Why Did The Bank Of England Lower Interest Rates? Explained

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Why Did the Bank of England Lower Interest Rates? Explained

The Bank of England's (BoE) recent decision to lower interest rates has sent ripples through the financial markets and sparked widespread discussion. But why did they do it, and what does it mean for you? Understanding the intricacies of monetary policy can be challenging, but this article will break down the key reasons behind the BoE's move and its potential implications.

A Slowing Economy: The Primary Driver

The primary reason behind the interest rate cut is the slowing UK economy. Recent economic data has pointed towards a weakening growth trajectory, with indicators like GDP growth, consumer spending, and business investment all showing signs of deceleration. The BoE, tasked with maintaining price stability and full employment, views lower interest rates as a tool to stimulate economic activity.

How Lower Rates Stimulate the Economy

Lower interest rates make borrowing cheaper for businesses and consumers. This encourages increased investment by businesses, leading to job creation and expansion. For consumers, lower rates translate to cheaper mortgages and loans, potentially boosting spending and overall demand. This increased economic activity is hoped to counter the slowdown and return the economy to a healthier growth path.

- Cheaper borrowing for businesses: Facilitates expansion, job creation, and investment in new projects.

- Lower mortgage rates: Encourages homebuying, stimulating the housing market and related industries.

- Increased consumer spending: As borrowing becomes cheaper, consumers are more likely to spend, boosting economic activity.

Inflation Concerns: A Delicate Balance

While stimulating economic growth is a key objective, the BoE also needs to manage inflation. Inflation, the rate at which prices rise, erodes the purchasing power of money. The BoE aims to keep inflation close to its 2% target. Lowering interest rates can, however, fuel inflation if it leads to excessive demand exceeding supply.

The BoE's decision reflects a careful assessment of the current economic landscape. They likely believe that the risks of a prolonged economic slowdown outweigh the risks of slightly higher inflation in the short term. This is a delicate balancing act, requiring careful monitoring of economic indicators and adjustments to policy as needed.

Global Economic Uncertainty: A Contributing Factor

The global economic climate plays a significant role in the BoE's decisions. Geopolitical uncertainty, trade wars, and global supply chain disruptions can all impact the UK economy. The BoE may have lowered rates as a preemptive measure to mitigate the potential negative consequences of these external factors. This proactive approach aims to bolster the resilience of the UK economy against global headwinds.

What Does This Mean for You?

The impact of lower interest rates varies depending on your individual circumstances. Homeowners with mortgages may see lower monthly payments, while savers might earn less interest on their deposits. Businesses may find it easier to secure loans for expansion, potentially leading to more job opportunities. However, it's crucial to remember that this is a complex economic equation with potential long-term implications.

Looking Ahead: Monitoring the Effects

The effectiveness of the interest rate cut will be closely monitored by the BoE and financial analysts. Future policy decisions will depend on the observed impact on economic growth, inflation, and other key indicators. The BoE's actions will continue to be a significant factor shaping the UK's economic trajectory in the coming months and years. Staying informed about economic news and the BoE's announcements is crucial for individuals and businesses alike.

Disclaimer: This article provides general information and should not be considered financial advice. For personalized guidance, consult with a qualified financial advisor.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Why Did The Bank Of England Lower Interest Rates? Explained. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Rakestraw Injury Fallout Reshaping The Detroit Lions Defensive Backfield

Aug 09, 2025

Rakestraw Injury Fallout Reshaping The Detroit Lions Defensive Backfield

Aug 09, 2025 -

Fleetwoods Marital Issues Age Gap And Public Rejection

Aug 09, 2025

Fleetwoods Marital Issues Age Gap And Public Rejection

Aug 09, 2025 -

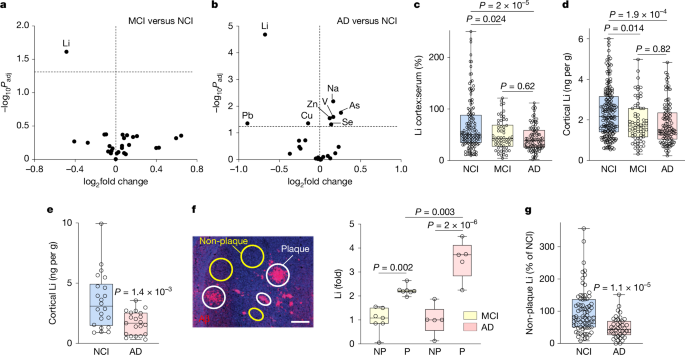

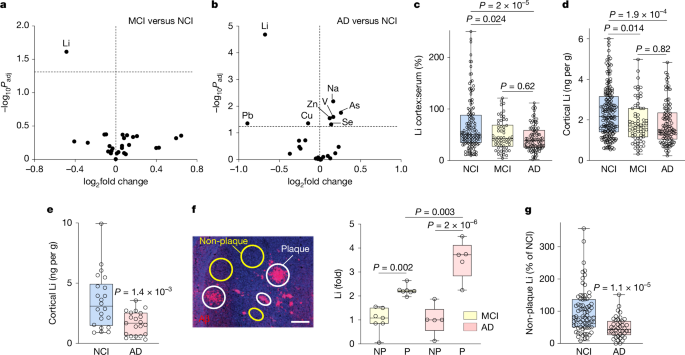

Alzheimers And Lithium Exploring The Connection Between Deficiency And Disease

Aug 09, 2025

Alzheimers And Lithium Exploring The Connection Between Deficiency And Disease

Aug 09, 2025 -

Lithium And Alzheimers Disease Investigating The Potential For Prevention And Treatment

Aug 09, 2025

Lithium And Alzheimers Disease Investigating The Potential For Prevention And Treatment

Aug 09, 2025 -

Mma Fighter Ennis Rakestraw Issues Public Apology For Offensive Messages

Aug 09, 2025

Mma Fighter Ennis Rakestraw Issues Public Apology For Offensive Messages

Aug 09, 2025

Latest Posts

-

Salaires Des Joueuses De Tennis A Cincinnati Analyse Du Prize Money

Aug 09, 2025

Salaires Des Joueuses De Tennis A Cincinnati Analyse Du Prize Money

Aug 09, 2025 -

France Uk Deportation Plan First Migrants Sent Back

Aug 09, 2025

France Uk Deportation Plan First Migrants Sent Back

Aug 09, 2025 -

Cincinnati Open 2025 Collins Vs Townsend Odds Picks And Prediction

Aug 09, 2025

Cincinnati Open 2025 Collins Vs Townsend Odds Picks And Prediction

Aug 09, 2025 -

Danielle Collins Vs Taylor Townsend Match Preview And Viewing Options

Aug 09, 2025

Danielle Collins Vs Taylor Townsend Match Preview And Viewing Options

Aug 09, 2025 -

Millions Demanded Uk Government Faces Pressure Over British Steel Ownership

Aug 09, 2025

Millions Demanded Uk Government Faces Pressure Over British Steel Ownership

Aug 09, 2025