Warren Buffett's Strategic Move: Reducing Bank Of America Holdings, Increasing Consumer Brand Stake

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Warren Buffett's Strategic Shift: Cutting Bank of America, Boosting Consumer Brands

Oracle of Omaha makes headlines again with significant portfolio adjustments, signaling a potential shift in investment strategy.

Warren Buffett's Berkshire Hathaway has sent ripples through the financial world with its recent quarterly 13F filing, revealing a significant reduction in its Bank of America holdings and a simultaneous increase in its stake in several prominent consumer brands. This strategic move, announced [Date of filing/news release], has sparked considerable speculation about the legendary investor's outlook on the economy and the future performance of various sectors.

The reduction in Bank of America shares, while still leaving Berkshire Hathaway as a major shareholder, represents a notable decrease from [Previous quarter's holdings] to [Current quarter's holdings]. This downsizing comes amidst a period of rising interest rates and increasing concerns about a potential recession, impacting the profitability of financial institutions. Analysts are interpreting this move as a strategic repositioning, potentially reflecting a less bullish outlook on the near-term performance of the banking sector. While Buffett has long praised Bank of America's management and its recovery from the 2008 financial crisis, this adjustment suggests a reassessment of risk versus reward in the current market climate.

A Focus on Consumer Staples: A Long-Term Play?

In contrast to the Bank of America reduction, Berkshire Hathaway increased its holdings in several consumer brands, including [List specific brands and percentage increases, linking to relevant company websites if possible]. This shift towards consumer staples suggests a focus on companies expected to maintain relatively stable demand, even during economic downturns. These brands, known for their resilient business models and strong consumer loyalty, are considered a safer bet in uncertain times. This strategy aligns with Buffett's long-term investment philosophy, focusing on companies with durable competitive advantages and consistent earnings growth.

This isn't a complete abandonment of the financial sector, however. Berkshire Hathaway retains significant stakes in other financial institutions, highlighting a nuanced approach rather than a complete sector-wide sell-off. The shift emphasizes a strategic reallocation of assets, reflecting a dynamic and adaptable investment strategy.

What Does This Mean for Investors?

Buffett's moves are always closely scrutinized by investors worldwide. His recent portfolio adjustments offer valuable insights into potential market trends. The reduced exposure to the banking sector might be interpreted as a cautious approach to potential economic headwinds, while the increased investment in consumer staples suggests a belief in their resilience.

Key takeaways from Buffett's recent portfolio adjustments:

- Reduced Bank of America holdings: Signals a potentially more cautious outlook on the banking sector's short-term prospects.

- Increased consumer brand holdings: Suggests a focus on companies with stable demand, regardless of economic conditions.

- Long-term investment strategy: Reinforces Buffett's commitment to a patient, value-oriented investment approach.

This strategic shift highlights the ever-evolving nature of investing and the importance of adapting to changing market conditions. While it’s impossible to predict the future with certainty, Buffett's actions provide a compelling case study in risk management and long-term investment strategy. For investors, careful analysis of market trends and diversification remain crucial elements of a successful portfolio. What are your thoughts on Buffett’s recent moves? Share your insights in the comments below.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Warren Buffett's Strategic Move: Reducing Bank Of America Holdings, Increasing Consumer Brand Stake. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Jannik Sinner Faces Bublik In French Open 2025 Quarter Finals Following Las Vegas Prep

Jun 05, 2025

Jannik Sinner Faces Bublik In French Open 2025 Quarter Finals Following Las Vegas Prep

Jun 05, 2025 -

The Untold Story Grace Potter And Her Newly Released Album

Jun 05, 2025

The Untold Story Grace Potter And Her Newly Released Album

Jun 05, 2025 -

Summer Houses Paige De Sorbo Announces Departure After Season 7

Jun 05, 2025

Summer Houses Paige De Sorbo Announces Departure After Season 7

Jun 05, 2025 -

Understanding The Appeal Of Robinhood Stock For Investors

Jun 05, 2025

Understanding The Appeal Of Robinhood Stock For Investors

Jun 05, 2025 -

Instability In The Netherlands Wilders Exit Triggers Government Crisis

Jun 05, 2025

Instability In The Netherlands Wilders Exit Triggers Government Crisis

Jun 05, 2025

Latest Posts

-

Aldo De Nigris Jr Y Sus Polemicas En La Casa De Los Famosos 3 Un Analisis Completo

Aug 17, 2025

Aldo De Nigris Jr Y Sus Polemicas En La Casa De Los Famosos 3 Un Analisis Completo

Aug 17, 2025 -

The Beast In Me Review A Dark And Intense Drama With Danes And Rhys

Aug 17, 2025

The Beast In Me Review A Dark And Intense Drama With Danes And Rhys

Aug 17, 2025 -

Cnns Kaitlan Collins Covering The Dc National Guard And The Trump Putin Summit

Aug 17, 2025

Cnns Kaitlan Collins Covering The Dc National Guard And The Trump Putin Summit

Aug 17, 2025 -

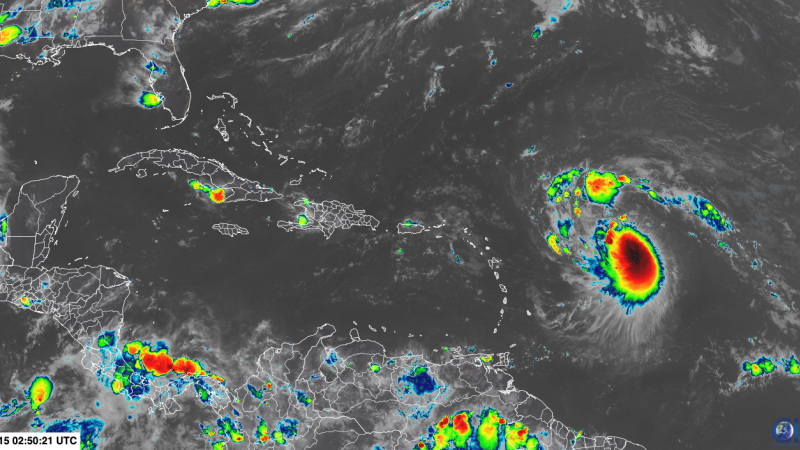

Will Tropical Storm Erin Become The First Hurricane Of The Season

Aug 17, 2025

Will Tropical Storm Erin Become The First Hurricane Of The Season

Aug 17, 2025 -

Austin Butler And Matthew Mc Conaughey Lead Caught Stealing Red Carpet

Aug 17, 2025

Austin Butler And Matthew Mc Conaughey Lead Caught Stealing Red Carpet

Aug 17, 2025