Weakening Bitcoin Demand: Analyzing The US Market And Future Price Movements

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Weakening Bitcoin Demand: Analyzing the US Market and Future Price Movements

Bitcoin's price has seen considerable volatility recently, prompting concerns about weakening demand, particularly within the crucial US market. This downturn raises critical questions about the future trajectory of Bitcoin's price and the overall health of the cryptocurrency market. Let's delve into the factors contributing to this trend and explore potential scenarios for the future.

The US Market: A Key Indicator of Global Sentiment

The United States remains a significant player in the global cryptocurrency market. Investor sentiment and regulatory actions in the US often serve as a barometer for broader market trends. Recent data suggests a decline in both institutional and retail investment in Bitcoin within the US. This weakening demand is a significant factor in the current price correction.

Several factors contribute to this decline:

-

Increased Regulatory Scrutiny: The ongoing regulatory uncertainty surrounding cryptocurrencies in the US, including potential stricter regulations on exchanges and stablecoins, has created a climate of apprehension among investors. This uncertainty discourages new investment and may lead existing holders to sell. Learn more about the evolving regulatory landscape in our article on .

-

Macroeconomic Headwinds: The persistent inflationary pressures and rising interest rates in the US have diverted investor capital towards more traditional, less volatile assets. Bitcoin, often considered a risk-on asset, is particularly susceptible to these macroeconomic shifts.

-

Decreased Institutional Adoption: While some institutional investors remain bullish on Bitcoin's long-term potential, the recent slowdown in institutional adoption rates suggests a cautious approach to the market. This hesitation further dampens price growth.

Analyzing Future Price Movements: A Complex Equation

Predicting the future price of Bitcoin is notoriously difficult. However, by analyzing the current market dynamics, we can identify potential scenarios:

-

Scenario 1: Continued Decline: If regulatory uncertainty persists and macroeconomic conditions remain challenging, Bitcoin's price could continue its downward trend. This scenario may lead to further consolidation and a prolonged period of low volatility.

-

Scenario 2: Consolidation and Gradual Recovery: A more likely scenario involves a period of consolidation, allowing the market to absorb recent losses. As regulatory clarity emerges and macroeconomic conditions improve, a gradual recovery could ensue.

-

Scenario 3: Unexpected Catalyst for Growth: A positive catalyst, such as widespread adoption by a major corporation or a significant breakthrough in Bitcoin's technology, could reignite investor enthusiasm and propel the price upwards.

The Role of Technological Advancements

Despite the current market challenges, ongoing developments in Bitcoin's underlying technology, such as the Lightning Network, continue to improve scalability and efficiency. These advancements could eventually bolster adoption and attract new investors. However, the impact of these advancements on the short-term price is debatable.

Conclusion: Navigating Uncertainty

The weakening Bitcoin demand in the US market underscores the complex interplay of regulatory, macroeconomic, and technological factors influencing cryptocurrency prices. While predicting the future remains impossible, understanding these underlying forces is crucial for navigating the market's volatility. Investors should adopt a long-term perspective, carefully assess their risk tolerance, and remain informed about market developments. Stay tuned for further updates and analysis as the situation unfolds. Consider diversifying your portfolio and seeking advice from a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Weakening Bitcoin Demand: Analyzing The US Market And Future Price Movements. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

East Tennessee Small Businesses Provide Input To Federal Sba Administration

Aug 01, 2025

East Tennessee Small Businesses Provide Input To Federal Sba Administration

Aug 01, 2025 -

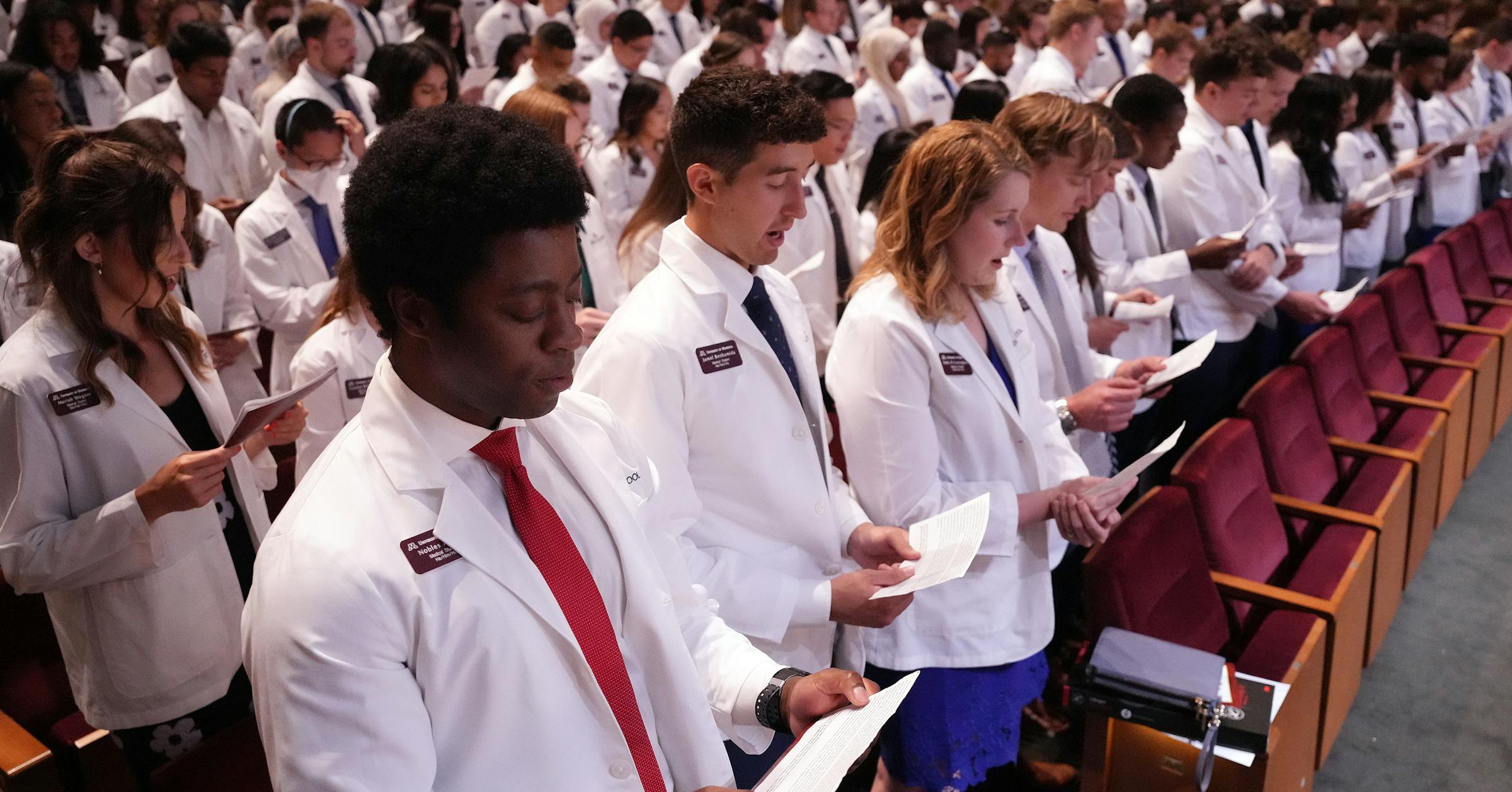

New Federal Loan Limits Higher Education Costs Price Out Students From Law And Medical School

Aug 01, 2025

New Federal Loan Limits Higher Education Costs Price Out Students From Law And Medical School

Aug 01, 2025 -

California High Speed Rail Concurrent Construction In Central Valley Gilroy And Palmdale

Aug 01, 2025

California High Speed Rail Concurrent Construction In Central Valley Gilroy And Palmdale

Aug 01, 2025 -

Colorado Dentist Receives Life Sentence For Wifes Poisoning

Aug 01, 2025

Colorado Dentist Receives Life Sentence For Wifes Poisoning

Aug 01, 2025 -

Your Guide To The Best Events This Week Featuring George Lopez And Third Eye Blind

Aug 01, 2025

Your Guide To The Best Events This Week Featuring George Lopez And Third Eye Blind

Aug 01, 2025

Latest Posts

-

Cornwall Mums Death Could Older Driver Rule Changes Have Saved Her Life

Aug 02, 2025

Cornwall Mums Death Could Older Driver Rule Changes Have Saved Her Life

Aug 02, 2025 -

Ukraine Zelensky Concedes To Youth Demands Averts Crisis

Aug 02, 2025

Ukraine Zelensky Concedes To Youth Demands Averts Crisis

Aug 02, 2025 -

Golden Dome Missile Defense First Major Pentagon Test Planned Before 2028

Aug 02, 2025

Golden Dome Missile Defense First Major Pentagon Test Planned Before 2028

Aug 02, 2025 -

Back To Basics Trump Brings Back The Presidential Fitness Test For Schools

Aug 02, 2025

Back To Basics Trump Brings Back The Presidential Fitness Test For Schools

Aug 02, 2025 -

Trumps 200 Million White House Ballroom Construction Starts September

Aug 02, 2025

Trumps 200 Million White House Ballroom Construction Starts September

Aug 02, 2025