Will Social Security Pay Full Benefits After 2034? The Urgent Need For Congressional Reform

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Will Social Security Pay Full Benefits After 2034? The Urgent Need for Congressional Reform

The looming question facing millions of Americans is simple yet terrifying: Will Social Security be able to pay full benefits after 2034? The short answer is: not without significant changes. The Social Security Administration (SSA) projects that the trust funds supporting retirement, disability, and survivor benefits will be depleted by 2034. This doesn't mean the program will vanish overnight, but it does mean significant cuts are inevitable unless Congress acts decisively.

This isn't a new crisis; it's a long-brewing issue exacerbated by demographic shifts and evolving economic realities. Understanding the problem and the potential solutions is crucial for every American, especially those nearing retirement age or currently relying on Social Security benefits.

Understanding the Social Security Funding Crisis

The Social Security system faces a multi-faceted challenge. The primary issue stems from the increasing number of retirees compared to the shrinking workforce paying into the system. This imbalance is largely due to:

- Increased Life Expectancy: People are living longer, drawing benefits for a longer period.

- Declining Birth Rates: Fewer younger workers are entering the workforce to support the growing retired population.

- Economic Shifts: Changes in the workforce, including the rise of the gig economy, affect Social Security tax revenue collection.

These factors combine to create a significant funding shortfall. By 2034, the SSA projects that the trust funds will be unable to pay 100% of scheduled benefits. Without reform, benefits could be cut by approximately 20%, a substantial reduction for millions relying on Social Security for their financial security.

What Happens if Congress Doesn't Act?

Failure to address the funding crisis will have severe consequences. A 20% reduction in benefits would represent a significant blow to retirees and beneficiaries already struggling with rising living costs. This could lead to:

- Increased Poverty Among Seniors: Many seniors rely heavily on Social Security, and a benefit cut could push them into poverty.

- Strain on Healthcare System: Financial hardship can negatively impact health, increasing the burden on the healthcare system.

- Economic Instability: Reduced consumer spending due to lower benefits could negatively affect the overall economy.

The consequences extend beyond individual financial hardship, impacting the overall social and economic fabric of the nation.

Potential Solutions and the Urgent Need for Congressional Reform

Several potential solutions are being debated in Congress, including:

- Raising the Full Retirement Age: Gradually increasing the age at which individuals can receive full benefits.

- Increasing the Social Security Tax Rate: Slightly raising the payroll tax rate to increase revenue.

- Increasing the Taxable Earnings Base: Expanding the amount of earnings subject to Social Security taxes.

- Benefit Reductions (as a last resort): While undesirable, reducing benefits is a possibility if other reforms are insufficient.

These are just some of the proposed solutions, and the optimal approach likely involves a combination of strategies. The key takeaway is the urgent need for bipartisan cooperation and decisive action from Congress. Delaying reform only exacerbates the problem and increases the severity of the eventual cuts.

What You Can Do

While the fate of Social Security largely rests with Congress, individuals can also take proactive steps:

- Stay Informed: Keep abreast of the ongoing debates and proposed solutions.

- Contact Your Representatives: Urge your elected officials to prioritize Social Security reform.

- Plan for Retirement: Regardless of the outcome, it’s crucial to plan for retirement and consider diversifying your retirement income sources. Explore options like private pensions, 401(k)s, and IRAs.

The future of Social Security is not predetermined. By understanding the challenges and demanding action from our elected officials, we can work towards a solution that ensures the long-term viability of this vital safety net for generations to come. The time to act is now. The future of Social Security – and the financial security of millions – depends on it.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Will Social Security Pay Full Benefits After 2034? The Urgent Need For Congressional Reform. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Immigration Battle 58 Year Green Card Holder Fights Deportation Order

Jun 20, 2025

Immigration Battle 58 Year Green Card Holder Fights Deportation Order

Jun 20, 2025 -

30 C Temperatures Predicted Across The Uk

Jun 20, 2025

30 C Temperatures Predicted Across The Uk

Jun 20, 2025 -

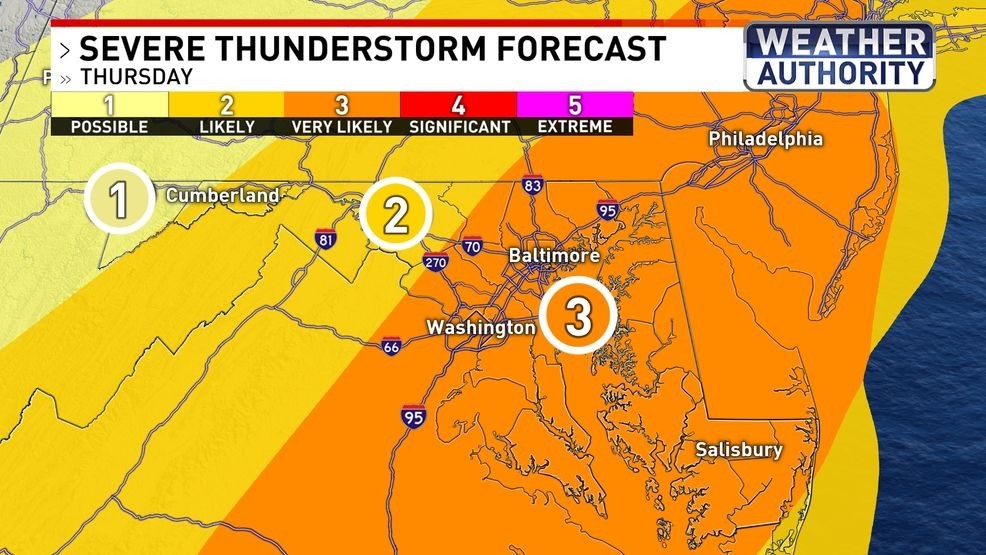

Severe Weather Outlook High Risk Of Storms Thursday Afternoon And Evening

Jun 20, 2025

Severe Weather Outlook High Risk Of Storms Thursday Afternoon And Evening

Jun 20, 2025 -

Indiana Fever Vs Golden State Valkyries Prediction Tv And Stream Info June 19 2025

Jun 20, 2025

Indiana Fever Vs Golden State Valkyries Prediction Tv And Stream Info June 19 2025

Jun 20, 2025 -

Check Your City Pg And E Power Shutoff Map For Bay Area Residents

Jun 20, 2025

Check Your City Pg And E Power Shutoff Map For Bay Area Residents

Jun 20, 2025

Latest Posts

-

2025 Mlb Season Verlanders Comeback Falters Winless Streak Continues

Jun 20, 2025

2025 Mlb Season Verlanders Comeback Falters Winless Streak Continues

Jun 20, 2025 -

Is Notting Hill Carnivals Future In Peril Financial Challenges And Potential Solutions

Jun 20, 2025

Is Notting Hill Carnivals Future In Peril Financial Challenges And Potential Solutions

Jun 20, 2025 -

Are Mlb Baseballs Juiced Or Deflated Mc Cutchen And The Data Offer Clues

Jun 20, 2025

Are Mlb Baseballs Juiced Or Deflated Mc Cutchen And The Data Offer Clues

Jun 20, 2025 -

Andrew Mc Cutchens Connections Unraveling The Mystery For Pittsburgh Pirates Fans

Jun 20, 2025

Andrew Mc Cutchens Connections Unraveling The Mystery For Pittsburgh Pirates Fans

Jun 20, 2025 -

Morocco Rabies Warning Uk Citizen Dies After Stray Dog Exposure

Jun 20, 2025

Morocco Rabies Warning Uk Citizen Dies After Stray Dog Exposure

Jun 20, 2025