Why I'm Keeping My Amazon Investment Despite A 560% Return

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Why I'm Keeping My Amazon Investment Despite a 560% Return

Headline: Amazon Stock: 560% Returns and I'm Still Holding – Here's Why

Meta Description: Amazon's stock has soared, giving some investors a 560% return. But one investor explains why they're not selling, despite the massive gains. Learn the reasoning behind this long-term strategy.

The tech world is buzzing. Amazon (AMZN) has delivered phenomenal returns for long-term investors. Many are celebrating gains of 560% or more on their initial investments. But while the allure of cashing out after such a massive win is undeniable, I'm choosing to hold onto my Amazon stock. This isn't blind faith; it's a strategic decision based on several key factors.

Why 560% Isn't Enough (For Now):

It's easy to get caught up in the euphoria of a 560% return. That kind of profit is life-changing. However, focusing solely on the past gains ignores Amazon's potential for future growth. My decision to hold rests on these pillars:

-

Amazon's Diversification: Amazon isn't just an online retailer anymore. They're a behemoth spanning cloud computing (AWS), digital advertising, streaming (Prime Video), and more. This diversification significantly reduces risk compared to investing in a single-sector company.

-

AWS's Unstoppable Growth: Amazon Web Services (AWS) is the undisputed leader in cloud computing. Its consistent growth fuels Amazon's overall profitability and provides a strong foundation for future expansion. [Link to a relevant AWS news article or statistic]

-

Prime's Lock-in Effect: Amazon Prime's subscriber base continues to expand, creating a sticky ecosystem that keeps customers locked into Amazon's services. This recurring revenue stream is incredibly valuable and provides a strong buffer against market fluctuations.

-

Long-Term Vision: Jeff Bezos's initial vision transcended simple online retail. Amazon's continued innovation and expansion into new markets suggest a long runway for growth. This isn't a short-term play; it's a bet on the future of e-commerce and technology.

Understanding the Risks:

Holding onto a stock that has already delivered such significant returns is not without risk. Market corrections, increased competition, and unforeseen economic downturns are all possibilities. However, I believe Amazon's diversified business model and strong market position mitigate these risks to a significant extent.

The Importance of Long-Term Investing:

My decision highlights the power of long-term investing. While short-term gains are tempting, focusing on a company's long-term potential often yields greater rewards. This approach requires patience and a tolerance for risk, but the potential payoff can be substantial.

Conclusion:

A 560% return is incredible, but it doesn't signal the end of Amazon's growth story. My decision to maintain my investment is a calculated one, based on a comprehensive assessment of the company's strengths, its diversification, and its long-term potential. While individual investment decisions should always be tailored to personal circumstances and risk tolerance, my experience underscores the potential rewards of a long-term, strategic approach to investing in growth stocks like Amazon.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Why I'm Keeping My Amazon Investment Despite A 560% Return. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

21 Children Among 73 Arrested In Jersey Shore Boardwalk Memorial Day Weekend Violence

May 28, 2025

21 Children Among 73 Arrested In Jersey Shore Boardwalk Memorial Day Weekend Violence

May 28, 2025 -

Billionaire Philanthropy Has The Gates Buffett Era Ended

May 28, 2025

Billionaire Philanthropy Has The Gates Buffett Era Ended

May 28, 2025 -

Leaked Recording Exposes Police Doubts In High Profile Abortion Case

May 28, 2025

Leaked Recording Exposes Police Doubts In High Profile Abortion Case

May 28, 2025 -

Heightened Tensions In Jerusalem Israeli March Sparks Clashes

May 28, 2025

Heightened Tensions In Jerusalem Israeli March Sparks Clashes

May 28, 2025 -

Dont Fall Victim New Text Message Scam Targeting Georgia Motorists

May 28, 2025

Dont Fall Victim New Text Message Scam Targeting Georgia Motorists

May 28, 2025

Latest Posts

-

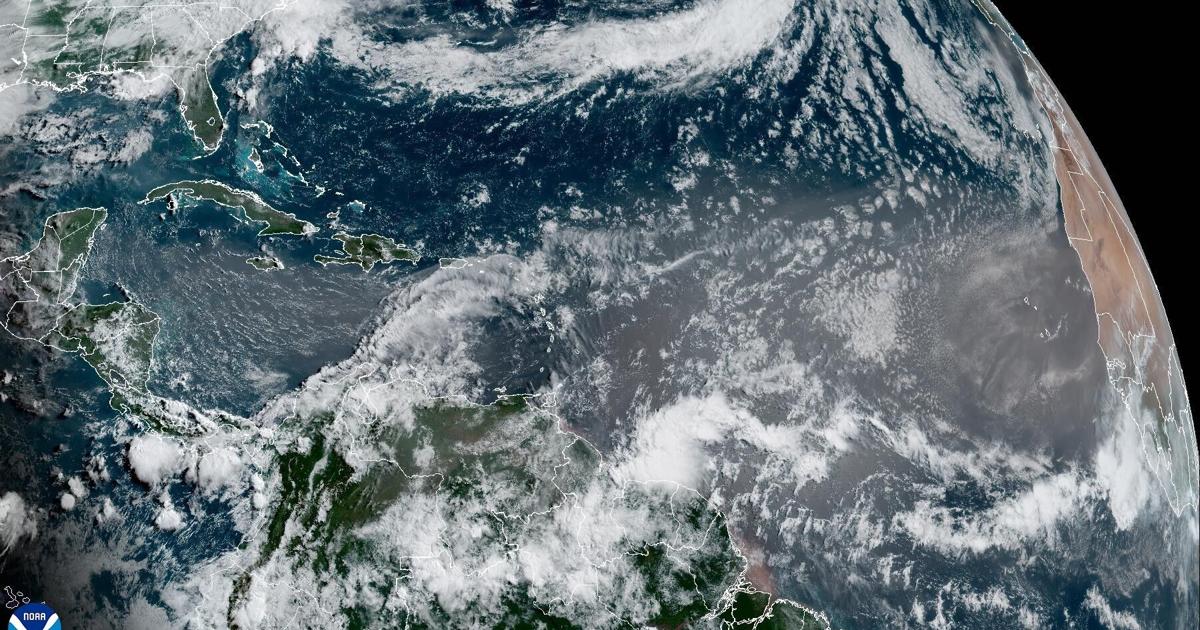

Saharan Dust Cloud To Impact Louisiana Sunset Forecast And Timing

May 30, 2025

Saharan Dust Cloud To Impact Louisiana Sunset Forecast And Timing

May 30, 2025 -

California High School Track New Rules Following Transgender Athletes Victory

May 30, 2025

California High School Track New Rules Following Transgender Athletes Victory

May 30, 2025 -

Analyzing The 1000 Growth Of Sbet Stock Investment Implications And Future Outlook

May 30, 2025

Analyzing The 1000 Growth Of Sbet Stock Investment Implications And Future Outlook

May 30, 2025 -

Lexington Police Expand Search For Missing And Endangered Teen

May 30, 2025

Lexington Police Expand Search For Missing And Endangered Teen

May 30, 2025 -

Us Trade Court Decision Trumps Global Tariffs Found Unconstitutional

May 30, 2025

Us Trade Court Decision Trumps Global Tariffs Found Unconstitutional

May 30, 2025