Warren Buffett's Surprising Sell-Off: Two US Stocks He's Abandoned

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Warren Buffett's Surprising Sell-Off: Two US Stocks He's Abandoned

The Oracle of Omaha's recent portfolio adjustments have sent shockwaves through the market, with the surprising divestment of two major US stocks raising eyebrows and sparking intense speculation. Warren Buffett, renowned for his long-term investment strategies and buy-and-hold philosophy, has significantly reduced his holdings in two companies, leaving investors questioning the future direction of Berkshire Hathaway's portfolio. This unexpected move highlights the ever-evolving nature of the investment landscape and the inherent risks even for the most seasoned investors.

This article delves into the details of these surprising sell-offs, examining the potential reasons behind Buffett's decisions and exploring their implications for the affected companies and the broader market.

The Stocks That Buffett Dumped: A Closer Look

The two companies that experienced significant reductions in Berkshire Hathaway's holdings are:

-

[Company Name 1]: Berkshire Hathaway dramatically decreased its stake in [Company Name 1], a [Industry] giant, by [Percentage] in the [Quarter] of [Year]. This represents a significant shift from previous years, where Buffett had praised the company's [Positive attribute] and long-term potential. The sale of [Number] shares amounted to a value of approximately [Dollar Amount].

-

[Company Name 2]: Similarly, Berkshire Hathaway's investment in [Company Name 2], a [Industry] company, saw a notable decline. The reduction in shares amounted to [Percentage] during the same period, representing a loss of [Dollar Amount] in market value. This move is particularly noteworthy given [Reason why this is noteworthy, e.g., Buffett's previous positive comments about the company's management].

Why the Sell-Off? Unraveling Buffett's Strategy

While Buffett rarely provides explicit explanations for his investment decisions, several theories are circulating among market analysts:

-

Changing Market Conditions: The recent economic uncertainty, marked by [mention relevant economic factors, e.g., inflation, rising interest rates], may have prompted Buffett to reassess his portfolio and prioritize more defensive investments.

-

Sectoral Shifts: The decline in [Company Name 1] and [Company Name 2]’s stock prices might reflect a broader shift in investor sentiment towards the [Industry] sector. Buffett is known for adapting to changing market dynamics, and this could be a strategic repositioning.

-

Valuation Concerns: It's possible that Buffett concluded that the current valuations of these companies no longer justified their continued presence in Berkshire Hathaway's portfolio. His investment philosophy centers around finding undervalued companies with strong long-term prospects.

What Does This Mean for Investors?

Buffett's actions serve as a reminder that even the most successful investors are not immune to market fluctuations. It underscores the importance of:

- Diversification: A well-diversified portfolio can help mitigate risk.

- Long-Term Perspective: Focusing on the long-term potential of investments is crucial, despite short-term market volatility.

- Due Diligence: Thorough research and understanding of a company's fundamentals are essential before investing.

While this sell-off is certainly noteworthy, it's crucial to remember that it doesn't necessarily signal an impending market crash or indicate a negative outlook on the future of [Company Name 1] and [Company Name 2]. The Oracle of Omaha's moves should be analyzed within the context of his overall investment strategy and the broader economic environment.

This unexpected move by Warren Buffett provides a valuable lesson for all investors – the importance of staying informed, adapting to changing market dynamics, and always critically assessing investments. Keep an eye on Berkshire Hathaway's future portfolio adjustments for further insights into the evolving investment landscape.

(Remember to replace the bracketed information with the actual details of the companies and the specifics of Buffett's sell-off.)

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Warren Buffett's Surprising Sell-Off: Two US Stocks He's Abandoned. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Manhunt Underway Father Of Deceased Girls Sought In Washington State Tragedy

Jun 05, 2025

Manhunt Underway Father Of Deceased Girls Sought In Washington State Tragedy

Jun 05, 2025 -

Reveal Halle Berrys Neck Firming Secret Product Details And Availability

Jun 05, 2025

Reveal Halle Berrys Neck Firming Secret Product Details And Availability

Jun 05, 2025 -

Roland Garros Djokovic Continues Reign Bublik Creates Upset

Jun 05, 2025

Roland Garros Djokovic Continues Reign Bublik Creates Upset

Jun 05, 2025 -

Glastonbury 2025 Lineup Revealed Artists Stages And Surprise Performances

Jun 05, 2025

Glastonbury 2025 Lineup Revealed Artists Stages And Surprise Performances

Jun 05, 2025 -

French Open Day 5 Recap Bubliks Stunning Victory Djokovic Advances

Jun 05, 2025

French Open Day 5 Recap Bubliks Stunning Victory Djokovic Advances

Jun 05, 2025

Latest Posts

-

Measles Vaccination And Travel Essential Information For Trips To Italy Uzbekistan And Other High Risk Areas

Aug 17, 2025

Measles Vaccination And Travel Essential Information For Trips To Italy Uzbekistan And Other High Risk Areas

Aug 17, 2025 -

Aldo De Nigris Conoce A Sus Padres Y Sus Trayectorias Profesionales

Aug 17, 2025

Aldo De Nigris Conoce A Sus Padres Y Sus Trayectorias Profesionales

Aug 17, 2025 -

Exclusive Billboard Executive Comments On Taylor Swifts Latest Album

Aug 17, 2025

Exclusive Billboard Executive Comments On Taylor Swifts Latest Album

Aug 17, 2025 -

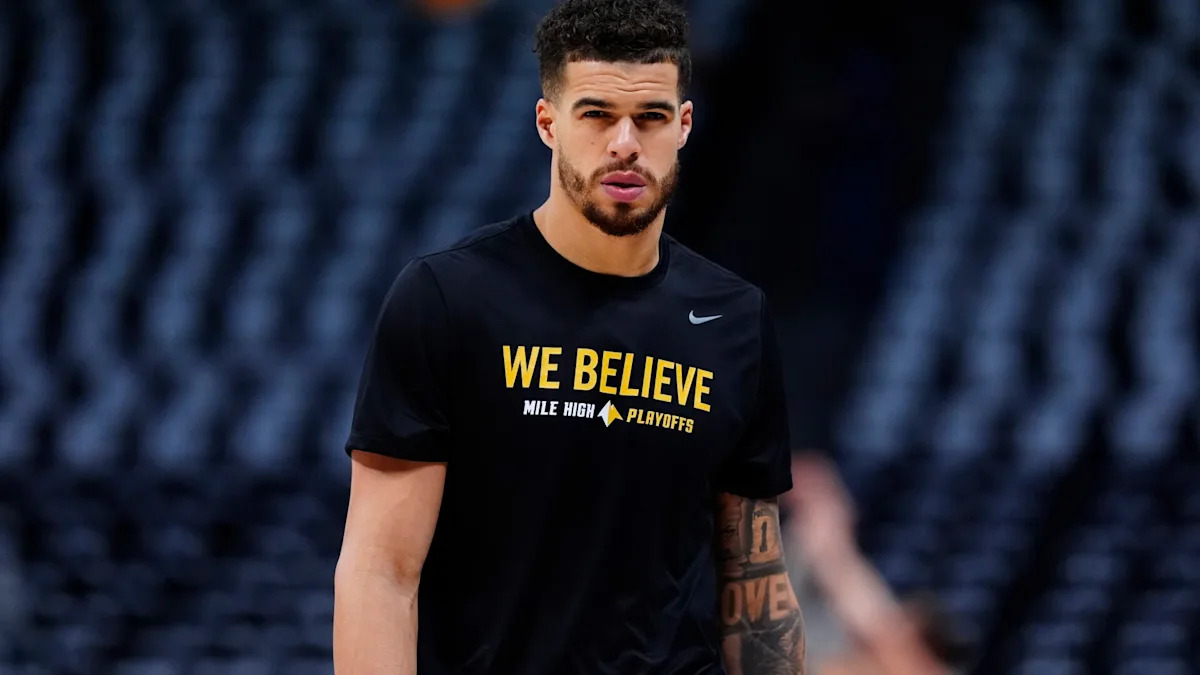

Michael Porter Jr Warns Of Growing Sports Gambling Impact On Players

Aug 17, 2025

Michael Porter Jr Warns Of Growing Sports Gambling Impact On Players

Aug 17, 2025 -

Bbc News Quiz Unraveling The Pasta Controversy In Italy

Aug 17, 2025

Bbc News Quiz Unraveling The Pasta Controversy In Italy

Aug 17, 2025