Who's Eligible For The Updated Car Loan Interest Deduction? A Comprehensive Guide

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Who's Eligible for the Updated Car Loan Interest Deduction? A Comprehensive Guide

Are you considering buying a new car and wondering about the car loan interest deduction? The rules surrounding tax deductions can be complex, and the car loan interest deduction is no exception. This comprehensive guide breaks down who qualifies for this deduction and what you need to know to maximize your tax benefits. Understanding the eligibility criteria is crucial for claiming this deduction and saving money on your taxes.

What is the Car Loan Interest Deduction?

Before diving into eligibility, let's clarify what the car loan interest deduction actually is. It allows taxpayers to deduct the interest paid on loans used to purchase a car for business purposes. This is different from personal vehicle loans. Crucially, the deduction isn't for the entire loan amount; it's specifically for the interest portion. This distinction is key for determining eligibility.

Key Eligibility Requirements:

To claim the car loan interest deduction, you must meet several stringent requirements:

-

Business Use: The vehicle must be used primarily for business purposes. The IRS generally defines "primarily" as more than 50% business use. Maintaining meticulous records of your vehicle's business and personal usage is essential. Failing to accurately track this can lead to penalties.

-

Self-Employment or Business Ownership: You must be self-employed or own a business. Employees generally cannot deduct car loan interest, even if they use their vehicle for work-related tasks.

-

Loan Documentation: You'll need comprehensive documentation of your car loan, including the loan agreement, interest payments, and mileage logs. Keep all this paperwork organized and readily accessible for tax season.

-

Type of Vehicle: The deduction applies to a wide range of vehicles used for business, including cars, trucks, and vans. However, luxury vehicles may have limitations, and it's crucial to consult the IRS guidelines for the most up-to-date information.

-

No Personal Use Deduction: Remember, the deduction is solely for the business portion of your loan. Any personal use of the vehicle will reduce the deductible amount proportionally.

How to Calculate Your Deduction:

Calculating your deduction requires careful tracking of your vehicle's business use. Methods for tracking mileage include:

- Mileage Log: Maintain a detailed log of all business-related trips, recording the date, starting and ending mileage, purpose of the trip, and total miles driven for business.

- Percentage of Use: If accurate mileage tracking is difficult, you can estimate the percentage of business use based on your overall driving habits. However, this method carries more risk if audited.

Common Mistakes to Avoid:

Many taxpayers make mistakes when claiming this deduction. Here are some common pitfalls to avoid:

- Inaccurate Record Keeping: Poor record keeping is the leading cause of rejection for car loan interest deductions. Be precise and meticulous in your tracking.

- Confusing Personal and Business Use: Clearly separate personal and business use of your vehicle. Failure to do so can significantly impact your deduction.

- Not Meeting the 50% Business Use Threshold: Ensure your vehicle is used primarily for business. If it's primarily for personal use, you cannot claim the deduction.

Seeking Professional Help:

Navigating tax laws can be complicated. If you're unsure about your eligibility or how to accurately calculate your deduction, consider consulting a tax professional or accountant. They can provide personalized guidance and help you avoid costly mistakes.

Conclusion:

The car loan interest deduction can offer significant tax savings for eligible taxpayers. By understanding the eligibility requirements and diligently maintaining accurate records, you can maximize your tax benefits. Remember, accurate record-keeping is paramount. Don't hesitate to seek professional assistance if needed. Proper planning and documentation are key to a successful claim.

Keywords: Car loan interest deduction, tax deduction, business expenses, self-employed, IRS, tax benefits, vehicle expenses, mileage log, business use, tax preparation, tax professional, auto loan interest.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Who's Eligible For The Updated Car Loan Interest Deduction? A Comprehensive Guide. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Rwznamh Jmhwry Aslamy Asyb Pdhyry Ayran Dr Brabr Nfwdh Kharjy Bh Dlyl Syast Hay Mhajrty

Jul 11, 2025

Rwznamh Jmhwry Aslamy Asyb Pdhyry Ayran Dr Brabr Nfwdh Kharjy Bh Dlyl Syast Hay Mhajrty

Jul 11, 2025 -

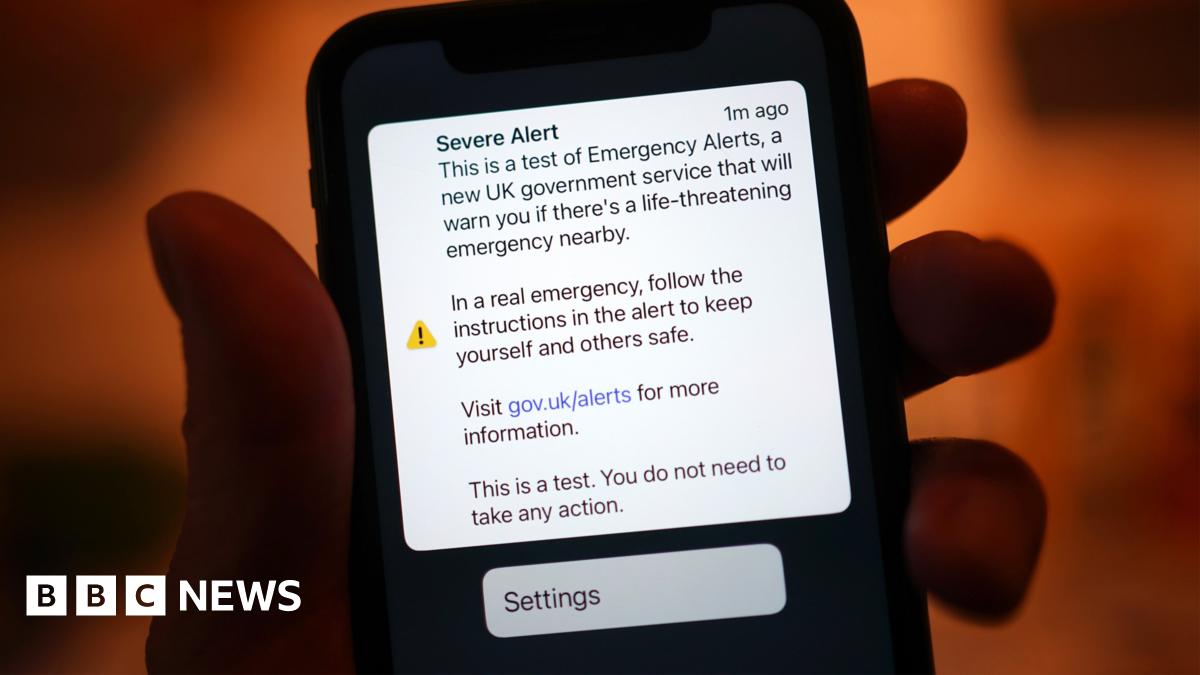

Nationwide Emergency Alert Test Get Ready For Septembers Trial

Jul 11, 2025

Nationwide Emergency Alert Test Get Ready For Septembers Trial

Jul 11, 2025 -

Big Brother Season 27 Meet The Players Competing For 750 000

Jul 11, 2025

Big Brother Season 27 Meet The Players Competing For 750 000

Jul 11, 2025 -

Rswayy Jdyd Eks Hay Jaswsy W Artbat Ba 120 Mqam Blndpayh

Jul 11, 2025

Rswayy Jdyd Eks Hay Jaswsy W Artbat Ba 120 Mqam Blndpayh

Jul 11, 2025 -

Waknsh Ha Bh Adeay Kwakbyan Drbarh Katryn Shkdm W Artbat Wy Ba 120 Shkhsyt Mhm Fylm

Jul 11, 2025

Waknsh Ha Bh Adeay Kwakbyan Drbarh Katryn Shkdm W Artbat Wy Ba 120 Shkhsyt Mhm Fylm

Jul 11, 2025

Latest Posts

-

Tpd Investigation Atv Crash Involving A Car

Jul 16, 2025

Tpd Investigation Atv Crash Involving A Car

Jul 16, 2025 -

Phillipa Soo Josh Gad Join All Star Cast For Jesus Christ Superstar At Hollywood Bowl

Jul 16, 2025

Phillipa Soo Josh Gad Join All Star Cast For Jesus Christ Superstar At Hollywood Bowl

Jul 16, 2025 -

Update Timur Khizriev 2024 Pfl Champion Shot In Russia

Jul 16, 2025

Update Timur Khizriev 2024 Pfl Champion Shot In Russia

Jul 16, 2025 -

Deltona Car Accident Lawyers Bengal Laws Expertise In Personal Injury Cases

Jul 16, 2025

Deltona Car Accident Lawyers Bengal Laws Expertise In Personal Injury Cases

Jul 16, 2025 -

Kings Ai Revolution Former Staff Replaced By Tools They Created

Jul 16, 2025

Kings Ai Revolution Former Staff Replaced By Tools They Created

Jul 16, 2025