Warren Buffett's Portfolio Shift: Bank Of America Down, Consumer Brand Up

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Warren Buffett's Portfolio Shift: Bank of America Down, Consumer Brand Up

Oracle of Omaha makes significant moves, signaling a potential shift in investment strategy.

Warren Buffett, the legendary investor and CEO of Berkshire Hathaway, has once again captivated the financial world with a significant reshuffling of his portfolio. Recent SEC filings reveal a notable decrease in Berkshire's holdings of Bank of America stock, coupled with a surprising increase in its investment in a major consumer brand – a move that has analysts buzzing and sparking debate about the future direction of Buffett's investment strategy.

This isn't just another minor adjustment; the scale of the changes suggests a deeper strategic shift, prompting speculation about Buffett's outlook on the current economic climate and his assessment of long-term growth prospects in different sectors. The details, however, remain shrouded in the characteristically understated style of the "Oracle of Omaha."

Bank of America: A Reduced Stake

Berkshire Hathaway's reduced position in Bank of America (BAC) has raised eyebrows. While still a significant holding, the decrease represents a notable departure from previous years where BAC was a cornerstone of Buffett's banking investments. This move comes amidst a period of rising interest rates and concerns about potential economic slowdown, potentially indicating a more cautious stance on the financial sector. Could this be a sign of brewing uncertainty in the banking sector for Buffett? Only time will tell.

Analysts are dissecting various factors that could be behind this decision. These include increasing regulatory scrutiny of the banking industry, the potential impact of rising interest rates on loan defaults, and the overall economic climate. Further investigation is needed to fully understand the rationale behind this significant reduction.

The Rise of the Consumer Brand: A Strategic Pivot?

In contrast to the decrease in Bank of America stock, Berkshire Hathaway has significantly increased its position in [Insert Name of Consumer Brand Here], a leading player in the [Insert Industry Here] sector. This move signals a potential bet on the resilience of consumer spending, even in the face of economic headwinds. The company’s strong brand recognition, consistent performance, and proven ability to adapt to changing consumer preferences likely influenced Buffett's decision.

This shift towards consumer staples hints at a strategy focusing on companies with consistent cash flows and strong defensive characteristics. It's a classic Buffett approach, prioritizing businesses with durable competitive advantages and predictable earnings. This is in line with his long-term value investing philosophy.

What Does it All Mean?

Buffett’s recent portfolio adjustments offer a glimpse into his assessment of the current market. While the specifics remain somewhat opaque, the overall message is clear: adaptation and careful consideration are key. This move underscores the dynamic nature of even the most established investment strategies. The Oracle of Omaha is not immune to shifting market conditions and continues to adapt his portfolio to reflect his evolving outlook.

Analyzing these moves requires further investigation and considering various market factors. Stay tuned for further updates as the financial landscape continues to evolve.

Keywords: Warren Buffett, Berkshire Hathaway, Bank of America, BAC, Consumer Brands, Investment Strategy, Portfolio Shift, Stock Market, Economic Outlook, Value Investing, Oracle of Omaha, SEC Filings.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Warren Buffett's Portfolio Shift: Bank Of America Down, Consumer Brand Up. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Why Paige De Sorbo Is Leaving Summer House After Seven Years

Jun 05, 2025

Why Paige De Sorbo Is Leaving Summer House After Seven Years

Jun 05, 2025 -

Alexander Bubliks Vegas Tune Up Pays Off French Open 2025 Quarter Final Berth

Jun 05, 2025

Alexander Bubliks Vegas Tune Up Pays Off French Open 2025 Quarter Final Berth

Jun 05, 2025 -

420 000 Retirement Cut Examining The Republican Plans Impact On Millennials

Jun 05, 2025

420 000 Retirement Cut Examining The Republican Plans Impact On Millennials

Jun 05, 2025 -

Karen Read Retrial Defense Filing Hints At No Witness Stand Appearance

Jun 05, 2025

Karen Read Retrial Defense Filing Hints At No Witness Stand Appearance

Jun 05, 2025 -

All American Rejects Unpermitted Gig Police Intervention In College Town

Jun 05, 2025

All American Rejects Unpermitted Gig Police Intervention In College Town

Jun 05, 2025

Latest Posts

-

Cnns Kaitlan Collins Covering The Dc National Guard And The Trump Putin Summit

Aug 17, 2025

Cnns Kaitlan Collins Covering The Dc National Guard And The Trump Putin Summit

Aug 17, 2025 -

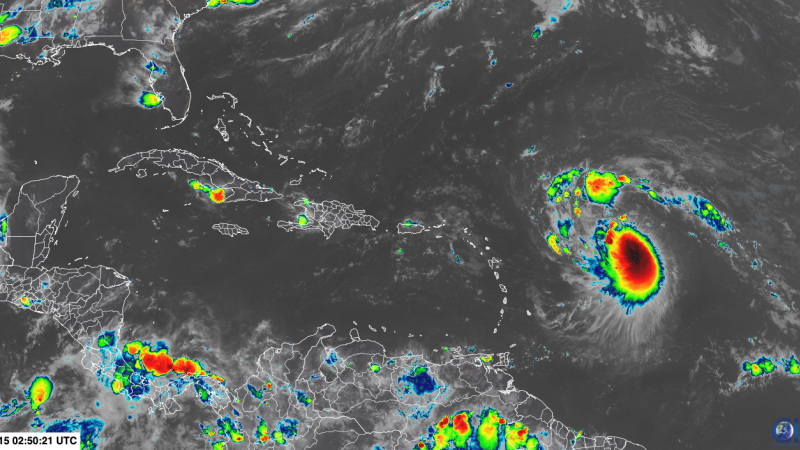

Will Tropical Storm Erin Become The First Hurricane Of The Season

Aug 17, 2025

Will Tropical Storm Erin Become The First Hurricane Of The Season

Aug 17, 2025 -

Austin Butler And Matthew Mc Conaughey Lead Caught Stealing Red Carpet

Aug 17, 2025

Austin Butler And Matthew Mc Conaughey Lead Caught Stealing Red Carpet

Aug 17, 2025 -

And Just Like That Highs Lows And Lasting Impressions

Aug 17, 2025

And Just Like That Highs Lows And Lasting Impressions

Aug 17, 2025 -

Nba And Nbpa Consider Regulations For Player Prop Betting Markets

Aug 17, 2025

Nba And Nbpa Consider Regulations For Player Prop Betting Markets

Aug 17, 2025