What's Next For Broadcom Stock (AVGO) After Latest Earnings Report?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

What's Next for Broadcom Stock (AVGO) After Latest Earnings Report?

Broadcom (AVGO) recently released its latest earnings report, sending ripples through the tech sector. The results were mixed, leaving investors wondering: what's next for this semiconductor giant? This article delves into the key takeaways from the report, analyzes the current market landscape, and explores potential future trajectories for AVGO stock.

Strong Financials, Cautious Outlook:

Broadcom exceeded expectations in several key areas. Revenue surpassed analyst predictions, driven by strong demand for its networking and infrastructure solutions. Profitability also remained robust. However, the company offered a relatively cautious outlook for the next quarter, citing macroeconomic uncertainties and potential softening in demand for certain product categories. This cautious guidance, despite the strong current results, is a key factor influencing investor sentiment.

Key Highlights from the Earnings Report:

- Revenue Beat: Broadcom reported revenue significantly higher than anticipated, fueled by growth in its networking and broadband segments. This reflects the continued demand for high-speed connectivity and cloud infrastructure.

- Profitability Remains Solid: Despite increased operating expenses, Broadcom maintained strong profitability margins, showcasing efficient operations and pricing power.

- Cautious Guidance: The company's guidance for the next quarter was below analyst consensus, raising concerns about potential headwinds in the near term. This is a crucial point to consider when evaluating the stock's future.

- Software Growth: Broadcom continues to emphasize its software business as a major growth driver, highlighting the strategic importance of software solutions in its long-term strategy.

Analyzing the Market Landscape:

The semiconductor industry is currently navigating a complex landscape. While long-term demand for semiconductors remains strong, driven by factors like 5G deployment, cloud computing, and artificial intelligence, near-term challenges include supply chain disruptions, geopolitical instability, and the potential for a global economic slowdown. These factors influence the overall outlook for AVGO and other semiconductor stocks.

Potential Future Trajectories for AVGO Stock:

Several factors will determine AVGO's stock performance in the coming months and years:

- Macroeconomic Conditions: The global economic outlook will play a significant role. A slowdown could negatively impact demand for Broadcom's products, while a robust recovery would likely benefit the company.

- Competition: Intense competition in the semiconductor industry is a constant challenge. Broadcom's ability to innovate and maintain its market share will be crucial.

- Strategic Acquisitions: Broadcom's history of strategic acquisitions suggests a potential for future growth through mergers and acquisitions. Acquiring complementary technologies could further enhance its product portfolio.

- Long-Term Growth Drivers: The long-term growth drivers for Broadcom, such as the expansion of 5G, the cloud computing boom, and AI development, remain positive. These factors support a bullish long-term outlook.

Conclusion:

While Broadcom's recent earnings report showcased strong current performance, the cautious outlook warrants careful consideration. Investors need to weigh the positive aspects of strong fundamentals and long-term growth drivers against the near-term challenges presented by macroeconomic uncertainty and competition. Further analysis of market trends and future announcements from Broadcom is necessary for a comprehensive assessment of the stock's potential. Conduct thorough research and consider seeking advice from a financial advisor before making any investment decisions.

Keywords: Broadcom, AVGO, stock, earnings report, semiconductor, technology, investment, market analysis, financial report, revenue, profit, growth, macroeconomic conditions, competition, future outlook, stock market, investing.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on What's Next For Broadcom Stock (AVGO) After Latest Earnings Report?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Hegseths Action Harvey Milks Legacy Challenged By Ship Renaming

Jun 06, 2025

Hegseths Action Harvey Milks Legacy Challenged By Ship Renaming

Jun 06, 2025 -

New Ni Product Launch Teens Brave Rain And Long Queues

Jun 06, 2025

New Ni Product Launch Teens Brave Rain And Long Queues

Jun 06, 2025 -

Robinhood Stock Investment Current Trends And Future Outlook

Jun 06, 2025

Robinhood Stock Investment Current Trends And Future Outlook

Jun 06, 2025 -

Is Robinhood Stock A Buy Analyzing Recent Performance

Jun 06, 2025

Is Robinhood Stock A Buy Analyzing Recent Performance

Jun 06, 2025 -

Madeleine Mc Cann Disappearance Is It Too Late For Answers

Jun 06, 2025

Madeleine Mc Cann Disappearance Is It Too Late For Answers

Jun 06, 2025

Latest Posts

-

Is Ibm Relevant In 2024 A Critical Analysis Of Its Comeback

Jun 06, 2025

Is Ibm Relevant In 2024 A Critical Analysis Of Its Comeback

Jun 06, 2025 -

Sade Robinson Death Updates On The Maxwell Anderson Trial Proceedings

Jun 06, 2025

Sade Robinson Death Updates On The Maxwell Anderson Trial Proceedings

Jun 06, 2025 -

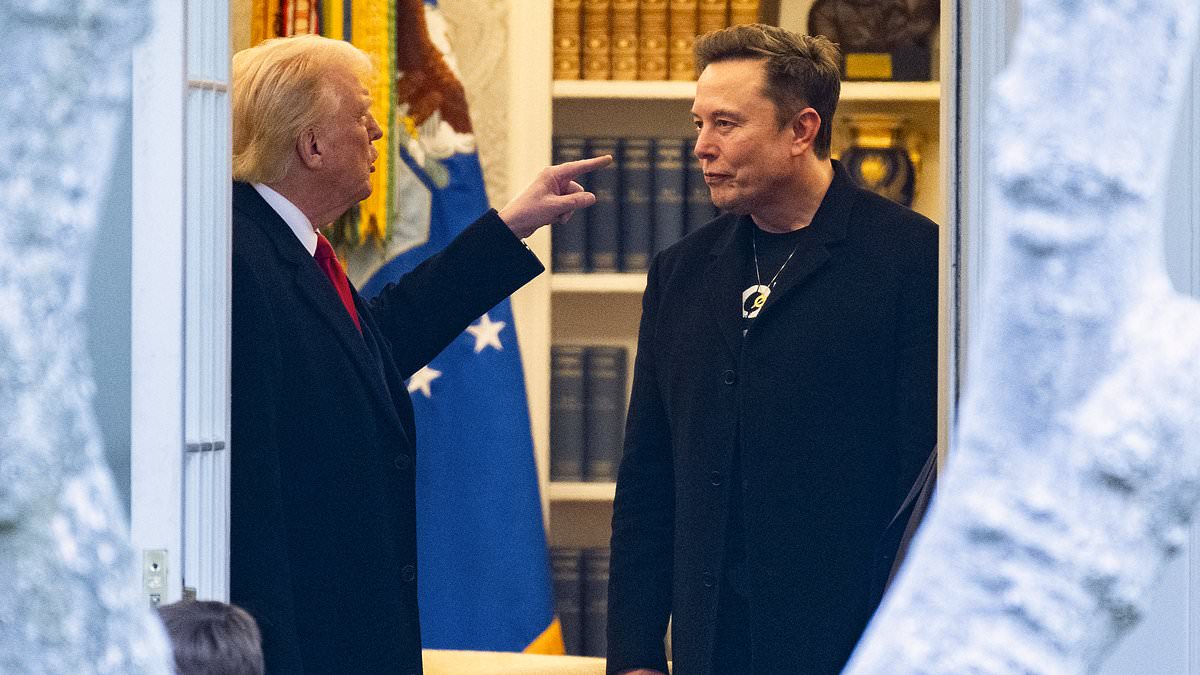

Key Trump Advisor At Center Of Musk Trump Feud

Jun 06, 2025

Key Trump Advisor At Center Of Musk Trump Feud

Jun 06, 2025 -

Gaza Hostage Crisis Israeli Military Confirms Recovery Of Two Bodies

Jun 06, 2025

Gaza Hostage Crisis Israeli Military Confirms Recovery Of Two Bodies

Jun 06, 2025 -

Nhl Playoffs Dallas Stars Fire Coach Pete De Boer After Conference Finals Defeat

Jun 06, 2025

Nhl Playoffs Dallas Stars Fire Coach Pete De Boer After Conference Finals Defeat

Jun 06, 2025