Why I'm Keeping My Amazon Shares After A Huge 560% Profit

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Why I'm Holding Onto My Amazon Shares After a 560% Profit: A Contrarian Investment Strategy

The tech sector has seen its fair share of volatility lately, and Amazon (AMZN) is no exception. Many investors, myself included, have ridden a thrilling rollercoaster, witnessing a staggering 560% increase in their Amazon stock investments. But with such massive gains, the natural question arises: do you cash out and secure your profits, or ride the wave further? For me, the answer is clear: I'm holding onto my Amazon shares, and here's why.

The Temptation of a Massive Win

Let's be honest, a 560% return is nothing short of phenomenal. The urge to secure such a significant profit is almost irresistible. The fear of missing out (FOMO) transforms into the fear of losing out (FOMo). Many financial advisors would advocate for taking profits and diversifying. And that's sound advice in many scenarios. But Amazon represents something different.

Beyond the Numbers: Amazon's Enduring Strength

My decision to hold isn't purely based on emotion. It’s grounded in a fundamental belief in Amazon's long-term growth potential. Here's what convinces me:

- Dominant Market Position: Amazon's dominance in e-commerce is undeniable. While competitors exist, none pose a serious threat to its market share. This entrenched position provides a strong foundation for continued growth.

- AWS: The Undisputed Cloud Leader: Amazon Web Services (AWS) is the undisputed leader in the cloud computing market. This high-margin, rapidly expanding segment provides a significant revenue stream, insulating Amazon from potential downturns in other areas. [Link to AWS website]

- Innovation and Diversification: Amazon consistently invests in innovation across various sectors, from grocery delivery (Whole Foods) to healthcare and entertainment (Prime Video). This diversification mitigates risk and opens doors to new revenue streams.

- Long-Term Vision: Jeff Bezos’s long-term vision has consistently proven successful. While his departure as CEO marked a significant change, the company’s strategic direction remains focused on innovation and customer experience.

Managing Risk: A Balanced Approach

Holding onto a significant investment after such a massive gain isn't reckless; it's a calculated risk. To manage this risk effectively, I've implemented the following strategies:

- Diversification: While I'm holding my Amazon shares, my overall investment portfolio is diversified across different asset classes. This reduces reliance on any single investment and mitigates overall portfolio risk.

- Regular Review: I regularly review my investment strategy, keeping a close eye on Amazon's financial performance and market conditions. This allows me to adjust my holdings if necessary.

- Emotional Discipline: This is perhaps the most crucial element. Sticking to a well-defined investment plan, despite market fluctuations, is key to long-term success. Fear and greed can be powerful emotions; managing them is crucial for rational decision-making.

Conclusion: A Long-Term Play

My decision to hold onto my Amazon shares, despite the substantial profit, is a long-term strategy based on a fundamental belief in the company's enduring strength and future potential. While there are always risks involved in investing, Amazon's market leadership, robust innovation, and diversification across various sectors provide a compelling case for continued growth. It’s a contrarian view, perhaps, but one rooted in careful analysis and a belief in the power of long-term investment. What’s your Amazon strategy? Share your thoughts in the comments below!

Disclaimer: This article expresses the personal opinion of the author and does not constitute financial advice. Investing in the stock market carries inherent risks, and past performance is not indicative of future results. Always conduct thorough research and consult with a qualified financial advisor before making investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Why I'm Keeping My Amazon Shares After A Huge 560% Profit. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Complete Guide June 2025 Social Security Payments In The Us

May 27, 2025

Complete Guide June 2025 Social Security Payments In The Us

May 27, 2025 -

Massive Russian Air Strikes Hit Ukraine Overnight

May 27, 2025

Massive Russian Air Strikes Hit Ukraine Overnight

May 27, 2025 -

Deadly Russian Airstrikes Hit Kyiv Despite Major Prisoner Exchange

May 27, 2025

Deadly Russian Airstrikes Hit Kyiv Despite Major Prisoner Exchange

May 27, 2025 -

Institutional Investor Focus Financial Avengers Large Stake In Bank Of America Bac

May 27, 2025

Institutional Investor Focus Financial Avengers Large Stake In Bank Of America Bac

May 27, 2025 -

Is Sirius Xm Holdings A Smart Long Term Investment A Detailed Look

May 27, 2025

Is Sirius Xm Holdings A Smart Long Term Investment A Detailed Look

May 27, 2025

Latest Posts

-

Relief In Gaza Us Backed Initiative Launches Aid Program

May 28, 2025

Relief In Gaza Us Backed Initiative Launches Aid Program

May 28, 2025 -

Macron Denies Allegations Following Viral Video With Brigitte Macron

May 28, 2025

Macron Denies Allegations Following Viral Video With Brigitte Macron

May 28, 2025 -

The Unexpected Rise Of Shepmates From Humble Beginnings To Viral Stardom

May 28, 2025

The Unexpected Rise Of Shepmates From Humble Beginnings To Viral Stardom

May 28, 2025 -

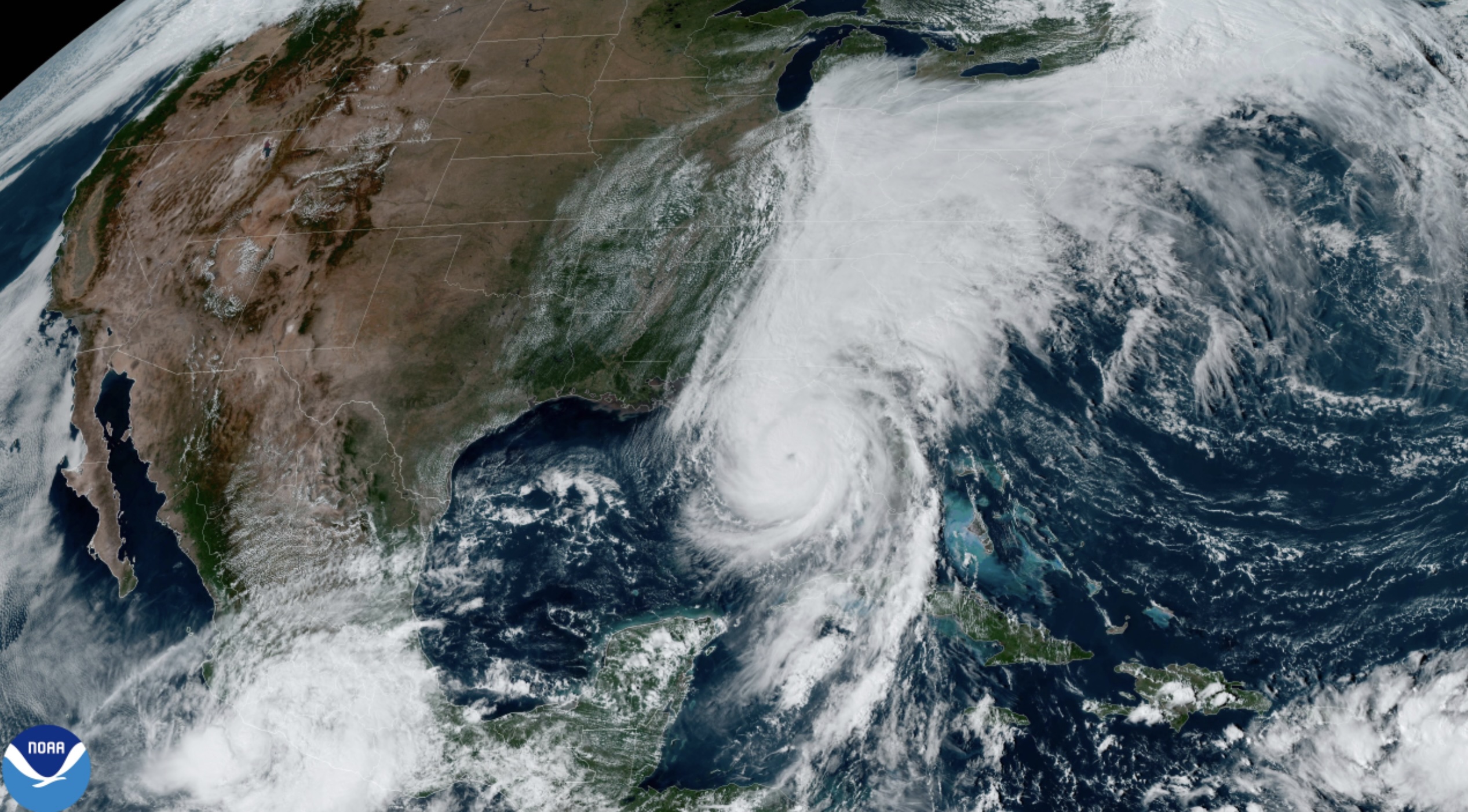

National Hurricane Center Predicts Above Normal Activity 10 Hurricanes Possible

May 28, 2025

National Hurricane Center Predicts Above Normal Activity 10 Hurricanes Possible

May 28, 2025 -

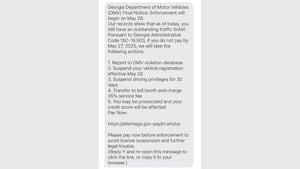

Urgent Warning Avoid This Georgia Drivers Services Text Message Scam

May 28, 2025

Urgent Warning Avoid This Georgia Drivers Services Text Message Scam

May 28, 2025