This move, while unexpected by some, might be a strategic repositioning rather than a vote of no confidence. Several factors could explain this decision:

- Profit-Taking: After substantial gains, selling a portion of the Bank of America stake allows Berkshire to realize profits and reinvest elsewhere. Buffett is known for his disciplined approach to profit-taking.

- Diversification: Diversification is a cornerstone of Buffett's investment philosophy. Reducing exposure to a single sector, even a strong performer like the financial sector, aligns with this principle. This move allows for a reallocation of capital into other promising opportunities.

- Market Outlook: While Bank of America remains a strong institution, economic headwinds, including potential interest rate hikes and geopolitical instability, could influence investment decisions. Buffett's move may reflect a cautious outlook on the short-term prospects of the financial sector.

It's important to remember that even a partial sell-off doesn't necessarily indicate a negative assessment of Bank of America's long-term prospects. Buffett has historically maintained a long-term view, and this move could simply be a tactical adjustment within his broader portfolio strategy.

A Massive Bet on Consumer Staples: A New Era?

Contrasting the Bank of America reduction, Berkshire Hathaway made a significant investment in [Insert Name of Consumer Brand Here – Replace with actual brand. For SEO, use the full brand name and relevant ticker symbol, e.g., Coca-Cola (KO)]. This investment signifies a renewed focus on consumer staples, a sector known for its resilience during economic downturns. This represents a significant shift, showcasing Buffett's adaptability and keen eye for identifying long-term growth potential.

This move suggests several key considerations:

- Inflation Hedge: Consumer staples, including food and beverage companies, often demonstrate pricing power during inflationary periods. This investment provides a hedge against inflation and protects Berkshire's portfolio from economic uncertainty.

- Recession-Proofing: Consumer staples typically experience less volatility during economic downturns. This bet might be a strategic move to bolster the portfolio's resilience in the face of potential recessionary pressures.

- Long-Term Growth Potential: Buffett's decision highlights his belief in the long-term growth potential of the chosen consumer brand, emphasizing the company's strong brand recognition, loyal customer base, and robust distribution network.

The Oracle's Wisdom: Lessons for Investors

Buffett's recent moves provide valuable lessons for both seasoned and novice investors:

- Flexibility is Key: Even the most successful investors adapt their strategies based on evolving market conditions. Buffett’s actions demonstrate the importance of flexibility and a willingness to adjust portfolios based on new information.

- Long-Term Vision: Buffett's focus remains on long-term value creation. While short-term market fluctuations might influence decisions, the core strategy emphasizes sustainable growth and resilience.

- Diversification Matters: A diversified portfolio is crucial for mitigating risk. The combination of trimming one position and substantially investing in another illustrates the importance of diversification in managing risk effectively.

Conclusion: Warren Buffett's recent investment decisions, while seemingly contradictory on the surface, highlight his consistent commitment to long-term value, strategic diversification, and adaptability to changing market conditions. His actions underscore the importance of considering a range of factors, from macroeconomic trends to individual company performance, when making investment decisions. These bold moves will undoubtedly continue to be dissected and analyzed by financial experts and investors for years to come. What are your thoughts on Buffett's recent strategies? Share your insights in the comments below.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Warren Buffett's Investment Strategy: Bank Of America Sell-Off And A Massive Consumer Brand Bet. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

After Minor League Success Ronny Mauricio Joins The New York Mets

Jun 04, 2025

After Minor League Success Ronny Mauricio Joins The New York Mets

Jun 04, 2025 -

Accel Kkrs Strategic Investment In Remote Patient Monitoring Platform Care Line Live

Jun 04, 2025

Accel Kkrs Strategic Investment In Remote Patient Monitoring Platform Care Line Live

Jun 04, 2025 -

John Brenkus 54 Dies Remembering The Sports Science Innovator

Jun 04, 2025

John Brenkus 54 Dies Remembering The Sports Science Innovator

Jun 04, 2025 -

Syrian Government Imprisonment Of Austin Tice Confirmed By Leaked Files

Jun 04, 2025

Syrian Government Imprisonment Of Austin Tice Confirmed By Leaked Files

Jun 04, 2025 -

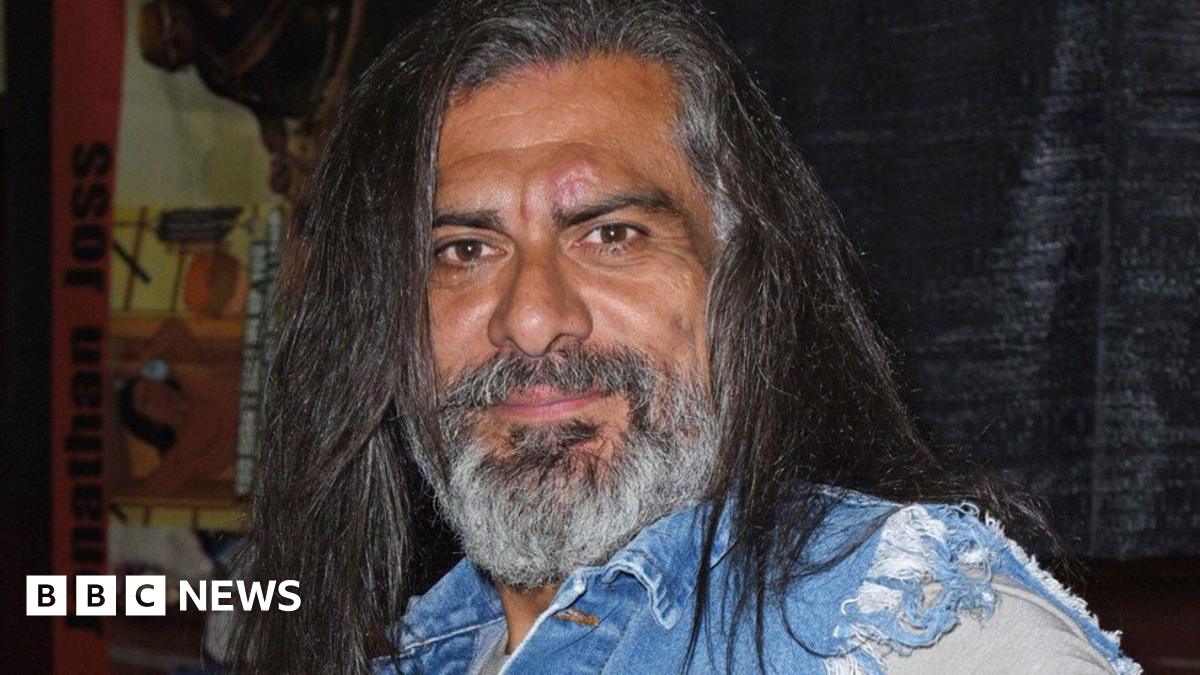

Tragic News Jonathan Joss Remembered For King Of The Hill Role Dies

Jun 04, 2025

Tragic News Jonathan Joss Remembered For King Of The Hill Role Dies

Jun 04, 2025

Latest Posts

-

Ketema Casting Fuels Speculation Ryan Goslings Potential As White Black Panther In Mcu

Jun 06, 2025

Ketema Casting Fuels Speculation Ryan Goslings Potential As White Black Panther In Mcu

Jun 06, 2025 -

Analyst Predictions Broadcom Stocks Trajectory After Latest Earnings Report

Jun 06, 2025

Analyst Predictions Broadcom Stocks Trajectory After Latest Earnings Report

Jun 06, 2025 -

Confirmed Joe Sacco Out At Bruins Joins Rival Teams Staff

Jun 06, 2025

Confirmed Joe Sacco Out At Bruins Joins Rival Teams Staff

Jun 06, 2025 -

May Jobs Report Reveals Worrying Trend 37 000 Private Sector Jobs Added

Jun 06, 2025

May Jobs Report Reveals Worrying Trend 37 000 Private Sector Jobs Added

Jun 06, 2025 -

The Bull Case For Robinhood Stock A Deep Dive Into Investment Potential

Jun 06, 2025

The Bull Case For Robinhood Stock A Deep Dive Into Investment Potential

Jun 06, 2025