Why Robinhood Stock Remains An Attractive Investment Option

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Why Robinhood Stock Remains an Attractive Investment Option

Robinhood Markets, Inc. (HOOD), the disruptive brokerage app that democratized investing for millions, has had a turbulent journey since its IPO. While its stock price has fluctuated significantly, analysts and investors continue to debate its long-term potential. But why do some still see Robinhood as an attractive investment option, despite its challenges? Let's delve into the reasons.

H2: A Massive User Base and Growing Revenue Streams

Robinhood's undeniable strength lies in its substantial user base. Millions of users, particularly younger investors, have embraced the platform for its user-friendly interface and commission-free trading. This vast network provides a solid foundation for future growth and revenue generation. Beyond traditional brokerage services, Robinhood is diversifying its revenue streams. The expansion into crypto trading, options trading, and wealth management services offers significant potential for increased profitability. This diversification mitigates reliance on a single revenue source, making it a more resilient business model.

H2: Continued Innovation and Technological Advantages

Robinhood consistently invests in technological advancements to enhance its platform and user experience. This commitment to innovation is crucial in a highly competitive financial technology landscape. Features like fractional shares and educational resources cater to a broader range of investors, attracting both beginners and experienced traders. Furthermore, the company's technology infrastructure allows for efficient and seamless trading, a critical factor in attracting and retaining users. Continued investment in AI and machine learning could further enhance personalized financial services and risk management tools, adding another layer of attractiveness for investors.

H2: Addressing Past Challenges and Regulatory Scrutiny

Robinhood has faced significant regulatory scrutiny and criticism in the past, impacting its stock performance. However, the company has been actively working to address these concerns and improve its compliance measures. Increased regulatory compliance, improved customer service, and a greater focus on responsible investing practices could significantly boost investor confidence and attract a more mature investor demographic. This proactive approach to addressing past issues is crucial for long-term growth and stability.

H3: Potential for International Expansion

While currently focused primarily on the US market, the potential for international expansion presents a significant growth opportunity. Replicating its success in other markets could exponentially increase Robinhood's user base and revenue. The global adoption of online brokerage services offers a vast untapped market, presenting substantial future growth potential.

H2: The Risks Remain

It's crucial to acknowledge the inherent risks associated with investing in Robinhood. The company faces intense competition from established players and newer fintech startups. Fluctuations in the broader financial markets can significantly impact its performance. Regulatory changes and evolving investor sentiment also present ongoing challenges. Before investing, thorough due diligence and understanding these risks are essential.

H2: Conclusion: A High-Risk, High-Reward Investment?

Robinhood's future remains uncertain, but its massive user base, diversification efforts, and commitment to innovation offer a compelling case for some investors. The potential for significant growth, particularly through international expansion and new product offerings, makes it a high-risk, high-reward investment opportunity. However, potential investors should carefully weigh the risks involved and conduct thorough research before making any investment decisions. Remember to consult with a qualified financial advisor before investing in any stock, including Robinhood. This is not financial advice.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Why Robinhood Stock Remains An Attractive Investment Option. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Ohio Woman Wins Workplace Discrimination Case Supreme Courts Unanimous Ruling

Jun 06, 2025

Ohio Woman Wins Workplace Discrimination Case Supreme Courts Unanimous Ruling

Jun 06, 2025 -

Winter Fuel Payment Government Reverses Policy For 2024

Jun 06, 2025

Winter Fuel Payment Government Reverses Policy For 2024

Jun 06, 2025 -

Two Households One Income A Struggle For Balance

Jun 06, 2025

Two Households One Income A Struggle For Balance

Jun 06, 2025 -

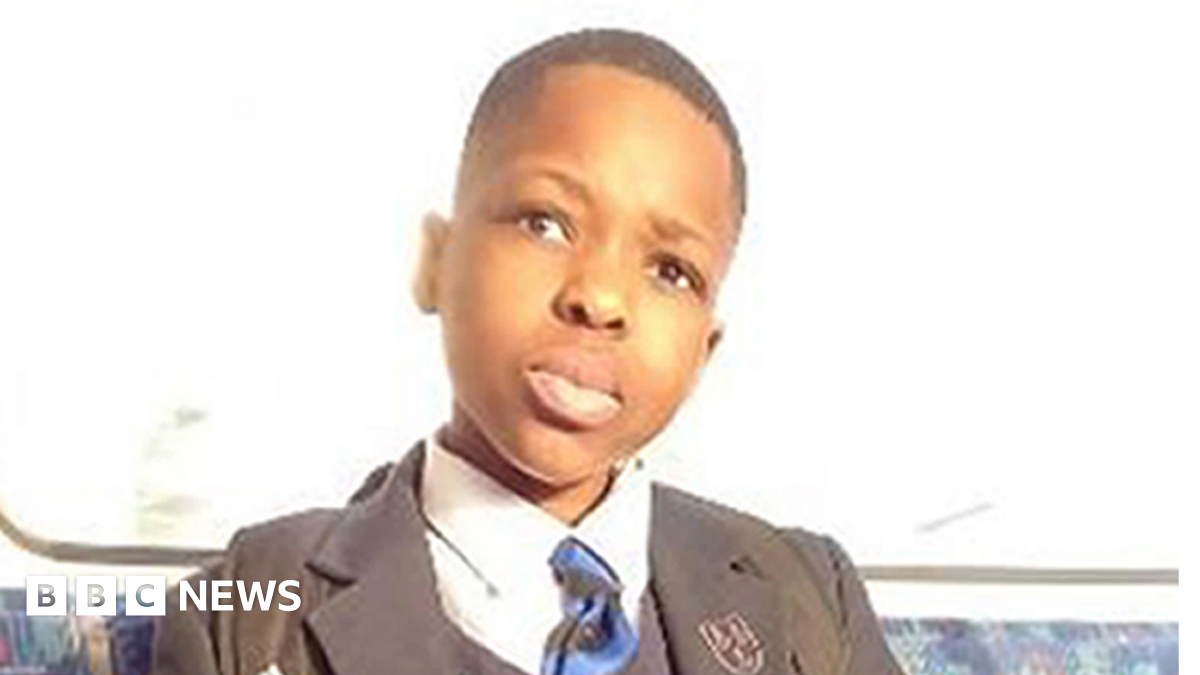

Daniel Anjorin Murder Case Witness Claims Marcus Monzos Desire To Kill

Jun 06, 2025

Daniel Anjorin Murder Case Witness Claims Marcus Monzos Desire To Kill

Jun 06, 2025 -

Silence From Karen Read Defense Filing Interpretation

Jun 06, 2025

Silence From Karen Read Defense Filing Interpretation

Jun 06, 2025

Latest Posts

-

Karine Jean Pierre Announces Independent Status After White House Role

Jun 06, 2025

Karine Jean Pierre Announces Independent Status After White House Role

Jun 06, 2025 -

Israeli Forces Hold Bbc Film Crew At Gunpoint In Southern Syria

Jun 06, 2025

Israeli Forces Hold Bbc Film Crew At Gunpoint In Southern Syria

Jun 06, 2025 -

Ibm Stock Underperforms Market Analysis And Reasons For Lagging

Jun 06, 2025

Ibm Stock Underperforms Market Analysis And Reasons For Lagging

Jun 06, 2025 -

Disqualification For Rob Cross Ex Darts Champions Tax Problems

Jun 06, 2025

Disqualification For Rob Cross Ex Darts Champions Tax Problems

Jun 06, 2025 -

Two Households One Income A Struggle For Balance

Jun 06, 2025

Two Households One Income A Struggle For Balance

Jun 06, 2025