Why IBM Stock Is Falling: Factors Affecting Performance

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Why IBM Stock Is Falling: Factors Affecting Performance

IBM, a tech giant with a storied history, has seen its stock price fluctuate significantly in recent years. While periods of growth exist, understanding the reasons behind recent declines is crucial for investors. This article delves into the key factors affecting IBM's performance and impacting its stock price.

The Shifting Tech Landscape: A Major Headwind

The technology sector is notoriously volatile, characterized by rapid innovation and fierce competition. IBM's struggles are, in part, a reflection of this dynamic environment. The company's traditional strengths in mainframes and enterprise software are facing increasing pressure from cloud computing giants like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform. These cloud providers offer scalable, cost-effective solutions, often attracting clients away from IBM's legacy systems. This shift is a major factor contributing to IBM's stock decline.

Competition and Market Saturation

Beyond cloud computing, IBM faces intense competition in numerous other markets. The company operates in various segments, including artificial intelligence (AI), cybersecurity, and hybrid cloud solutions. However, each of these areas is crowded with established players and innovative startups, making it challenging for IBM to maintain market share and achieve substantial growth. This competitive pressure directly impacts investor confidence and stock valuation.

Hybrid Cloud Strategy: A Double-Edged Sword

IBM's strategic focus on hybrid cloud solutions—combining on-premise infrastructure with cloud services—is a double-edged sword. While this approach offers flexibility, it also requires significant investment in infrastructure and expertise. The complexity of integrating different systems and managing hybrid environments can lead to higher costs and slower deployment times, potentially hindering IBM's ability to compete effectively with pure-play cloud providers.

Financial Performance and Profitability Concerns

Recent financial reports have highlighted concerns about IBM's profitability and revenue growth. While the company has shown some progress in certain areas, overall performance hasn't met the expectations of some investors. Consistent year-over-year revenue growth is crucial for maintaining a strong stock price, and any shortfall can lead to downward pressure. Analyzing IBM's quarterly earnings reports and comparing them to industry benchmarks is essential for gauging its financial health.

Long-Term Growth Prospects: A Cautious Outlook

Despite the challenges, IBM isn't without potential. Its investments in AI, quantum computing, and other emerging technologies hold promise for long-term growth. However, realizing this potential requires significant execution and overcoming the aforementioned hurdles. Investors are understandably cautious, leading to fluctuations in the stock price as they assess IBM's ability to navigate the competitive landscape and deliver sustainable profitability.

What's Next for IBM Stock?

Predicting the future trajectory of IBM's stock price is challenging. However, investors should closely monitor the following:

- Financial performance: Consistent revenue growth and improved profitability are vital.

- Hybrid cloud strategy execution: Successful implementation and market adoption are crucial.

- Competitive landscape: IBM's ability to compete with cloud giants and other players will influence its performance.

- Innovation: Continued investment in and success with emerging technologies are essential for long-term growth.

Ultimately, IBM's stock price will likely reflect the company's ability to adapt to the changing technological environment, effectively manage its hybrid cloud strategy, and demonstrate consistent financial performance. Staying informed about these factors is essential for investors seeking to understand the ongoing dynamics impacting IBM's stock. Conduct your own thorough research before making any investment decisions.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Why IBM Stock Is Falling: Factors Affecting Performance. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Former Biden Spokesperson Karine Jean Pierre On Her New Independent Path

Jun 07, 2025

Former Biden Spokesperson Karine Jean Pierre On Her New Independent Path

Jun 07, 2025 -

Four Imprisoned For Role In Massive 6m Nhs Scotland Contract Fraud

Jun 07, 2025

Four Imprisoned For Role In Massive 6m Nhs Scotland Contract Fraud

Jun 07, 2025 -

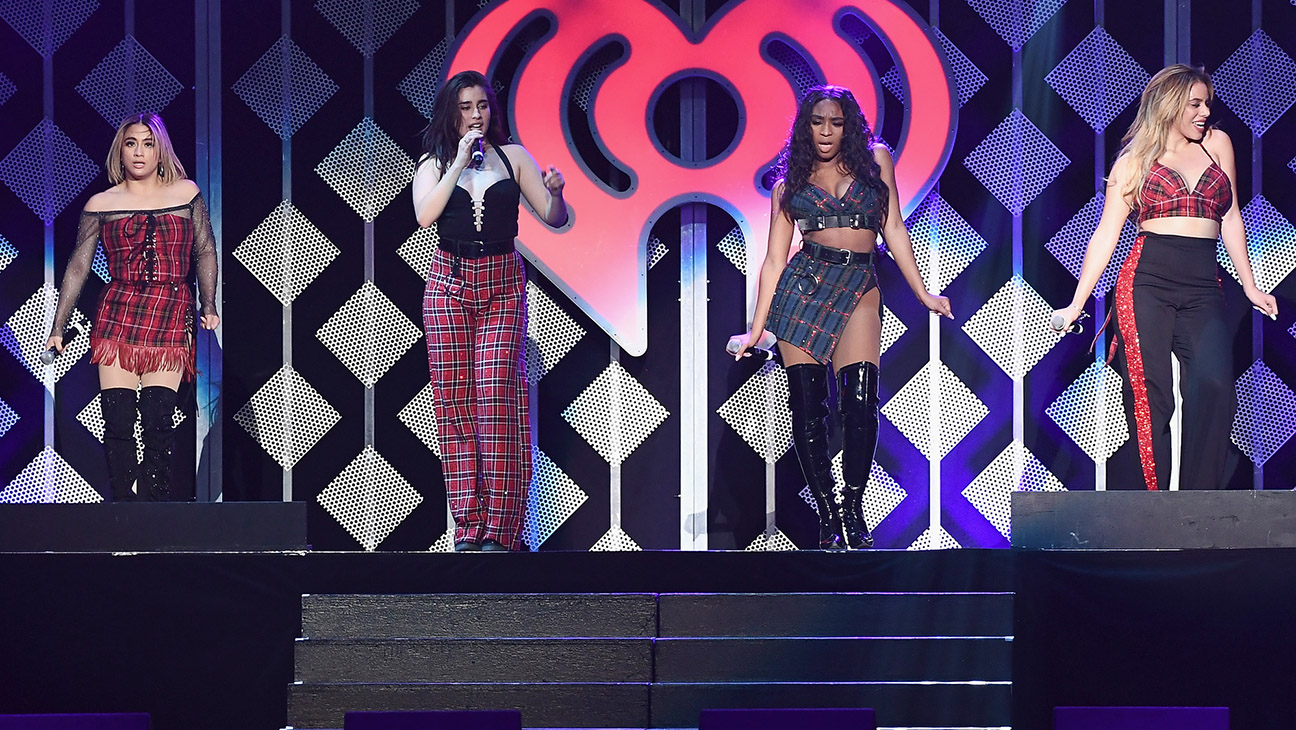

Fifth Harmony Minus Camila Is A Reunion On The Horizon

Jun 07, 2025

Fifth Harmony Minus Camila Is A Reunion On The Horizon

Jun 07, 2025 -

First Date Turned Fatal Wisconsin Mans Conviction In Dismemberment Case

Jun 07, 2025

First Date Turned Fatal Wisconsin Mans Conviction In Dismemberment Case

Jun 07, 2025 -

Miscarriage Criminal Charges West Virginia Prosecutors Warning Sparks Outrage

Jun 07, 2025

Miscarriage Criminal Charges West Virginia Prosecutors Warning Sparks Outrage

Jun 07, 2025

Latest Posts

-

Predicting Tony Award Winners A Data Driven Approach

Jun 07, 2025

Predicting Tony Award Winners A Data Driven Approach

Jun 07, 2025 -

El Dia Que Koldo Alvarez Deslumbro A Beckham Lampard Y Gerrard En Montjuic

Jun 07, 2025

El Dia Que Koldo Alvarez Deslumbro A Beckham Lampard Y Gerrard En Montjuic

Jun 07, 2025 -

Chelsea And Arsenal In 5m Transfer Talks Progress Reported

Jun 07, 2025

Chelsea And Arsenal In 5m Transfer Talks Progress Reported

Jun 07, 2025 -

Miscarriage Criminal Charges West Virginia Prosecutors Warning Sparks Outrage

Jun 07, 2025

Miscarriage Criminal Charges West Virginia Prosecutors Warning Sparks Outrage

Jun 07, 2025 -

Kepa To Arsenal Artetas Pursuit Of Chelseas Backup Goalkeeper

Jun 07, 2025

Kepa To Arsenal Artetas Pursuit Of Chelseas Backup Goalkeeper

Jun 07, 2025