Will Social Security Pay Full Benefits After 2034?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Will Social Security Pay Full Benefits After 2034? The Truth About the Trust Fund

The looming question on the minds of millions of Americans nearing retirement: Will Social Security pay full benefits after 2034? The short answer is complicated, but here's the breakdown of what we know and what it means for you.

The Social Security Administration (SSA) has projected that the Social Security trust fund will be depleted by 2034. This doesn't mean Social Security will disappear entirely. However, it does mean significant changes are likely unless Congress acts.

What Happens When the Trust Fund is Depleted?

When the trust fund is depleted, the SSA will only be able to pay out approximately 80% of scheduled benefits using incoming payroll taxes. This translates to a substantial cut for current and future retirees. Imagine receiving only 80% of the retirement income you've planned for – a significant financial blow for many.

Why is the Trust Fund Depleted?

Several factors contribute to the projected shortfall:

- Increasing Life Expectancy: Americans are living longer, meaning they draw Social Security benefits for a longer period.

- Declining Birth Rate: A lower birth rate means fewer workers contributing to the system to support a growing population of retirees.

- Changing Demographics: The baby boomer generation, a large cohort, is now entering retirement, putting increased strain on the system.

What Can Congress Do?

Congress has several options to address the impending crisis:

- Raising the Retirement Age: Gradually increasing the full retirement age could delay benefit payouts and ease the strain on the system. However, this is a politically sensitive issue.

- Increasing Payroll Taxes: Raising the Social Security tax rate or increasing the taxable earnings base could generate more revenue. This would impact workers' take-home pay.

- Reducing Benefits: This could involve adjusting cost-of-living adjustments (COLAs) or modifying benefit formulas. This option is unpopular with retirees and those nearing retirement.

- Raising the Cap on Taxable Earnings: Currently, Social Security taxes only apply to earnings up to a certain amount. Raising this cap would bring in more revenue from higher earners.

What You Can Do Now:

While the future of Social Security remains uncertain, you can take proactive steps:

- Plan for a Reduced Benefit: Consider scenarios where you receive only 80% of your expected benefits. Adjust your retirement savings plan accordingly.

- Maximize Your Earnings: Contribute the maximum amount allowed to your Social Security account to ensure you receive the maximum benefit possible.

- Stay Informed: Keep up-to-date on developments regarding Social Security reform by following reputable news sources and the SSA website. [Link to SSA website]

- Diversify Your Retirement Income: Don't rely solely on Social Security for retirement income. Invest in other retirement savings plans like 401(k)s and IRAs.

The Bottom Line:

The depletion of the Social Security trust fund in 2034 is a serious concern, but it's not the end of Social Security. However, it necessitates significant changes to ensure the long-term sustainability of the program. Staying informed and planning for various scenarios is crucial for securing your financial future. The decisions made by Congress in the coming years will significantly impact the benefits received by future retirees. Therefore, engaging in the political discourse surrounding Social Security reform is vital for every American.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Will Social Security Pay Full Benefits After 2034?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Parliament Opts For Alternative Pest Control Cats Officially Rejected

Jun 20, 2025

Parliament Opts For Alternative Pest Control Cats Officially Rejected

Jun 20, 2025 -

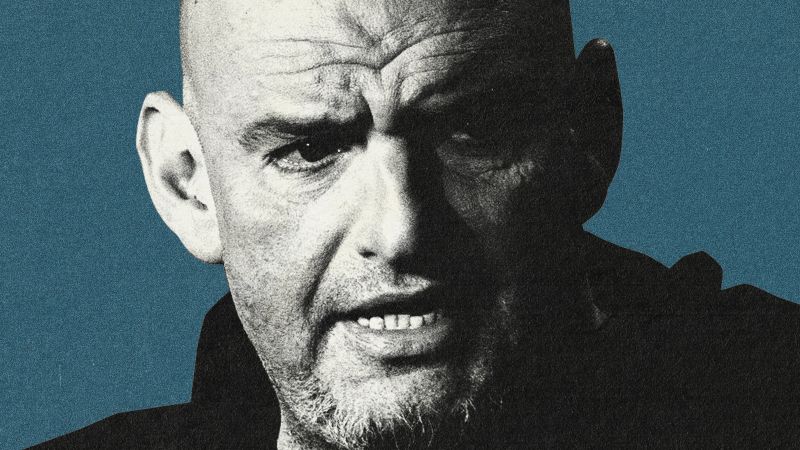

Fettermans Continued Criticism A Growing Headache For Pennsylvania Democrats

Jun 20, 2025

Fettermans Continued Criticism A Growing Headache For Pennsylvania Democrats

Jun 20, 2025 -

Rabies In Morocco Claims Life Of British Citizen After Stray Dog Contact

Jun 20, 2025

Rabies In Morocco Claims Life Of British Citizen After Stray Dog Contact

Jun 20, 2025 -

2034 And Beyond Securing The Future Of Social Security Benefits

Jun 20, 2025

2034 And Beyond Securing The Future Of Social Security Benefits

Jun 20, 2025 -

Cats Rejected As Pest Control Solution In Uk Parliament

Jun 20, 2025

Cats Rejected As Pest Control Solution In Uk Parliament

Jun 20, 2025

Latest Posts

-

Juneteenth 2024 A Roundup Of News And Events

Jun 20, 2025

Juneteenth 2024 A Roundup Of News And Events

Jun 20, 2025 -

Andrew Mc Cutchens Baseball Knowledge What Do The Pirates Know

Jun 20, 2025

Andrew Mc Cutchens Baseball Knowledge What Do The Pirates Know

Jun 20, 2025 -

Severe Weather Pummels Maryland Power Lines Down Extensive Damage Reported

Jun 20, 2025

Severe Weather Pummels Maryland Power Lines Down Extensive Damage Reported

Jun 20, 2025 -

Andrew Mc Cutchens Claim Are Baseballs Changed This Year Data Provides Answers

Jun 20, 2025

Andrew Mc Cutchens Claim Are Baseballs Changed This Year Data Provides Answers

Jun 20, 2025 -

The Aftermath Of Kyivs Violent Night Recovery And Identification Efforts

Jun 20, 2025

The Aftermath Of Kyivs Violent Night Recovery And Identification Efforts

Jun 20, 2025