Why I'm Not Selling My Amazon Stock Despite A 560% Increase

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Why I'm Not Selling My Amazon Stock Despite a 560% Increase

Amazon. The name conjures images of ubiquitous online shopping, cloud computing dominance, and futuristic innovations. For many investors, holding Amazon stock (AMZN) has been a wildly successful ride. But what happens when your investment skyrockets by a staggering 560%? Do you cash out and celebrate your monumental gains? For me, the answer is a resounding no, and here's why.

While the recent surge in Amazon's stock price is undeniably impressive, selling now would be a premature and potentially costly mistake. My decision is rooted in a long-term perspective, fueled by a deep understanding of Amazon's multifaceted business model and its unparalleled growth potential.

H2: Beyond the Numbers: Amazon's Enduring Strength

The 560% increase is a headline grabber, but it's crucial to look beyond the immediate numbers. Amazon's success isn't simply a fleeting market trend; it's built on a solid foundation of several key pillars:

-

E-commerce Dominance: Amazon continues to reign supreme in online retail, constantly innovating with features like Prime, one-click ordering, and personalized recommendations. Their logistics network, while facing challenges like rising costs, remains a significant competitive advantage. [Link to article on Amazon's logistics network]

-

AWS: The Cloud Computing Giant: Amazon Web Services (AWS) is a powerhouse in the cloud computing sector, powering countless businesses and applications worldwide. Its consistent growth and profitability provide a crucial buffer against fluctuations in other parts of Amazon's empire. [Link to AWS website]

-

Expansion into New Markets: Amazon is not resting on its laurels. Its ventures into advertising, healthcare (Amazon Pharmacy, telehealth initiatives), and even grocery delivery (Whole Foods, Amazon Fresh) demonstrate a strategic commitment to diversification and future growth.

-

Long-Term Visionary Leadership: Under Jeff Bezos's successor, Andy Jassy, Amazon remains focused on long-term growth and innovation, a characteristic that instills confidence in its continued success.

H2: The Risks of Selling Now

While holding onto any stock involves risk, selling my Amazon shares now feels particularly unwise. The potential for future growth far outweighs the temptation of immediate profits. Consider these factors:

-

Missed Opportunities: Selling now means forfeiting potential gains from future innovations and market expansion. Amazon’s consistent evolution ensures it will likely continue to generate substantial returns.

-

Tax Implications: Realizing such significant gains would trigger substantial capital gains taxes, significantly reducing the actual amount received.

-

Market Volatility: While Amazon's stock is performing exceptionally well, market volatility remains a reality. There's no guarantee that investing the proceeds elsewhere would yield comparable returns, especially in the short term.

H2: A Long-Term Investment Strategy

My approach to Amazon stock is firmly rooted in a long-term investment strategy. I believe in the company's ability to adapt and innovate, consistently capturing market share and generating value for its shareholders. While short-term fluctuations are inevitable, the underlying strength of Amazon's business model gives me confidence in its long-term prospects.

H3: Disclaimer: This article reflects the author's personal investment strategy and should not be considered financial advice. Always conduct thorough research and consult with a qualified financial advisor before making any investment decisions.

This isn't about getting rich quick; it's about participating in the growth of a truly transformative company. The 560% increase is a testament to that growth, and I'm confident that the best is yet to come. What's your investment strategy with Amazon stock? Share your thoughts in the comments below.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Why I'm Not Selling My Amazon Stock Despite A 560% Increase. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Incident Macron Macron L Elysee Repond Aux Speculations Sur La Video

May 27, 2025

Incident Macron Macron L Elysee Repond Aux Speculations Sur La Video

May 27, 2025 -

Gary Linekers Bbc Exit The End Of A Long And Successful Career

May 27, 2025

Gary Linekers Bbc Exit The End Of A Long And Successful Career

May 27, 2025 -

Sirius Xm Stock A Deep Dive Into Its Millionaire Making Potential

May 27, 2025

Sirius Xm Stock A Deep Dive Into Its Millionaire Making Potential

May 27, 2025 -

My Rationale For Not Selling Amazon Stock After A 560 Increase

May 27, 2025

My Rationale For Not Selling Amazon Stock After A 560 Increase

May 27, 2025 -

Legal Battle Texas Woman Fights For 83 5 Million Lottery Win

May 27, 2025

Legal Battle Texas Woman Fights For 83 5 Million Lottery Win

May 27, 2025

Latest Posts

-

From Lumber To Likes Shepmates Journey To Social Media Domination

May 28, 2025

From Lumber To Likes Shepmates Journey To Social Media Domination

May 28, 2025 -

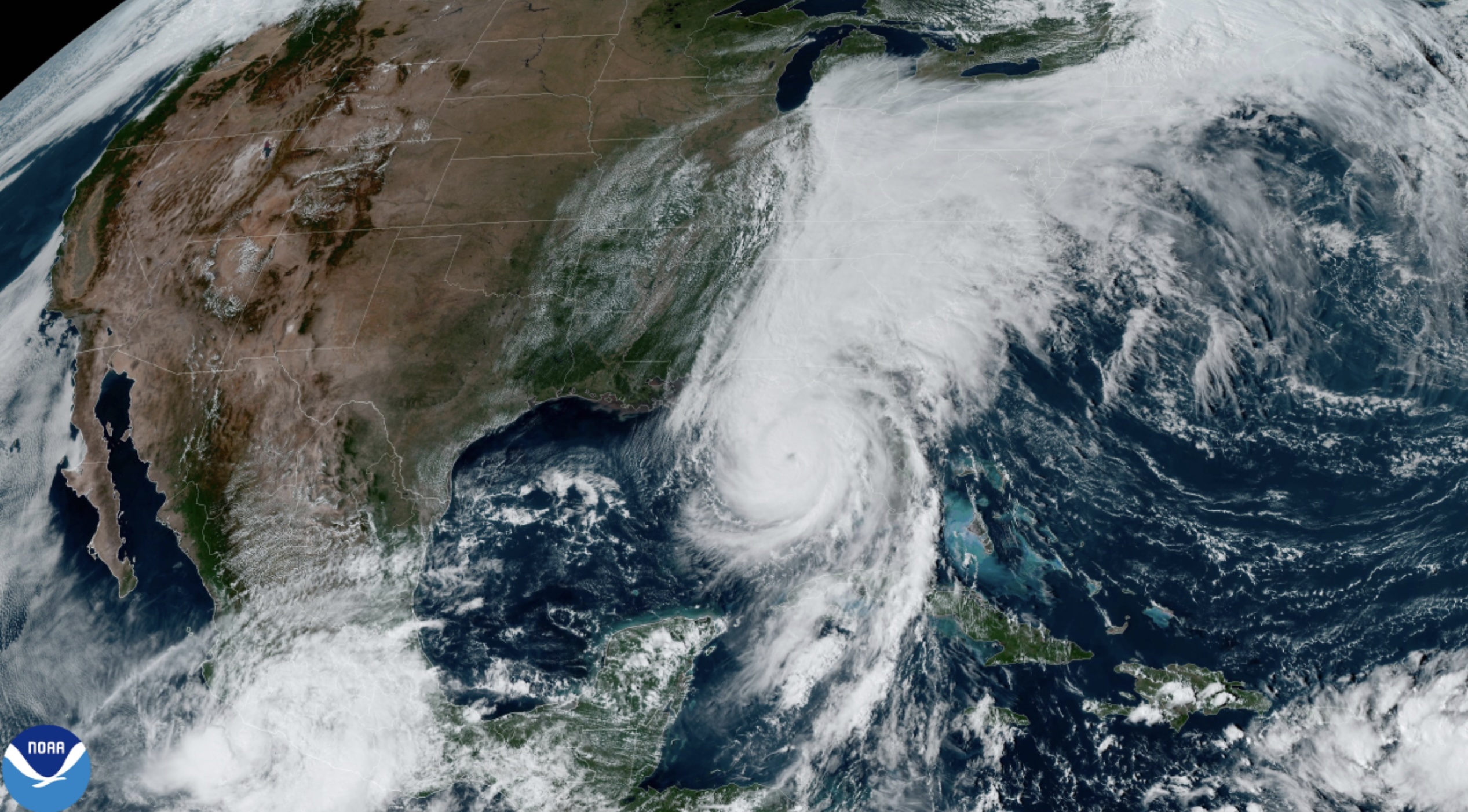

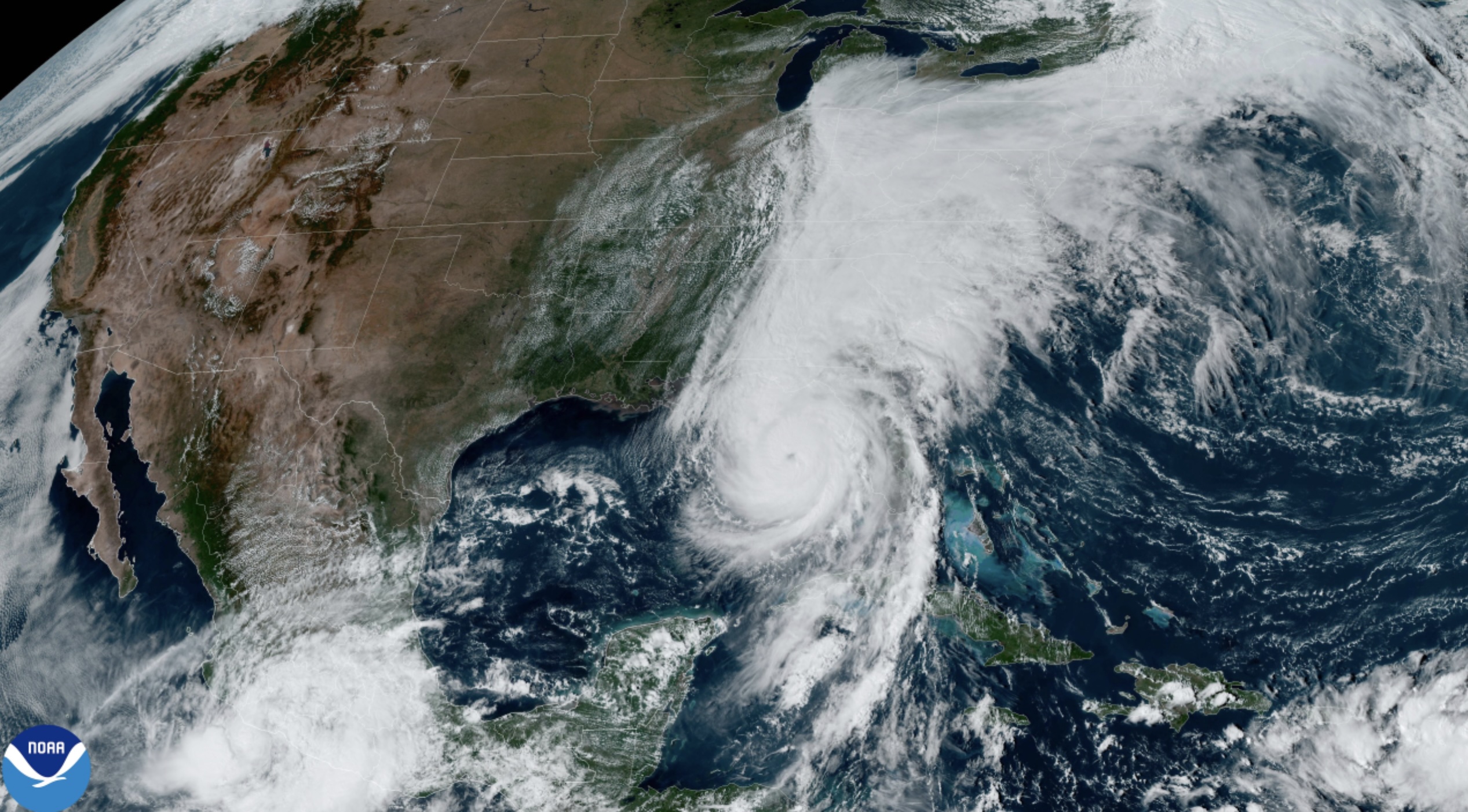

Increased Hurricane Threat Above Normal Conditions Could Mean 10 Us Hurricanes This Summer

May 28, 2025

Increased Hurricane Threat Above Normal Conditions Could Mean 10 Us Hurricanes This Summer

May 28, 2025 -

Above Normal Hurricane Season Forecast 10 Storms Possible For The Us

May 28, 2025

Above Normal Hurricane Season Forecast 10 Storms Possible For The Us

May 28, 2025 -

Royal Visit And Political Controversy King Charles In Canada As Trump Eyes 51st State

May 28, 2025

Royal Visit And Political Controversy King Charles In Canada As Trump Eyes 51st State

May 28, 2025 -

Could Reversed Climate Policies Lead To A Livestock Pest Epidemic The Trump Factor

May 28, 2025

Could Reversed Climate Policies Lead To A Livestock Pest Epidemic The Trump Factor

May 28, 2025