Why Is IBM Stock Falling? A Deep Dive Into Performance

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Why is IBM Stock Falling? A Deep Dive into Big Blue's Performance

IBM, a tech giant synonymous with innovation for decades, has seen its stock price fluctuate significantly in recent years. While the company continues to be a major player in the industry, investors are increasingly questioning its future performance. This deep dive explores the key factors contributing to IBM's recent stock decline and analyzes the potential for future growth.

The Decline: A Multi-Faceted Issue

Several interconnected factors contribute to the downward pressure on IBM's stock price. It's not a single issue, but a confluence of challenges impacting investor confidence.

1. Transitioning Away From Legacy Businesses: IBM's historical strength lay in its mainframe computers and legacy software. However, the shift towards cloud computing and subscription-based services has presented challenges. The transition, while necessary for long-term survival, has impacted short-term revenue and profitability. Investors are wary of the time and resources required to fully capitalize on the cloud market, especially given the intense competition from established players like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud.

2. Competitive Landscape: The technology sector is fiercely competitive. IBM faces stiff competition not only in cloud computing but also in areas like artificial intelligence (AI) and hybrid cloud solutions. Maintaining a leading edge requires substantial investment in research and development (R&D), putting pressure on profit margins. The failure to consistently outpace competitors in key growth areas further erodes investor confidence.

3. Slow Revenue Growth: Consistent and substantial revenue growth is crucial for attracting investors. IBM's revenue growth has been relatively sluggish compared to its competitors, leading to concerns about its ability to maintain market share and profitability in a rapidly evolving technological landscape. This slow growth fuels speculation about the company's long-term viability in its current form.

4. High Debt Levels: While not insurmountable, IBM's debt levels are a concern for some investors. High debt can limit the company's financial flexibility and ability to invest in future growth initiatives. Managing debt effectively is crucial for regaining investor trust and improving the company's overall financial health.

5. Economic Headwinds: The broader macroeconomic environment also plays a role. Global economic uncertainty, inflation, and potential recessions can significantly impact investor sentiment and lead to a sell-off in even established companies like IBM. This external factor adds another layer of complexity to the analysis of IBM's stock performance.

Looking Ahead: Potential for Growth and Recovery?

Despite the challenges, IBM isn't without potential. Its strong presence in hybrid cloud, AI, and quantum computing offers opportunities for future growth. Successful execution of its strategic initiatives and a demonstration of consistent revenue growth could help regain investor confidence. Key to this is a clear and compelling narrative showcasing innovation and a path to sustainable profitability.

What to Watch For:

- Hybrid Cloud Market Share: IBM's success in this space will be crucial for future growth.

- AI Innovation: Breakthroughs in artificial intelligence could significantly boost IBM's revenue streams.

- Debt Reduction Strategies: Effective debt management will improve financial flexibility.

- Revenue Growth Trajectory: Consistent revenue growth is essential for investor confidence.

Conclusion:

The decline in IBM's stock price is a complex issue stemming from a combination of internal challenges and external factors. While the company faces significant hurdles, its potential in emerging technologies provides a glimmer of hope. Investors will be closely watching IBM's strategic execution and financial performance in the coming quarters to gauge its long-term prospects. Only time will tell whether Big Blue can successfully navigate these challenges and regain its position as a tech industry leader.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Why Is IBM Stock Falling? A Deep Dive Into Performance. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Clay Court Tennis The Physics And Strategy Behind Its Difficulty

Jun 06, 2025

Clay Court Tennis The Physics And Strategy Behind Its Difficulty

Jun 06, 2025 -

Dallas Stars Coaching Change Rick Bowness Out New Era Begins

Jun 06, 2025

Dallas Stars Coaching Change Rick Bowness Out New Era Begins

Jun 06, 2025 -

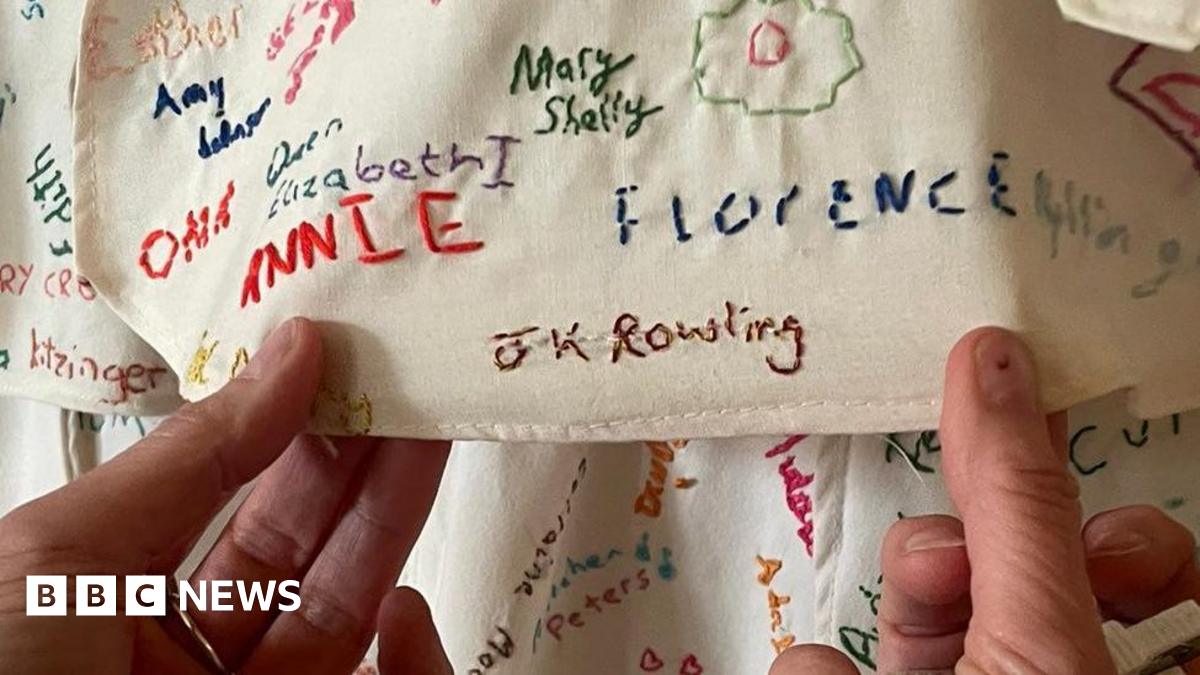

National Trust Addresses Damage To J K Rowling Related Artwork In Derbyshire

Jun 06, 2025

National Trust Addresses Damage To J K Rowling Related Artwork In Derbyshire

Jun 06, 2025 -

Advocating For Pension Plans For Retired Police Dogs A Necessary Change

Jun 06, 2025

Advocating For Pension Plans For Retired Police Dogs A Necessary Change

Jun 06, 2025 -

Is Robinhood Stock Still A Good Investment Analyzing Recent Performance

Jun 06, 2025

Is Robinhood Stock Still A Good Investment Analyzing Recent Performance

Jun 06, 2025

Latest Posts

-

Analyzing The Impact Of Ukraines Surprise Airfield Attacks

Jun 07, 2025

Analyzing The Impact Of Ukraines Surprise Airfield Attacks

Jun 07, 2025 -

Sade Robinsons Killing The Maxwell Anderson Trial And Its Implications

Jun 07, 2025

Sade Robinsons Killing The Maxwell Anderson Trial And Its Implications

Jun 07, 2025 -

Investigation Ordered Trump Targets Bidens Autopen Use And Actions Raising Cognitive Decline Questions

Jun 07, 2025

Investigation Ordered Trump Targets Bidens Autopen Use And Actions Raising Cognitive Decline Questions

Jun 07, 2025 -

Overnight Campout At Jd Sports The Hunt For The New 110s

Jun 07, 2025

Overnight Campout At Jd Sports The Hunt For The New 110s

Jun 07, 2025 -

Gut Microbiome And Hospitalization The Significance Of Initial Bacterial Colonization

Jun 07, 2025

Gut Microbiome And Hospitalization The Significance Of Initial Bacterial Colonization

Jun 07, 2025