Why Did The Bank Of England Lower Interest Rates? A Comprehensive Explanation

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Why Did the Bank of England Lower Interest Rates? A Comprehensive Explanation

The Bank of England (BoE) recently announced a cut to its base interest rate, sparking widespread discussion and analysis. This move, impacting everything from mortgages to savings accounts, begs the question: why did they do it? Understanding the BoE's decision requires examining the current economic climate and the tools at its disposal. This article will provide a comprehensive explanation, breaking down the complex factors influencing this crucial monetary policy decision.

The Current Economic Landscape: A Slowdown and Inflationary Pressures

The UK economy, like many globally, is facing a period of uncertainty. While unemployment remains relatively low, there are clear signs of a slowdown. Consumer spending, a significant driver of economic growth, is weakening, partly due to persistent high inflation. This inflationary pressure, fueled by rising energy prices and supply chain disruptions, is eroding purchasing power and dampening consumer confidence. The BoE faces a delicate balancing act: stimulating economic growth while simultaneously managing inflation.

Interest Rates: A Powerful Tool for Economic Management

Interest rates are a central lever the BoE uses to influence the economy. By lowering the base rate, the BoE aims to:

- Stimulate borrowing and lending: Lower interest rates make borrowing cheaper for businesses and consumers. This encourages investment and spending, boosting economic activity. Businesses might invest in expansion, while consumers might be more inclined to take out loans for large purchases like homes or cars.

- Weaken the Pound: A lower interest rate can make the Pound less attractive to international investors, leading to a weaker currency. This can boost exports by making UK goods cheaper for overseas buyers, thereby stimulating economic growth. However, a weaker Pound also makes imports more expensive, potentially contributing to inflation.

Why the Recent Rate Cut? A Multi-faceted Analysis

The BoE's decision to lower interest rates wasn't taken lightly. Several factors likely contributed:

- Slowing Economic Growth: Data pointing to a weakening economy, including declining consumer spending and business investment, strongly suggested the need for stimulus.

- Inflationary Concerns, But…: While inflation remains a significant concern, the BoE likely judged that the risk of a sharp economic contraction outweighed the immediate danger of slightly higher inflation. They are betting on a lower interest rate leading to increased economic activity without significantly exacerbating inflation in the long term. This is a high-stakes gamble.

- Global Economic Uncertainty: Geopolitical instability and global economic slowdown played a role. The BoE likely considered the need to provide support to the UK economy in the face of external headwinds.

Potential Consequences and Criticisms

Lowering interest rates is not without its drawbacks. Critics argue that:

- It could fuel inflation further: Increased borrowing and spending could exacerbate inflationary pressures if supply constraints persist.

- It might not stimulate the economy effectively: If businesses and consumers remain cautious due to uncertainty, lower interest rates may not translate into increased investment and spending.

- It could devalue the Pound: A weaker Pound could make imports more expensive, increasing the cost of living.

Looking Ahead: Monitoring the Impact

The impact of the BoE's decision will unfold over time. The effectiveness of the rate cut will depend on various factors, including consumer and business confidence, global economic conditions, and the trajectory of inflation. The BoE will closely monitor economic data to assess the impact of its policy and adjust accordingly. Further rate cuts or hikes are always a possibility depending on future economic indicators.

Conclusion: The BoE's decision to lower interest rates reflects a complex assessment of the current economic situation. While aiming to stimulate growth, the BoE acknowledges the risks associated with this move. The coming months will be crucial in determining whether this strategy proves successful in achieving its intended goals. Stay informed by following reputable financial news sources for updates and analysis.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Why Did The Bank Of England Lower Interest Rates? A Comprehensive Explanation. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

One In One Out First Migrants Returned To France Under New Agreement

Aug 09, 2025

One In One Out First Migrants Returned To France Under New Agreement

Aug 09, 2025 -

Which Player Should Each Nfl Team Trade In 2025 Preseason Analysis

Aug 09, 2025

Which Player Should Each Nfl Team Trade In 2025 Preseason Analysis

Aug 09, 2025 -

Danielle Collins Vs Taylor Townsend Wta Cincinnati Open 2025 Prediction

Aug 09, 2025

Danielle Collins Vs Taylor Townsend Wta Cincinnati Open 2025 Prediction

Aug 09, 2025 -

One Nfl Player Per Team 2025 Preseason Trade Block Candidates

Aug 09, 2025

One Nfl Player Per Team 2025 Preseason Trade Block Candidates

Aug 09, 2025 -

Yeni Sezon Trendyol Sueper Lig Takimlar Ve Baslangic Maclari

Aug 09, 2025

Yeni Sezon Trendyol Sueper Lig Takimlar Ve Baslangic Maclari

Aug 09, 2025

Latest Posts

-

Ufc Fight Night Edwards Vs Cachoeira Betting Odds And Analysis

Aug 10, 2025

Ufc Fight Night Edwards Vs Cachoeira Betting Odds And Analysis

Aug 10, 2025 -

Jaxson Darts Preseason Debut Best Plays And Highlights From Week 1

Aug 10, 2025

Jaxson Darts Preseason Debut Best Plays And Highlights From Week 1

Aug 10, 2025 -

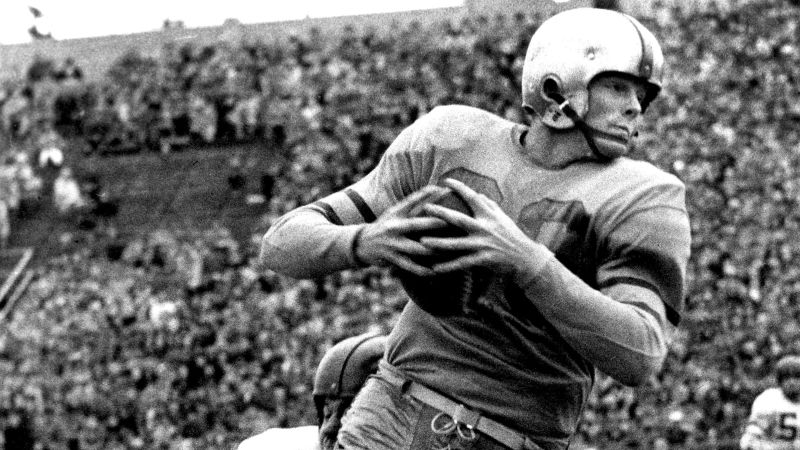

Hall Of Fame Candidate Billy Howton Packers Star And Nflpa Founder Dead At 95

Aug 10, 2025

Hall Of Fame Candidate Billy Howton Packers Star And Nflpa Founder Dead At 95

Aug 10, 2025 -

Apollo 13s Jim Lovell A Life In Space And A Nations Tribute

Aug 10, 2025

Apollo 13s Jim Lovell A Life In Space And A Nations Tribute

Aug 10, 2025 -

Nicola Sturgeons Memoir Arrest Detailed As Worst Day Of My Life

Aug 10, 2025

Nicola Sturgeons Memoir Arrest Detailed As Worst Day Of My Life

Aug 10, 2025