Weak Private Sector Job Growth: 37,000 Jobs Added, Signaling Economic Slowdown?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Weak Private Sector Job Growth: 37,000 Jobs Added, Signaling Economic Slowdown?

The latest private sector employment report paints a concerning picture of the U.S. economy. With a meager 37,000 jobs added in July, significantly below expectations, many economists are voicing concerns about a potential economic slowdown. This underwhelming figure follows months of fluctuating job growth, raising questions about the resilience of the American economy and the effectiveness of current monetary policy.

A Disappointing Figure Amidst Rising Interest Rates

The July jobs report, released by [Source - e.g., ADP], falls drastically short of the anticipated 189,000 jobs. This substantial miss raises serious questions about the health of the economy, particularly considering the Federal Reserve's ongoing efforts to combat inflation through interest rate hikes. These hikes, while intended to cool down the economy and curb inflation, are also impacting job growth and consumer spending. The disconnect between the Fed's actions and the weak job market suggests a delicate balancing act that may be proving difficult to master.

Analyzing the Numbers: Sectoral Breakdown and Potential Causes

The disappointing overall figure masks some variation across sectors. While [mention specific sectors that performed well, if any, with data], other key sectors showed significant weakness. [Mention specific sectors with weak performance and data]. This disparity hints at a more complex economic picture than a single number can convey.

Several factors could be contributing to this subdued job growth:

- High Interest Rates: The Federal Reserve's aggressive interest rate increases are making borrowing more expensive for businesses, potentially hindering investment and expansion, thus impacting hiring.

- Lingering Inflation: Persistent inflation continues to erode consumer purchasing power, leading to decreased demand and reduced business activity. This, in turn, translates to fewer job creation opportunities.

- Global Uncertainty: Geopolitical instability and global economic slowdown are also casting a shadow over the US economy, impacting business confidence and investment decisions.

- Shifting Labor Market Dynamics: The nature of work itself is changing, with the rise of automation and remote work potentially affecting traditional job creation patterns.

Economic Slowdown or Temporary Blip?

The question remains: is this a temporary blip or a harbinger of a more significant economic slowdown? While one month's data doesn't definitively answer this question, the consistent underperformance of job growth figures over recent months warrants serious consideration. Further data, including the upcoming non-farm payroll report from the Bureau of Labor Statistics (BLS), will be crucial in determining the overall economic trajectory.

Looking Ahead: What to Watch For

The coming months will be critical in assessing the health of the economy. Investors and economists will closely monitor several key indicators, including:

- Consumer Spending: Changes in consumer spending patterns will provide valuable insights into the overall economic health.

- Inflation Rates: The trajectory of inflation will be key in determining the Federal Reserve's future monetary policy decisions.

- Business Investment: Increased business investment often correlates with job growth, so this will be a critical factor to watch.

- Upcoming Economic Reports: The next few months' economic reports, including the BLS's employment situation summary, will provide further clarity.

Conclusion: A Cautious Outlook

The weak private sector job growth figures for July signal a potential economic slowdown. While it's too early to definitively declare a recession, the data warrants caution and close monitoring. The coming months will be critical in determining the true trajectory of the U.S. economy. Stay informed and consult with financial professionals for personalized advice.

Keywords: Private sector job growth, economic slowdown, July jobs report, ADP report, interest rates, inflation, recession, economic indicators, BLS, Federal Reserve, employment, unemployment, US economy, economic outlook.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Weak Private Sector Job Growth: 37,000 Jobs Added, Signaling Economic Slowdown?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Thames Water Faces Challenges Preferred Bidders Withdrawal

Jun 05, 2025

Thames Water Faces Challenges Preferred Bidders Withdrawal

Jun 05, 2025 -

Analyzing Nvidias Core Weave Path To Us Business Leadership

Jun 05, 2025

Analyzing Nvidias Core Weave Path To Us Business Leadership

Jun 05, 2025 -

Political Earthquake In The Netherlands Coalition Collapse After Wilders Exit

Jun 05, 2025

Political Earthquake In The Netherlands Coalition Collapse After Wilders Exit

Jun 05, 2025 -

Grooming And Abuse Real Stories From Survivors

Jun 05, 2025

Grooming And Abuse Real Stories From Survivors

Jun 05, 2025 -

Rising Tariffs Dollar Generals Unexpected Benefit For American Shoppers

Jun 05, 2025

Rising Tariffs Dollar Generals Unexpected Benefit For American Shoppers

Jun 05, 2025

Latest Posts

-

Battlefield 6s Rush Mode A Letdown Player Feedback On Map Size

Aug 17, 2025

Battlefield 6s Rush Mode A Letdown Player Feedback On Map Size

Aug 17, 2025 -

Stalker 2 Coming To Ps 5 And Ps 5 Pro Development Update Includes Engine Upgrade

Aug 17, 2025

Stalker 2 Coming To Ps 5 And Ps 5 Pro Development Update Includes Engine Upgrade

Aug 17, 2025 -

1992 Biden Sounds Alarm On Dc Crime Democrats Now Criticize Trumps Response

Aug 17, 2025

1992 Biden Sounds Alarm On Dc Crime Democrats Now Criticize Trumps Response

Aug 17, 2025 -

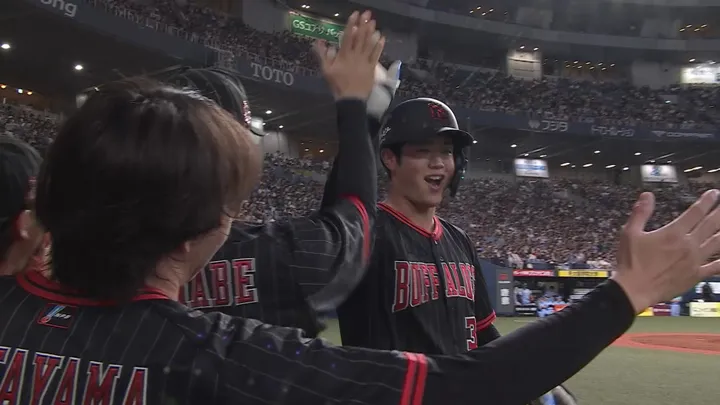

Ryo Otas Eighth Bases Loaded Grand Slam Narrows The Gap

Aug 17, 2025

Ryo Otas Eighth Bases Loaded Grand Slam Narrows The Gap

Aug 17, 2025 -

Orixs Nakagawa Delivers Two Run Blast Sixth Inning Comeback

Aug 17, 2025

Orixs Nakagawa Delivers Two Run Blast Sixth Inning Comeback

Aug 17, 2025