Why I'm Keeping My Amazon Stock Despite 560% Growth

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Why I'm Holding My Amazon Stock Despite a 560% Growth Surge

The e-commerce giant has experienced phenomenal growth, leaving many investors wondering if it's time to cash in. But for some, like myself, the story isn't over yet. Holding onto Amazon (AMZN) stock, even after a staggering 560% increase, might seem counterintuitive. Many would advise taking profits after such a dramatic rise. But my reasons for maintaining my position are rooted in a long-term perspective and a belief in Amazon's continued dominance across multiple sectors.

Amazon's Unstoppable Momentum: More Than Just E-commerce

The 560% growth isn't just about online shopping; it reflects Amazon's diversification and expansion into incredibly lucrative markets. While its e-commerce dominance remains undisputed, its success story extends far beyond just retail:

- Amazon Web Services (AWS): This cloud computing behemoth is a cash cow, consistently delivering strong revenue and profit growth. AWS's market share continues to expand, cementing its position as a leader in the cloud computing space. [Link to AWS website or relevant news article about AWS growth]

- Amazon Prime: The subscription service is a powerful engine of customer loyalty and recurring revenue. With its ever-expanding benefits, including Prime Video, Prime Music, and free shipping, Prime continues to attract and retain millions of subscribers worldwide. [Link to an article discussing Amazon Prime membership growth]

- Advertising: Amazon's advertising platform is rapidly becoming a major competitor to Google and Facebook. Leveraging its vast user base and detailed consumer data, Amazon's advertising revenue is experiencing explosive growth. [Link to article on Amazon's advertising revenue growth]

- Expanding into New Markets: From grocery (Whole Foods) to healthcare, Amazon continues to aggressively pursue new markets, demonstrating its ambition and adaptability. This constant innovation ensures future growth potential.

Addressing the Concerns: Why Not Sell Now?

The temptation to sell after such significant gains is understandable. However, several factors contribute to my decision to hold:

- Long-Term Vision: Amazon's long-term growth potential remains substantial. Its innovative culture and relentless pursuit of efficiency suggest continued market leadership for years to come.

- Market Volatility: While the market is experiencing some volatility, I believe Amazon's strong fundamentals will cushion it against short-term fluctuations.

- Missed Opportunities: Selling now might mean missing out on potentially even greater returns in the future. Amazon's track record of innovation and expansion suggests further growth is likely.

- Dividend Potential (Future): Although Amazon doesn't currently pay dividends, the possibility of future dividend payouts adds to the long-term appeal.

Managing Risk: Diversification is Key

It's crucial to remember that investing in any single stock, even Amazon, carries inherent risk. Diversifying your investment portfolio is essential to mitigate these risks. My Amazon holdings represent only a portion of my overall investment strategy.

Conclusion: A Calculated Hold

Holding my Amazon stock despite its significant growth isn't a gamble; it's a calculated decision based on a long-term perspective, a belief in Amazon's enduring strength, and a diversified investment strategy. While market conditions can change, Amazon's continued innovation and expansion across multiple sectors suggest a promising future.

Disclaimer: This article represents the author's personal opinion and should not be considered financial advice. Always conduct thorough research and consult with a financial advisor before making investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Why I'm Keeping My Amazon Stock Despite 560% Growth. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

I Os 18 4 1 For I Phone A Detailed Update Analysis

May 27, 2025

I Os 18 4 1 For I Phone A Detailed Update Analysis

May 27, 2025 -

Financial Avengers Inc S Top Holdings Bank Of America A Major Position

May 27, 2025

Financial Avengers Inc S Top Holdings Bank Of America A Major Position

May 27, 2025 -

Chaos On The Jersey Shore Boardwalk Violence Leads To Multiple Stabbings

May 27, 2025

Chaos On The Jersey Shore Boardwalk Violence Leads To Multiple Stabbings

May 27, 2025 -

Brunei Sultans Kl Hospital Stay Fatigue Reported Say Malaysian Government Sources

May 27, 2025

Brunei Sultans Kl Hospital Stay Fatigue Reported Say Malaysian Government Sources

May 27, 2025 -

Jo Jo Siwa And Chris Hughes A Bouquet Of Flowers And A Flutter Of Romance

May 27, 2025

Jo Jo Siwa And Chris Hughes A Bouquet Of Flowers And A Flutter Of Romance

May 27, 2025

Latest Posts

-

Chinese Chemical Plant Hit By Huge Explosion Authorities Investigating

May 28, 2025

Chinese Chemical Plant Hit By Huge Explosion Authorities Investigating

May 28, 2025 -

Analysis Understanding The Events At The Liverpool Victory Parade

May 28, 2025

Analysis Understanding The Events At The Liverpool Victory Parade

May 28, 2025 -

Historic Village Residents Protest New Housing Development Sewage Capacity Crisis

May 28, 2025

Historic Village Residents Protest New Housing Development Sewage Capacity Crisis

May 28, 2025 -

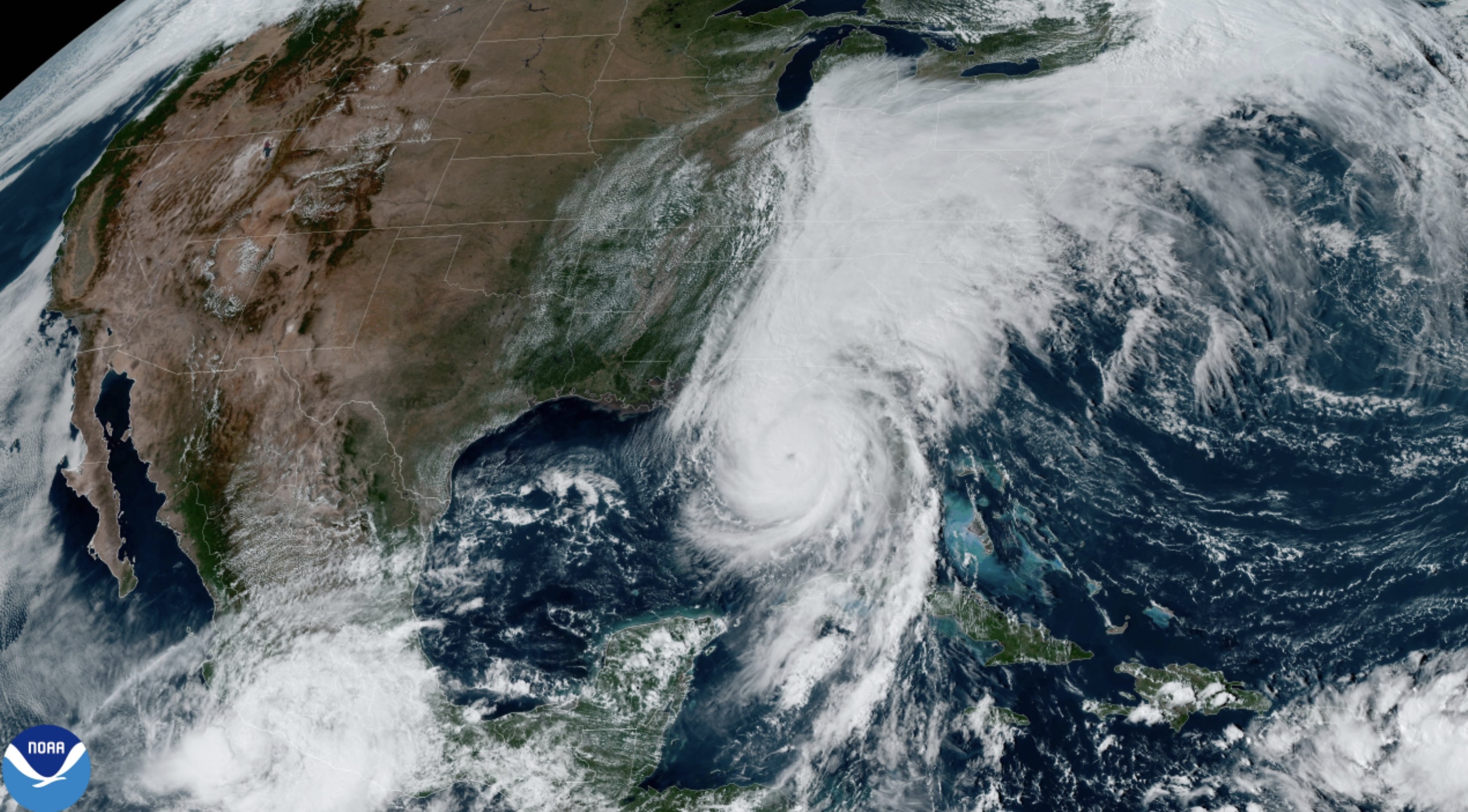

Brace For Impact Above Normal Hurricane Activity Predicted For Us

May 28, 2025

Brace For Impact Above Normal Hurricane Activity Predicted For Us

May 28, 2025 -

Tourism To Canada Navigating The Current Climate Of Boycott Sentiment

May 28, 2025

Tourism To Canada Navigating The Current Climate Of Boycott Sentiment

May 28, 2025