Why I'm Staying Invested In Amazon After A Huge Profit

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Why I'm Staying Invested in Amazon After a Huge Profit

The recent surge in Amazon's stock price has left many investors wondering what to do next. Did you cash in your profits? Or are you, like me, holding onto your shares despite the significant gains? This article explores why I believe staying invested in Amazon, even after a substantial profit, is a strategically sound move.

The Amazon Juggernaut: More Than Just Online Retail

It's easy to think of Amazon as just an online retailer, but that drastically undersells its true power. Amazon is a multifaceted behemoth dominating several key sectors, including:

- E-commerce: While competition is fierce, Amazon's Prime membership, vast selection, and efficient logistics network remain unparalleled.

- Cloud Computing (AWS): Amazon Web Services is the undisputed leader in cloud computing, providing crucial infrastructure for businesses worldwide. This segment consistently delivers strong revenue and growth.

- Advertising: Amazon's advertising platform is rapidly expanding, leveraging its massive user base to offer targeted advertising solutions.

- Subscription Services: Beyond Prime, Amazon offers a diverse range of subscription services, from music and video streaming to grocery delivery, creating recurring revenue streams.

Reasons to Stay Invested:

My decision to remain invested in Amazon post-profit stems from several key factors:

- Long-Term Growth Potential: While short-term market fluctuations are inevitable, Amazon's long-term growth prospects remain exceptionally strong. Its diversification across numerous sectors mitigates risk and ensures continued expansion.

- Innovation and Expansion: Amazon continuously innovates and expands into new markets. From drone delivery to its foray into healthcare, the company consistently pushes boundaries, creating new opportunities for growth and revenue. This commitment to innovation is a key differentiator.

- Market Dominance: Amazon's market share across many of its sectors is substantial. This dominance translates to significant pricing power and a strong competitive advantage.

- Resilience: Despite economic downturns, Amazon has consistently demonstrated resilience. Its diverse revenue streams and adaptability ensure it can weather economic storms more effectively than many competitors.

Managing Risk and Profit-Taking:

It's crucial to acknowledge the inherent risks in any investment. While I believe in Amazon's long-term potential, sensible risk management is paramount. Strategies like diversifying your portfolio and employing dollar-cost averaging can help mitigate potential losses. Partial profit-taking is also a valid strategy; it allows you to secure some gains while maintaining exposure to future growth.

The Future of Amazon:

Predicting the future is impossible, but the signs point towards continued success for Amazon. Its commitment to innovation, market dominance, and diverse revenue streams make it a compelling investment for the long term. The recent profit surge is a testament to its strength, not a reason to exit the market prematurely.

Conclusion:

My decision to hold onto my Amazon shares after a significant profit is based on a thorough assessment of the company's strengths, its future potential, and a well-defined risk management strategy. While individual investment decisions should always be based on your personal circumstances and risk tolerance, I believe Amazon remains a strong long-term investment. Remember to conduct your own thorough research and consult with a financial advisor before making any investment decisions. This article is for informational purposes only and should not be considered financial advice.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Why I'm Staying Invested In Amazon After A Huge Profit. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Kfcs Uk And Ireland Growth Spurring 7 000 New Jobs

May 28, 2025

Kfcs Uk And Ireland Growth Spurring 7 000 New Jobs

May 28, 2025 -

Latest Nba Trade Buzz Dallas Targets Holiday And Ball Bucks Keep Antetokounmpo Nets Draft Strategy

May 28, 2025

Latest Nba Trade Buzz Dallas Targets Holiday And Ball Bucks Keep Antetokounmpo Nets Draft Strategy

May 28, 2025 -

Historic Village Housing Approval Sparks Sewage Capacity Battle

May 28, 2025

Historic Village Housing Approval Sparks Sewage Capacity Battle

May 28, 2025 -

Wwii Bomber Crash Recovery Of Four Airmens Remains Brings Closure After Decades

May 28, 2025

Wwii Bomber Crash Recovery Of Four Airmens Remains Brings Closure After Decades

May 28, 2025 -

Bruneis Sultan In Kuala Lumpur Hospital Fatigue Prompts Medical Care

May 28, 2025

Bruneis Sultan In Kuala Lumpur Hospital Fatigue Prompts Medical Care

May 28, 2025

Latest Posts

-

Is Doc Rivers The Answer Milwaukee Bucks Uncertain Future With Giannis Antetokounmpo

May 29, 2025

Is Doc Rivers The Answer Milwaukee Bucks Uncertain Future With Giannis Antetokounmpo

May 29, 2025 -

Police Officer Hurt In Crash Charges Filed Against Driver

May 29, 2025

Police Officer Hurt In Crash Charges Filed Against Driver

May 29, 2025 -

Chemical Plant Blast In China Authorities Investigate Cause And Impact

May 29, 2025

Chemical Plant Blast In China Authorities Investigate Cause And Impact

May 29, 2025 -

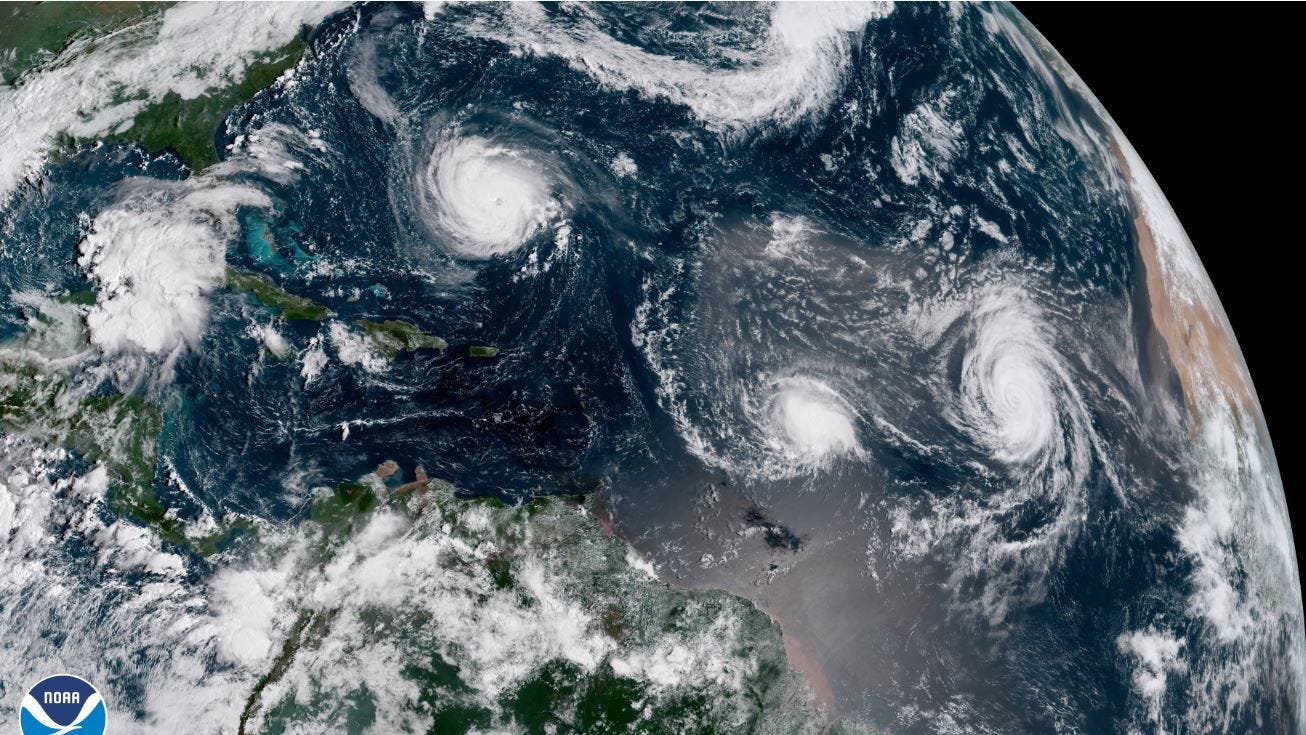

Complete Guide Preparing For The 2025 Hurricane Season

May 29, 2025

Complete Guide Preparing For The 2025 Hurricane Season

May 29, 2025 -

Heart Attacks Under 50 Understanding The Risk In Young Couples

May 29, 2025

Heart Attacks Under 50 Understanding The Risk In Young Couples

May 29, 2025