Will Social Security Pay Full Benefits In 2034? The Urgent Need For Congressional Action

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Will Social Security Pay Full Benefits in 2034? The Urgent Need for Congressional Action

The looming Social Security shortfall is no longer a distant threat; it's a present danger. Millions of Americans rely on Social Security benefits for their retirement security, and the program's projected insolvency by 2034 casts a long shadow over their financial futures. But will Social Security actually pay full benefits in 2034? The answer is complex and hinges critically on Congressional action.

The Social Security Administration (SSA) has repeatedly warned about the impending crisis. Their projections indicate that by 2034, the Social Security Trust Fund will be depleted, meaning it won't be able to pay 100% of scheduled benefits. This doesn't automatically mean benefits will cease entirely. Instead, the SSA projects that it will only be able to pay approximately 80% of scheduled benefits based on current tax revenue. This drastic reduction would significantly impact retirees and their families.

Understanding the Problem: Why is Social Security Facing a Funding Crisis?

Several factors contribute to Social Security's financial challenges:

- Aging Population: The baby boomer generation is entering retirement, leading to a surge in benefit recipients.

- Declining Birth Rates: Fewer workers are entering the workforce to support a growing number of retirees.

- Increased Life Expectancy: People are living longer, requiring longer periods of benefit payouts.

- Stagnant Wages: Wage growth hasn't kept pace with the rising cost of living, resulting in lower payroll tax revenue.

What Happens if Congress Doesn't Act?

Failure to address the funding shortfall will have severe consequences:

- Benefit Cuts: As previously mentioned, a 20% across-the-board reduction in benefits is a highly probable scenario. This would drastically reduce the financial security of millions of retirees, pushing many into poverty.

- Increased Strain on Other Programs: The financial burden of supporting retirees could fall on other government programs and families, further exacerbating existing social and economic inequalities.

- Economic Instability: A significant reduction in Social Security benefits could trigger a ripple effect throughout the economy, impacting consumer spending and overall economic growth.

The Path Forward: What Can Congress Do?

Several potential solutions are being debated in Congress:

- Raising the Retirement Age: Gradually increasing the full retirement age could help alleviate the burden on the system.

- Increasing the Payroll Tax: A modest increase in the payroll tax could generate additional revenue for the Social Security Trust Fund.

- Raising the Taxable Earnings Base: Expanding the amount of earnings subject to Social Security taxes could also bolster funding.

- Benefit Adjustments: Minor benefit adjustments could help ensure the long-term sustainability of the program.

The Urgency of Congressional Action

Delaying action only exacerbates the problem and reduces the range of viable solutions. The longer Congress waits, the more drastic the measures will need to be to address the shortfall. The future of Social Security and the financial well-being of millions of Americans depend on immediate and decisive action by our lawmakers. We urge citizens to contact their representatives and senators to express their concerns and advocate for solutions to ensure the long-term solvency of Social Security.

Call to Action: Learn more about Social Security's financial challenges and contact your elected officials today. Visit the for more information. Your voice matters in securing the future of this vital program.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Will Social Security Pay Full Benefits In 2034? The Urgent Need For Congressional Action. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Bay Area Power Outage Pg And E Announces Service Interruptions

Jun 20, 2025

Bay Area Power Outage Pg And E Announces Service Interruptions

Jun 20, 2025 -

Powerful Storms Cause Havoc In Maryland Leaving Thousands Without Power

Jun 20, 2025

Powerful Storms Cause Havoc In Maryland Leaving Thousands Without Power

Jun 20, 2025 -

Verlanders 2025 Struggles Winless Despite Return

Jun 20, 2025

Verlanders 2025 Struggles Winless Despite Return

Jun 20, 2025 -

Maryland Storm Damage Power Restoration Efforts Underway After Severe Weather

Jun 20, 2025

Maryland Storm Damage Power Restoration Efforts Underway After Severe Weather

Jun 20, 2025 -

Long Time Green Card Holder Faces Deportation After Decades In The Us

Jun 20, 2025

Long Time Green Card Holder Faces Deportation After Decades In The Us

Jun 20, 2025

Latest Posts

-

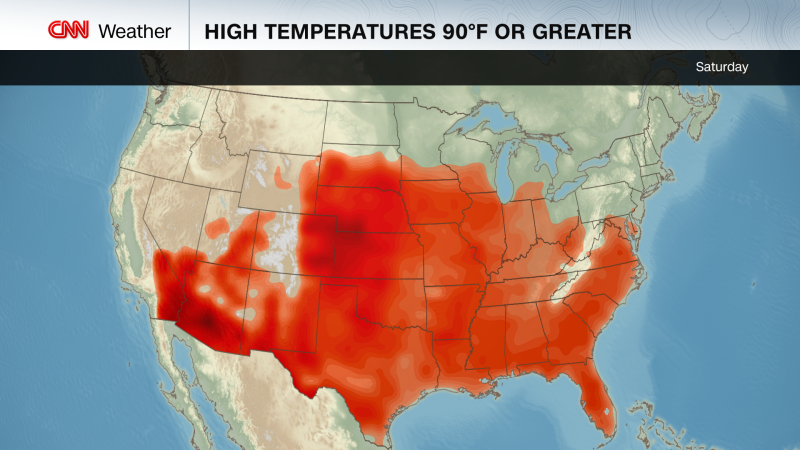

Record Breaking Heat East Coast Braces For Scorching Temperatures Next Week

Jun 20, 2025

Record Breaking Heat East Coast Braces For Scorching Temperatures Next Week

Jun 20, 2025 -

Bay Area Power Outage Pg And E Announces Service Interruption

Jun 20, 2025

Bay Area Power Outage Pg And E Announces Service Interruption

Jun 20, 2025 -

New Evidence In Kohberger Case Witness Claims To Identify Him At Crime Scene

Jun 20, 2025

New Evidence In Kohberger Case Witness Claims To Identify Him At Crime Scene

Jun 20, 2025 -

The Puzzling Shift In Mlb Baseball Dynamics Whats Behind The Changes

Jun 20, 2025

The Puzzling Shift In Mlb Baseball Dynamics Whats Behind The Changes

Jun 20, 2025 -

Inside Baseball Andrew Mc Cutchen And The Questions From Pittsburgh Fans

Jun 20, 2025

Inside Baseball Andrew Mc Cutchen And The Questions From Pittsburgh Fans

Jun 20, 2025