Why Robinhood Stock Remains An Attractive Investment Opportunity

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Why Robinhood Stock Remains an Attractive Investment Opportunity

Robinhood, the once-ubiquitous trading app, has experienced a rollercoaster ride since its IPO. While initial enthusiasm waned, and the stock price took a significant dip, analysts are increasingly pointing to reasons why Robinhood stock remains an attractive investment opportunity for the long-term investor. This article delves into the factors contributing to this renewed optimism.

H2: Navigating the Turbulence: Robinhood's Recent Challenges and Strategic Shifts

Robinhood's initial public offering (IPO) in 2021 was met with high expectations, fueled by its massive user base and disruptive approach to trading. However, the subsequent decline in its stock price was largely attributed to several factors: increased regulatory scrutiny, heightened competition in the brokerage industry, and a post-pandemic slowdown in retail trading activity. The company also faced criticism regarding its platform's functionality and customer service.

However, Robinhood hasn't remained stagnant. The company has actively worked to address these challenges, focusing on several key strategic initiatives:

-

Expanding its revenue streams: Beyond its core brokerage services, Robinhood is actively diversifying its revenue streams through the introduction of new features and services, including options trading, cryptocurrency trading, and a subscription-based premium service. This diversification reduces reliance on trading commissions and enhances overall profitability.

-

Improving the user experience: Robinhood has invested heavily in improving its platform's user interface and functionality, addressing past criticisms regarding ease of use and customer support. These enhancements aim to retain existing users and attract new customers.

-

Strengthening its financial position: The company has taken steps to improve its financial stability, focusing on cost-cutting measures and strategic investments. This focus on fiscal responsibility is reassuring to potential investors.

H2: The Bull Case for Robinhood: Why Investors are Taking a Second Look

Despite past challenges, several compelling arguments support the case for Robinhood as a promising investment:

-

Large and engaged user base: Robinhood still boasts a substantial user base, particularly among younger investors, representing a significant market share and potential for future growth. This established user base provides a strong foundation for future expansion.

-

Untapped growth potential: The company's expansion into new financial products and services, such as crypto trading and wealth management, presents significant opportunities for revenue growth and market penetration. This diversification strategy is crucial for long-term sustainability.

-

Technological innovation: Robinhood continues to invest in technological advancements, seeking to enhance its platform and stay ahead of the competition in the ever-evolving fintech landscape. This commitment to innovation is vital for maintaining a competitive edge.

-

Improving financial performance: Recent financial reports show signs of improvement in Robinhood's revenue and profitability, suggesting a positive trajectory. This improved performance is a key indicator of the company's ability to overcome past challenges.

H2: Risks to Consider

While the outlook for Robinhood is increasingly positive, investors should be aware of potential risks:

-

Increased competition: The brokerage industry is highly competitive, with established players and new entrants constantly vying for market share. Maintaining a competitive edge requires continuous innovation and adaptation.

-

Regulatory uncertainty: The regulatory landscape for financial technology companies is constantly evolving, and Robinhood may face future challenges related to compliance and regulatory changes.

-

Market volatility: The overall performance of the stock market can significantly impact Robinhood's stock price. Market downturns can negatively affect investor sentiment and trading activity.

H2: Conclusion: A Long-Term Investment Perspective

Robinhood's journey has been characterized by both significant challenges and strategic adaptations. While short-term volatility is expected, the company's efforts to diversify revenue streams, enhance its platform, and improve its financial performance suggest a promising long-term outlook. For investors with a long-term perspective and a tolerance for risk, Robinhood stock might present a compelling investment opportunity. However, thorough due diligence and careful consideration of the risks involved are crucial before making any investment decisions. Remember to consult with a financial advisor before making any investment choices.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Why Robinhood Stock Remains An Attractive Investment Opportunity. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Winter Fuel Payment Government Reverses Course Announces New Plan

Jun 05, 2025

Winter Fuel Payment Government Reverses Course Announces New Plan

Jun 05, 2025 -

Dollar Generals Growth Amidst Economic Uncertainty A Tariff Driven Trend

Jun 05, 2025

Dollar Generals Growth Amidst Economic Uncertainty A Tariff Driven Trend

Jun 05, 2025 -

The Coca Cola Company Ko Current Financial Outlook And Future Prospects

Jun 05, 2025

The Coca Cola Company Ko Current Financial Outlook And Future Prospects

Jun 05, 2025 -

Car Carrier Fire North Pacific Lifeboat Rescue Of 22 Crew Members

Jun 05, 2025

Car Carrier Fire North Pacific Lifeboat Rescue Of 22 Crew Members

Jun 05, 2025 -

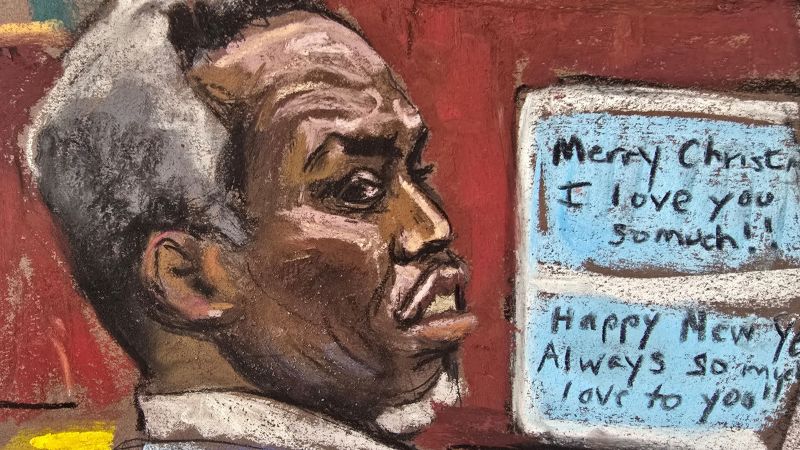

Sean Combs Faces Court Key Moments And Updates From The Trial

Jun 05, 2025

Sean Combs Faces Court Key Moments And Updates From The Trial

Jun 05, 2025

Latest Posts

-

Measles Vaccination And Travel Essential Information For Trips To Italy Uzbekistan And Other High Risk Areas

Aug 17, 2025

Measles Vaccination And Travel Essential Information For Trips To Italy Uzbekistan And Other High Risk Areas

Aug 17, 2025 -

Aldo De Nigris Conoce A Sus Padres Y Sus Trayectorias Profesionales

Aug 17, 2025

Aldo De Nigris Conoce A Sus Padres Y Sus Trayectorias Profesionales

Aug 17, 2025 -

Exclusive Billboard Executive Comments On Taylor Swifts Latest Album

Aug 17, 2025

Exclusive Billboard Executive Comments On Taylor Swifts Latest Album

Aug 17, 2025 -

Michael Porter Jr Warns Of Growing Sports Gambling Impact On Players

Aug 17, 2025

Michael Porter Jr Warns Of Growing Sports Gambling Impact On Players

Aug 17, 2025 -

Bbc News Quiz Unraveling The Pasta Controversy In Italy

Aug 17, 2025

Bbc News Quiz Unraveling The Pasta Controversy In Italy

Aug 17, 2025