Why Did The Bank Of England Lower Interest Rates? A Detailed Explanation

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Why Did the Bank of England Lower Interest Rates? A Detailed Explanation

The Bank of England's (BoE) recent decision to lower interest rates has sent ripples through the financial markets and sparked considerable public interest. But why did they do it? Understanding the intricacies of monetary policy requires looking beyond the headlines. This detailed explanation will unpack the reasons behind the BoE's move, exploring the economic context and potential consequences.

A Slowing Economy: The Primary Driver

The most significant factor driving the BoE's rate cut is the slowing UK economy. Recent economic indicators, including [link to relevant Office for National Statistics data], have pointed towards a weakening growth trajectory. Factors contributing to this slowdown include:

- Global Uncertainty: Geopolitical instability, trade wars, and Brexit-related anxieties have created a climate of uncertainty, impacting business investment and consumer confidence.

- Weakening Consumer Spending: Falling real wages and rising inflation have squeezed household budgets, leading to a reduction in consumer spending, a key driver of economic growth.

- Brexit Uncertainty (Lingering Effects): While the immediate impact of Brexit has lessened, ongoing uncertainty surrounding trade deals and regulatory frameworks continues to dampen economic activity.

These factors collectively paint a picture of an economy operating below its potential, prompting the BoE to intervene.

Inflation Concerns: A Delicate Balancing Act

The BoE's mandate is to maintain price stability and support sustainable economic growth. While a slowing economy typically leads to lower inflation, the BoE must carefully balance the risk of deflation with the need to stimulate growth. Recent inflation figures [link to relevant BoE inflation report] have shown a decline, but the BoE likely wants to avoid a deflationary spiral, where falling prices lead to reduced spending and further economic contraction. A rate cut can help to prevent this by encouraging borrowing and spending.

The Transmission Mechanism: How Lower Rates Work

Lowering interest rates aims to stimulate the economy through several channels:

- Increased Borrowing: Lower rates make borrowing cheaper for businesses and consumers, encouraging investment and spending.

- Reduced Mortgage Payments: Lower mortgage rates free up disposable income for homeowners, potentially leading to increased spending.

- Weakened Pound: A lower interest rate can weaken the pound, making UK exports more competitive and potentially boosting economic activity.

Potential Risks and Criticisms

While a rate cut can provide a short-term boost, it's not without potential downsides. Critics argue that:

- It fuels inflation in the long run: Increased borrowing and spending could eventually lead to higher inflation if not managed carefully.

- It may not be effective in addressing structural issues: Lower rates might not solve underlying economic problems stemming from Brexit uncertainty or lack of investment.

- It could exacerbate asset bubbles: Lower rates can inflate asset prices (like housing), potentially creating unsustainable bubbles that could burst later.

Conclusion: A Calculated Gamble

The Bank of England's decision to lower interest rates represents a calculated gamble. It's a proactive attempt to counter a slowing economy and avert the risk of deflation. However, the effectiveness of this move will depend on various factors, including the response of businesses and consumers, as well as the evolving global economic landscape. The coming months will be crucial in assessing whether this strategy proves successful in achieving the BoE's objectives of sustainable growth and price stability. Further monitoring of economic indicators and the BoE's future announcements will be essential to understanding the full impact of this policy decision. Stay tuned for further updates.

Call to action (subtle): For in-depth analysis of the UK economy, visit the Bank of England's website.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Why Did The Bank Of England Lower Interest Rates? A Detailed Explanation. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Collins Vs Townsend 2025 Western And Southern Open Prediction And Odds

Aug 09, 2025

Collins Vs Townsend 2025 Western And Southern Open Prediction And Odds

Aug 09, 2025 -

Controversial Dms Ennis Rakestraws Plea For Respect And Cessation Of Online Abuse

Aug 09, 2025

Controversial Dms Ennis Rakestraws Plea For Respect And Cessation Of Online Abuse

Aug 09, 2025 -

Lions Cornerback Ennis Rakestraw Jr Out For Season With Shoulder Injury

Aug 09, 2025

Lions Cornerback Ennis Rakestraw Jr Out For Season With Shoulder Injury

Aug 09, 2025 -

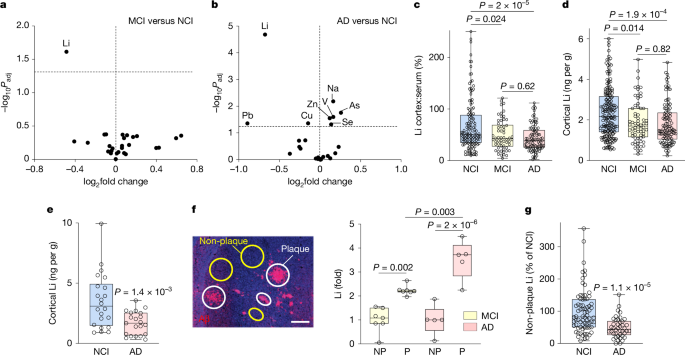

The Link Between Lithium Levels And Alzheimers Disease Onset

Aug 09, 2025

The Link Between Lithium Levels And Alzheimers Disease Onset

Aug 09, 2025 -

Clinical Study Daily Pill Leads To 12 Average Weight Loss

Aug 09, 2025

Clinical Study Daily Pill Leads To 12 Average Weight Loss

Aug 09, 2025

Latest Posts

-

Exclusive Interviewing Of Unaccompanied Migrant Children By Federal Authorities Begins

Aug 10, 2025

Exclusive Interviewing Of Unaccompanied Migrant Children By Federal Authorities Begins

Aug 10, 2025 -

Unaccompanied Migrant Children Face Federal Law Enforcement Interviews

Aug 10, 2025

Unaccompanied Migrant Children Face Federal Law Enforcement Interviews

Aug 10, 2025 -

Jim Lovell Apollo 13 Hero Passes Away At Age 97

Aug 10, 2025

Jim Lovell Apollo 13 Hero Passes Away At Age 97

Aug 10, 2025 -

Federal Agents To Interview Unaccompanied Migrant Children In Custody

Aug 10, 2025

Federal Agents To Interview Unaccompanied Migrant Children In Custody

Aug 10, 2025 -

High Expectations The Hype Train Surrounding A Vikings Newcomer

Aug 10, 2025

High Expectations The Hype Train Surrounding A Vikings Newcomer

Aug 10, 2025