Why Amazon (AMZN) Stock's Momentum Could Continue

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Why Amazon (AMZN) Stock's Momentum Could Continue

Amazon (AMZN) has shown remarkable resilience in a challenging market, and many analysts believe its upward trajectory could persist. While economic headwinds remain, several key factors suggest that Amazon's stock momentum may continue its climb. This isn't a guarantee, of course, but understanding these factors can help investors make informed decisions.

Amazon's Diversified Revenue Streams: A Key Strength

One of the most compelling reasons for continued AMZN stock growth is its diversification. Amazon isn't just an online retailer; it's a sprawling tech conglomerate with fingers in many lucrative pies. From its dominant e-commerce platform and AWS (Amazon Web Services), the leading cloud computing provider, to its burgeoning advertising business and burgeoning healthcare initiatives, Amazon boasts a diverse revenue stream that mitigates risk. If one sector experiences a downturn, others can often offset the losses, providing a level of stability rare in the tech sector. This resilience is a significant factor in investor confidence.

AWS: The Engine of Growth

AWS remains a powerhouse, consistently exceeding expectations and driving significant revenue growth for Amazon. The cloud computing market is booming, and Amazon holds a commanding market share. As businesses continue to migrate their operations to the cloud, AWS is perfectly positioned to benefit, ensuring sustained revenue and profitability for Amazon. The ongoing investment in infrastructure and new technologies further solidifies AWS's leadership position, providing a strong foundation for future growth. [Link to a reputable source on AWS market share].

Advertising Revenue Surge

Amazon's advertising business is another significant contributor to its robust financial performance. With millions of active users browsing its platform daily, Amazon possesses an unparalleled advertising inventory. This allows them to compete directly with giants like Google and Meta, capitalizing on the ever-increasing demand for targeted advertising. The continued growth of this segment signals a healthy and diversifying revenue stream, lessening reliance on traditional retail sales.

E-commerce Dominance and Expansion

While brick-and-mortar stores continue to exist, the trend towards online shopping shows no signs of slowing down. Amazon's market share in e-commerce remains substantial, and their ongoing investments in logistics, fulfillment centers, and innovative technologies like drone delivery position them to maintain this dominance. Furthermore, Amazon’s expansion into new markets and product categories demonstrates an unwavering commitment to growth and innovation.

Navigating Economic Uncertainty

It's crucial to acknowledge the current economic climate. Inflation, rising interest rates, and potential recessionary pressures are real concerns. However, Amazon's scale, diversification, and ability to adapt to changing market conditions suggest it's well-positioned to weather the storm. Its cost-cutting measures and focus on efficiency further enhance its resilience.

Risks to Consider

Despite the positive outlook, investors should remain aware of potential risks. Increased competition, regulatory scrutiny, and potential economic downturns could impact Amazon's performance. Careful due diligence and a long-term investment perspective are crucial.

Conclusion: A Cautiously Optimistic Outlook

While no investment is without risk, Amazon's diversified revenue streams, strong performance in key sectors like AWS and advertising, and continued dominance in e-commerce suggest that its positive momentum could continue. However, investors should conduct thorough research and consider their own risk tolerance before making any investment decisions. Staying informed about Amazon's performance and the broader economic landscape is essential for making sound judgments. Remember to consult with a financial advisor before making any investment decisions.

Keywords: AMZN, Amazon stock, Amazon, AWS, Amazon Web Services, e-commerce, cloud computing, advertising revenue, stock momentum, investment, stock market, tech stock, economic outlook, financial analysis, diversification.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Why Amazon (AMZN) Stock's Momentum Could Continue. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Invasive Species Alert The Man Eater Screwworms Resurgence

May 28, 2025

Invasive Species Alert The Man Eater Screwworms Resurgence

May 28, 2025 -

New Study Highlights Alcohols Devastating Impact On The Brain

May 28, 2025

New Study Highlights Alcohols Devastating Impact On The Brain

May 28, 2025 -

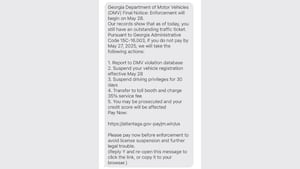

Fake Text Message From Ga Department Of Driver Services Is It A Scam

May 28, 2025

Fake Text Message From Ga Department Of Driver Services Is It A Scam

May 28, 2025 -

Black Lung Prevention Efforts Hampered By Federal Budget Cuts And Staff Reductions

May 28, 2025

Black Lung Prevention Efforts Hampered By Federal Budget Cuts And Staff Reductions

May 28, 2025 -

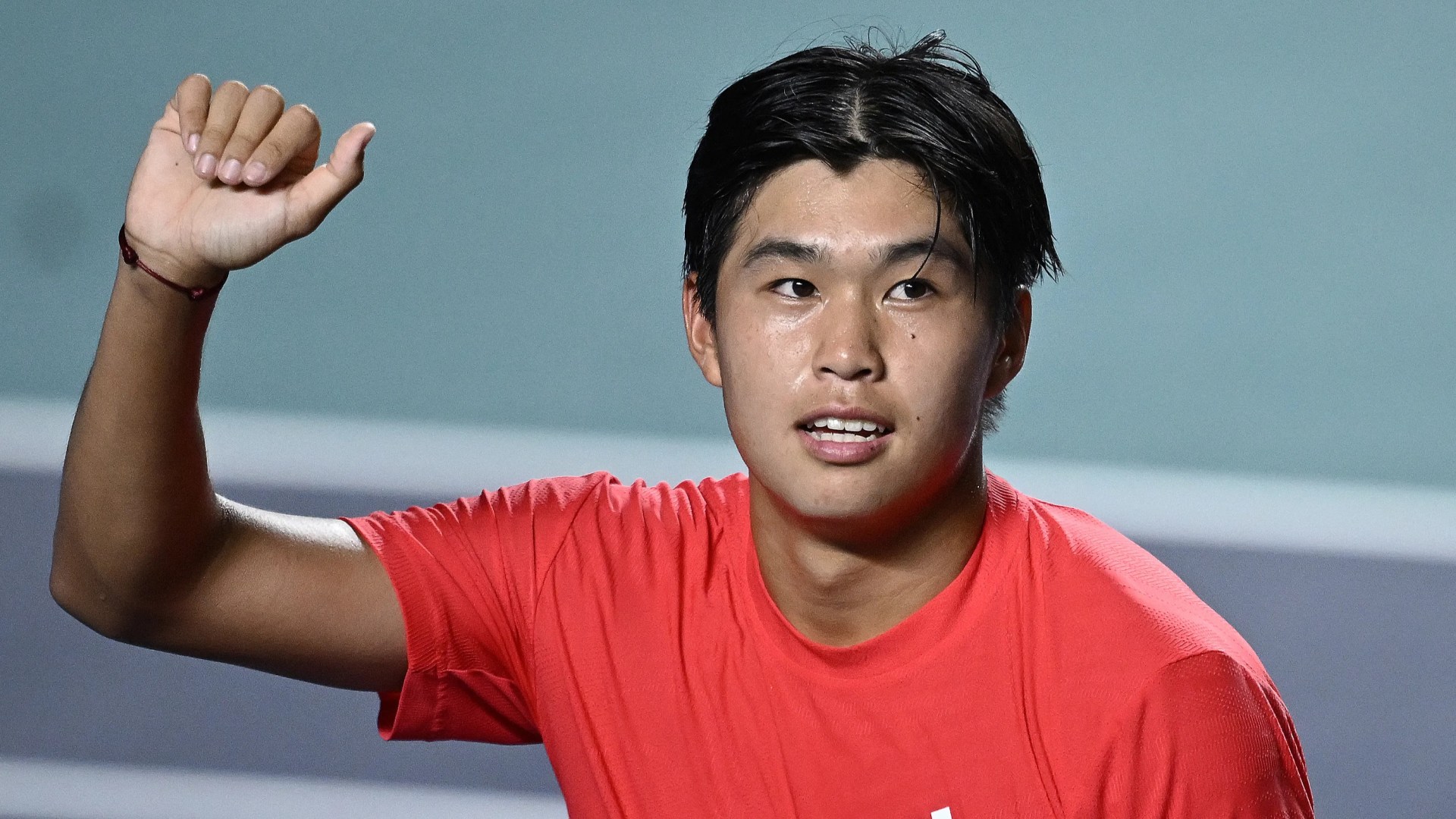

Us Tennis Sensation Named For Moms Occupation Sets Sights On World No 3

May 28, 2025

Us Tennis Sensation Named For Moms Occupation Sets Sights On World No 3

May 28, 2025

Latest Posts

-

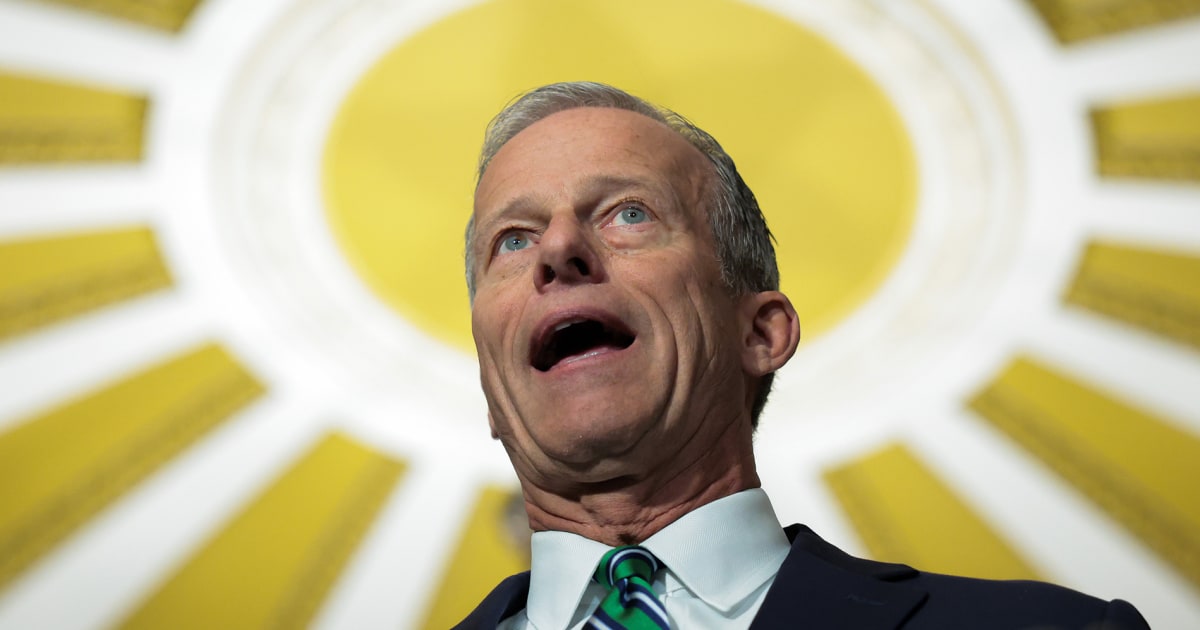

Will Trumps Massive Spending Bill Survive The Senate A Gop Endgame Analysis

May 29, 2025

Will Trumps Massive Spending Bill Survive The Senate A Gop Endgame Analysis

May 29, 2025 -

Recent High Profile Us Jailbreaks Spark Nationwide Manhunt Frenzy

May 29, 2025

Recent High Profile Us Jailbreaks Spark Nationwide Manhunt Frenzy

May 29, 2025 -

Decades Old Rape Case Solved The Controversial Warrant That Led To A Former Arkansas Police Chiefs Conviction

May 29, 2025

Decades Old Rape Case Solved The Controversial Warrant That Led To A Former Arkansas Police Chiefs Conviction

May 29, 2025 -

Met Police Call Handler Quits After Colleagues Reinstatement

May 29, 2025

Met Police Call Handler Quits After Colleagues Reinstatement

May 29, 2025 -

Alexander Zverevs French Open Day 5 Challenge A De Jong Showdown

May 29, 2025

Alexander Zverevs French Open Day 5 Challenge A De Jong Showdown

May 29, 2025