Why Investors Are Still Betting On Robinhood Stock

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Why Investors Are Still Betting on Robinhood Stock: A Risky Gamble or Smart Investment?

Robinhood Markets, Inc. (HOOD) has had a rollercoaster ride since its IPO. Plagued by regulatory scrutiny, decreased user engagement, and significant losses, many would assume the stock is a sinking ship. Yet, despite these challenges, some investors remain bullish on Robinhood's future. But why? Is this unwavering faith justified, or are these investors taking a considerable risk? Let's delve into the reasons behind the persistent optimism surrounding HOOD stock.

H2: The Appeal of a Disruptive Force in Retail Investing

Robinhood's initial success stemmed from its disruptive approach to brokerage services. Its commission-free trading platform democratized investing, attracting millions of new, often younger, investors. This innovative model, although now replicated by many competitors, remains a core element of its brand identity and a key factor attracting investors who believe in its long-term potential. The company still boasts a significant user base, providing a foundation for future growth.

H2: Long-Term Growth Potential and Expansion Strategies

Despite recent setbacks, Robinhood is actively pursuing diversification strategies to broaden its revenue streams beyond trading commissions. These include:

- Expanding into new financial products: Robinhood is steadily adding new services, such as options trading, cryptocurrencies, and cash management accounts, to appeal to a wider range of users and increase revenue streams.

- Improving its platform and features: The company is constantly working on enhancing its user interface, adding new functionalities, and improving the overall user experience to retain existing customers and attract new ones.

- International expansion: While still primarily focused on the US market, Robinhood's potential for international growth remains a significant factor for optimistic investors.

H3: Addressing the Challenges: Regulatory Hurdles and Competition

It's crucial to acknowledge the significant challenges Robinhood faces. Intense competition from established players like Fidelity and Charles Schwab, coupled with ongoing regulatory scrutiny, poses significant threats. High inflation and a potential recession also impact investor sentiment and trading activity.

The company is actively working to address these challenges, focusing on improving compliance and enhancing its financial stability. However, overcoming these obstacles will be crucial for Robinhood to realize its full potential.

H2: The Role of Speculation and Sentiment

It's undeniable that speculation plays a significant role in HOOD's stock price fluctuations. The stock has become a favorite among retail investors, leading to periods of significant price volatility driven by sentiment rather than purely fundamental analysis. This volatility, while risky, also presents opportunities for those willing to navigate the market's emotional swings.

H2: Is it a Smart Investment? A Cautious Approach

While the potential for Robinhood's long-term growth is evident, it's important to adopt a cautious approach. The company still faces considerable challenges, and its stock price remains highly volatile. Investors should conduct thorough due diligence, understand the associated risks, and consider their own risk tolerance before investing in HOOD.

H2: The Bottom Line:

Robinhood's future remains uncertain. While its disruptive model and growth potential attract investors, the company needs to overcome significant hurdles to achieve sustainable profitability. Investors betting on Robinhood are making a high-risk, high-reward gamble. Those considering investing should carefully weigh the potential for growth against the substantial risks involved. Remember to consult a financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Why Investors Are Still Betting On Robinhood Stock. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

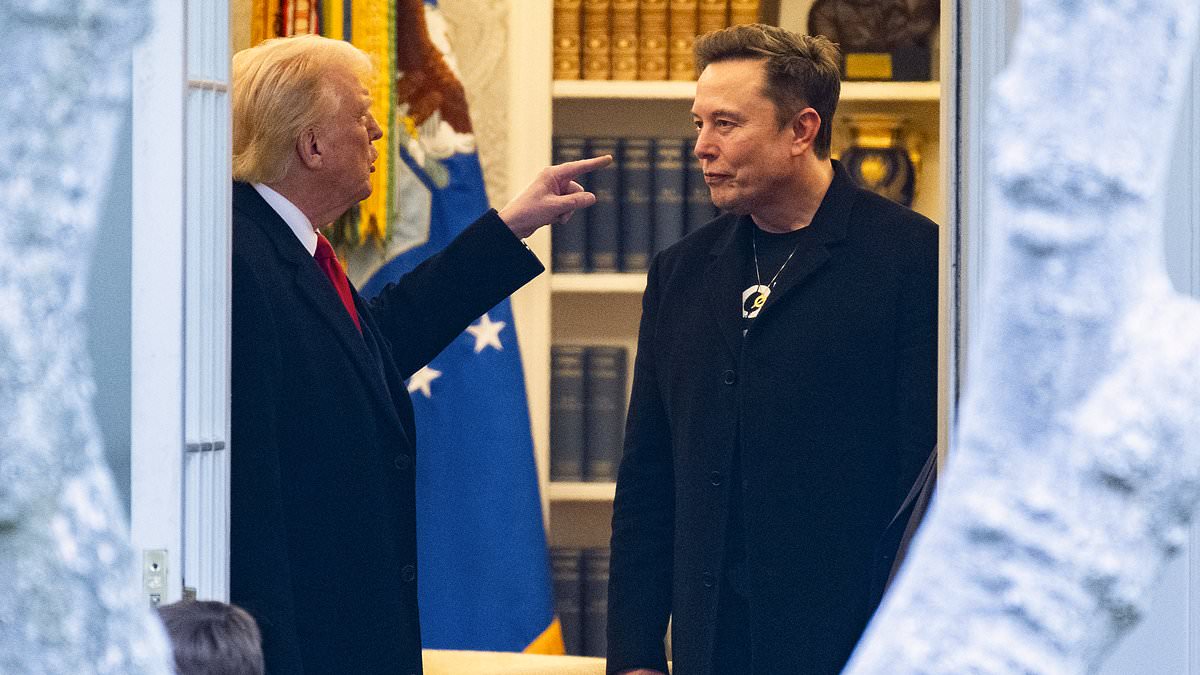

Trump Vs Musk A Powerful Advisors Impact On The Feud

Jun 06, 2025

Trump Vs Musk A Powerful Advisors Impact On The Feud

Jun 06, 2025 -

The Science Behind Clay Why Roland Garros Presents Unique Challenges For Players

Jun 06, 2025

The Science Behind Clay Why Roland Garros Presents Unique Challenges For Players

Jun 06, 2025 -

Ryan Gosling For White Black Panther Mcu Casting Rumors And Fan Reactions

Jun 06, 2025

Ryan Gosling For White Black Panther Mcu Casting Rumors And Fan Reactions

Jun 06, 2025 -

Coca Cola Ko Why Investors Are Taking Notice

Jun 06, 2025

Coca Cola Ko Why Investors Are Taking Notice

Jun 06, 2025 -

Karine Jean Pierre From Biden Press Secretary To Independent

Jun 06, 2025

Karine Jean Pierre From Biden Press Secretary To Independent

Jun 06, 2025

Latest Posts

-

Apld Secures 5 Billion To Accelerate Hyperscale Data Center Expansion

Jun 07, 2025

Apld Secures 5 Billion To Accelerate Hyperscale Data Center Expansion

Jun 07, 2025 -

From Comedy To Crime Steve Guttenbergs Shocking Transformation In Lifetimes Latest Thriller

Jun 07, 2025

From Comedy To Crime Steve Guttenbergs Shocking Transformation In Lifetimes Latest Thriller

Jun 07, 2025 -

Taylor Lewans First Pitch Cardinals Game Highlights A Memorable Miss

Jun 07, 2025

Taylor Lewans First Pitch Cardinals Game Highlights A Memorable Miss

Jun 07, 2025 -

Trump Scholz Summit Understanding The Stakes For Transatlantic Relations

Jun 07, 2025

Trump Scholz Summit Understanding The Stakes For Transatlantic Relations

Jun 07, 2025 -

Could Fifth Harmony Reunite Without Camila Exclusive Report On Talks

Jun 07, 2025

Could Fifth Harmony Reunite Without Camila Exclusive Report On Talks

Jun 07, 2025