Why I'm Staying Invested In Amazon Despite A 560% Profit

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Why I'm Staying Invested in Amazon Despite a 560% Profit: A Contrarian View

Amazon. The name conjures images of ubiquitous online shopping, cloud computing dominance, and a seemingly unstoppable juggernaut. For many investors, a 560% profit would be a reason to celebrate and cash out. But my approach is different. Despite achieving such impressive returns on my Amazon investment, I'm choosing to hold onto my shares. Here's why.

This isn't about greed; it's about long-term vision and understanding the fundamental strengths of a company that continues to adapt and innovate, even amidst economic uncertainty. Many might see the current market conditions and consider taking profits, but I believe Amazon's potential for future growth significantly outweighs the risks.

H2: The Power of Prime and Beyond: Amazon's Diversified Empire

Amazon's success isn't solely reliant on online retail. The company has meticulously built a diversified empire, mitigating risk and creating multiple avenues for growth. Consider these key factors:

-

Amazon Prime: The subscription service is a cash cow, offering unparalleled convenience and locking in millions of loyal customers. This recurring revenue stream provides a stable foundation even during economic downturns. Think about the sticky nature of Prime – once you're in, the benefits are hard to resist.

-

Amazon Web Services (AWS): The undisputed leader in cloud computing, AWS fuels innovation across various industries. As businesses increasingly rely on cloud-based solutions, AWS's dominance ensures continued revenue growth and profitability. Their market share is impressive, and the growth potential in this sector is enormous. [Link to AWS website]

-

Advertising: Amazon's advertising platform is rapidly growing, leveraging its vast user base and sophisticated targeting capabilities. This segment is becoming a significant revenue generator, rivaling even established advertising giants.

-

Emerging Technologies: Amazon consistently invests in emerging technologies like artificial intelligence (AI), machine learning (ML), and robotics. These investments position them for future growth and maintain their competitive edge.

H2: Navigating Market Volatility: A Long-Term Perspective

The stock market is inherently volatile. While a 560% profit is exceptional, focusing solely on short-term gains can be detrimental to long-term wealth building. My strategy is grounded in a long-term perspective, recognizing Amazon's enduring competitive advantages and future potential. Short-term market fluctuations are simply noise in the grand scheme of things.

H3: Why Holding is Smarter Than Selling (for me)

My decision to remain invested isn't driven by recklessness. It's a calculated decision based on several factors:

-

Compounding Returns: Reinvesting profits allows for compounding returns over time, accelerating wealth accumulation significantly. This is a core principle of long-term investing.

-

Missed Opportunities: Cashing out now could mean missing out on future growth opportunities. Amazon's consistent innovation means there's always potential for further expansion and higher share prices.

-

Tax Implications: Capital gains taxes can significantly reduce the net profit from selling shares. Holding allows for tax-efficient wealth building.

H2: The Risks and Considerations

It's crucial to acknowledge the risks involved. No investment is without risk, and Amazon is no exception. Potential challenges include:

-

Increased Competition: Amazon faces increasing competition from other e-commerce players and in various sectors of its business.

-

Regulatory Scrutiny: Antitrust concerns and regulatory changes could impact Amazon's operations and profitability.

-

Economic Downturns: Even a company as resilient as Amazon isn't immune to the effects of a severe economic downturn.

However, I believe Amazon's diversification and adaptability mitigate these risks to a considerable extent.

H2: Conclusion: A Calculated Hold

My decision to stay invested in Amazon despite a substantial profit reflects a long-term, value-based investment strategy. While the market is volatile, Amazon's fundamental strengths, diversified business model, and commitment to innovation make it a compelling long-term investment in my portfolio. This is my personal investment strategy and should not be taken as financial advice. Always conduct your own thorough research and consult with a financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Why I'm Staying Invested In Amazon Despite A 560% Profit. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Memorial Day Weekend Mayhem Mass Arrests At Popular Jersey Shore Boardwalk

May 27, 2025

Memorial Day Weekend Mayhem Mass Arrests At Popular Jersey Shore Boardwalk

May 27, 2025 -

Seaside Heights Curfew Ineffective Boardwalk Violence Leads To Multiple Injuries

May 27, 2025

Seaside Heights Curfew Ineffective Boardwalk Violence Leads To Multiple Injuries

May 27, 2025 -

Large Scale Arrests At Jersey Shore Boardwalk Memorial Day Weekend Violence Leads To 73 In Custody

May 27, 2025

Large Scale Arrests At Jersey Shore Boardwalk Memorial Day Weekend Violence Leads To 73 In Custody

May 27, 2025 -

Social Security Payment Changes In June 2025 What You Need To Know

May 27, 2025

Social Security Payment Changes In June 2025 What You Need To Know

May 27, 2025 -

Andriy Portnovs Murder A Lack Of Sympathy And Unresolved Mysteries In Ukraine

May 27, 2025

Andriy Portnovs Murder A Lack Of Sympathy And Unresolved Mysteries In Ukraine

May 27, 2025

Latest Posts

-

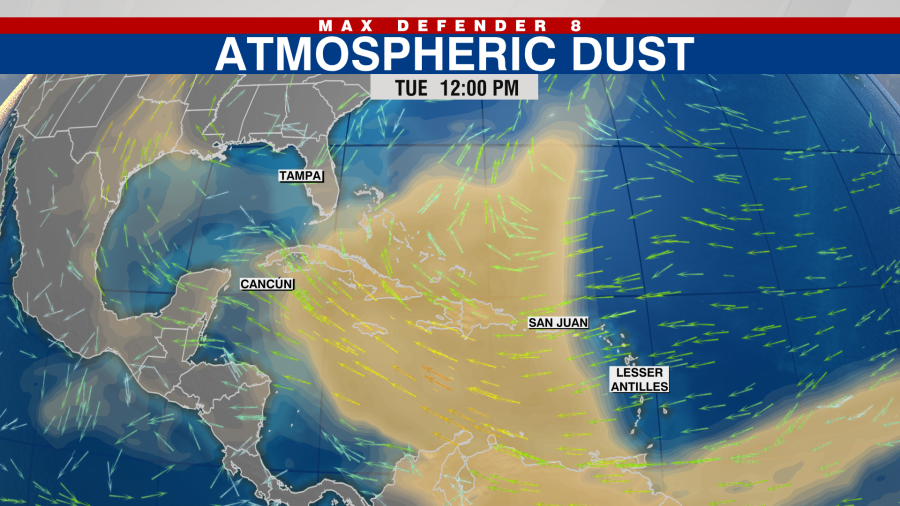

Saharan Dust Plume To Affect Florida Visibility And Respiratory Concerns

May 31, 2025

Saharan Dust Plume To Affect Florida Visibility And Respiratory Concerns

May 31, 2025 -

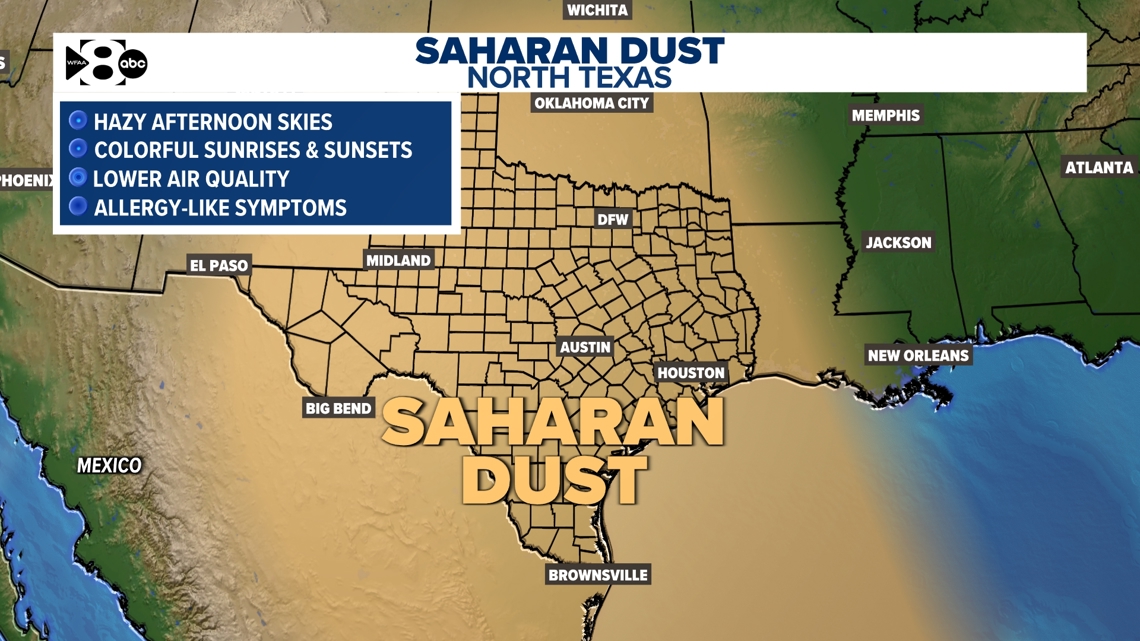

5 000 Mile Dust Journey Saharan Dusts Effects On North Texas Air Quality

May 31, 2025

5 000 Mile Dust Journey Saharan Dusts Effects On North Texas Air Quality

May 31, 2025 -

West Bank Settlement Growth Israel Unveils New Construction Plans

May 31, 2025

West Bank Settlement Growth Israel Unveils New Construction Plans

May 31, 2025 -

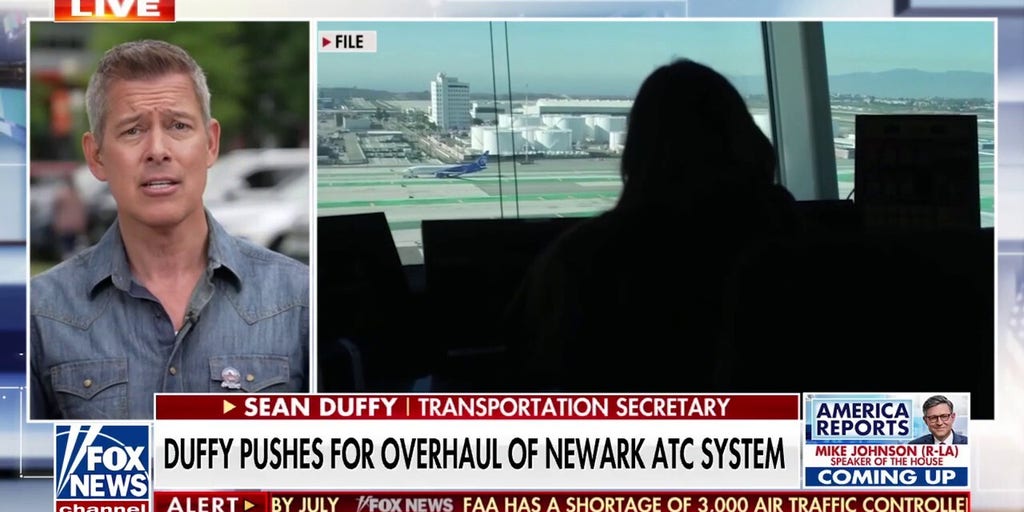

Newark Departure Slowdowns Amidst Air Traffic Control Debate

May 31, 2025

Newark Departure Slowdowns Amidst Air Traffic Control Debate

May 31, 2025 -

Rule Change Debate In California High School Track After Trans Athletes Win

May 31, 2025

Rule Change Debate In California High School Track After Trans Athletes Win

May 31, 2025