Why I'm Staying Invested In Amazon Despite A 560% Return

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Why I'm Staying Invested in Amazon Despite a 560% Return

For many investors, a 560% return on investment would be the stuff of dreams, a golden ticket to early retirement. That's precisely the situation I found myself in with my Amazon (AMZN) stock. Yet, despite this incredible windfall, I'm not selling. Why? Because while past performance is not indicative of future results, I believe Amazon's long-term growth potential remains incredibly strong. This article explores my reasoning, looking beyond the immediate gains and focusing on the enduring power of the Amazon ecosystem.

The Temptation to Cash Out

Let's be clear: a 560% return is nothing to sneeze at. It's a life-changing amount of money for most. The temptation to take profits and diversify, or even simply enjoy the fruits of my labor, was immense. I wrestled with the decision for weeks, considering the potential risks associated with holding onto a stock that has already experienced such dramatic growth. Market corrections, unforeseen competition, and shifts in consumer behavior are all legitimate concerns.

Why I'm Holding Onto My Amazon Stock

However, after careful consideration of Amazon's current position and future prospects, I've decided to remain invested. My rationale rests on several key pillars:

1. Dominance in E-commerce and Cloud Computing: Amazon's market share in e-commerce remains staggering. While competitors exist, Amazon's Prime membership program, vast logistics network, and ever-expanding product selection offer a formidable barrier to entry. Furthermore, Amazon Web Services (AWS) is the undisputed leader in the cloud computing market, powering countless businesses and generating substantial revenue streams. This dual dominance creates a robust and resilient foundation for future growth.

2. Continued Innovation and Expansion: Amazon isn't resting on its laurels. The company continues to invest heavily in research and development, exploring new markets and technologies. From its foray into healthcare with Amazon Pharmacy and telehealth initiatives to its advancements in artificial intelligence and autonomous delivery, Amazon consistently demonstrates its commitment to innovation and expansion into new, high-growth sectors. This proactive approach mitigates the risk associated with relying solely on its existing businesses.

3. Long-Term Vision and Strategic Acquisitions: Amazon’s long-term vision goes beyond simply selling products. They are building a comprehensive ecosystem, encompassing everything from entertainment (Prime Video, Amazon Music) to groceries (Whole Foods Market) and smart home devices (Alexa). Strategic acquisitions, such as the purchase of Whole Foods, demonstrate their ability to expand their reach and integrate new businesses into their existing ecosystem, creating synergies and new revenue streams.

4. Resilience in the Face of Economic Uncertainty: While economic downturns can impact consumer spending, Amazon's diverse business model and essential services often prove resilient. Even during periods of economic uncertainty, consumers are still likely to rely on Amazon for everyday essentials and online services. This inherent resilience makes it an attractive investment even during turbulent market conditions.

Managing Risk and Diversification

It’s crucial to acknowledge that even with my bullish outlook, risk management remains paramount. I’m not advocating for putting all your eggs in one basket. My Amazon investment represents a significant portion of my portfolio, but I've also diversified into other sectors to mitigate risk. Regularly reviewing my portfolio and adapting my investment strategy based on market conditions is an integral part of my approach.

Conclusion: A Long-Term Investment

My decision to remain invested in Amazon despite a significant return is a calculated one, based on a thorough assessment of the company's strengths, its long-term growth potential, and its ability to navigate evolving market dynamics. While past performance is not a guarantee of future success, Amazon's dominant position, continued innovation, and strategic vision lead me to believe it remains a compelling long-term investment. However, remember to conduct your own research and consult with a financial advisor before making any investment decisions. This article represents my personal opinion and should not be construed as financial advice.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Why I'm Staying Invested In Amazon Despite A 560% Return. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Pdd Holdings Q1 2025 Financial Performance A Deep Dive Into The Results

May 28, 2025

Pdd Holdings Q1 2025 Financial Performance A Deep Dive Into The Results

May 28, 2025 -

Wwii Bomber Crash Remains Of Four Airmen Finally Identified Returned Home

May 28, 2025

Wwii Bomber Crash Remains Of Four Airmen Finally Identified Returned Home

May 28, 2025 -

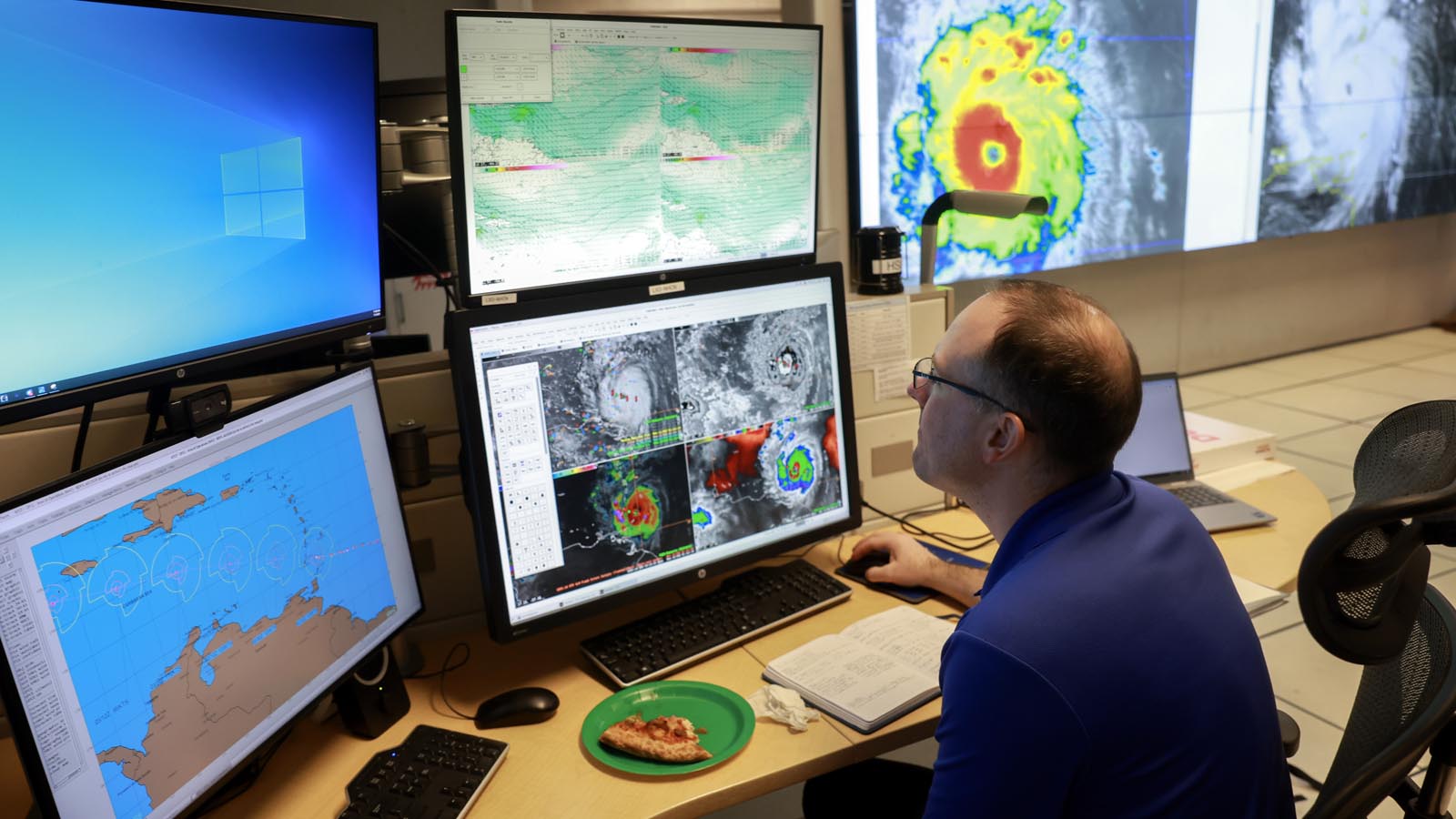

Understanding Hurricane Model Accuracy Making Informed Decisions For 2025

May 28, 2025

Understanding Hurricane Model Accuracy Making Informed Decisions For 2025

May 28, 2025 -

Amazons Amzn Stock Momentum Factors To Consider

May 28, 2025

Amazons Amzn Stock Momentum Factors To Consider

May 28, 2025 -

Analyzing Zverev Mensiks French Open R1 Matches Predictions And Key Insights

May 28, 2025

Analyzing Zverev Mensiks French Open R1 Matches Predictions And Key Insights

May 28, 2025

Latest Posts

-

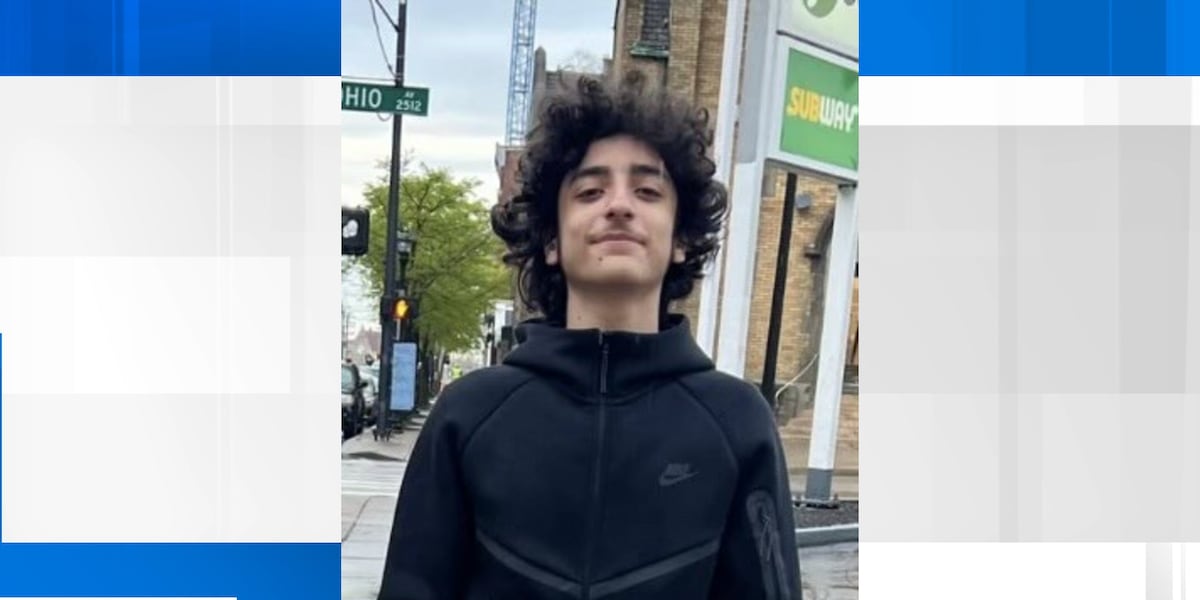

Lexington Teen Missing Police Appeal For Information In Urgent Case

May 30, 2025

Lexington Teen Missing Police Appeal For Information In Urgent Case

May 30, 2025 -

Day 4 Spotlight Junior Athletes Shine Under The Lights

May 30, 2025

Day 4 Spotlight Junior Athletes Shine Under The Lights

May 30, 2025 -

White House Confirms Elon Musks Exit From Trumps Team

May 30, 2025

White House Confirms Elon Musks Exit From Trumps Team

May 30, 2025 -

Debating Fairness The Athletic Performance Of Transgender Women In Sports

May 30, 2025

Debating Fairness The Athletic Performance Of Transgender Women In Sports

May 30, 2025 -

Kemi Badenoch Tory Insiders Criticize Recent Political Missteps

May 30, 2025

Kemi Badenoch Tory Insiders Criticize Recent Political Missteps

May 30, 2025