Will The Fed Cut Rates By 0.5%? Traders Weigh The Odds

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Will the Fed Cut Rates by 0.5%? Traders Weigh the Odds

The financial markets are buzzing with anticipation as traders grapple with the probability of a substantial 0.5% interest rate cut by the Federal Reserve. This unprecedented move, significantly larger than the typical 0.25% adjustment, is being debated intensely, with the outcome potentially impacting everything from mortgage rates to the stock market. Will the Fed pull the trigger on such a dramatic intervention? Let's delve into the factors influencing this crucial decision.

Inflation's Persistent Grip: A Major Factor

The primary driver behind speculation of a larger rate cut is the persistent inflation gripping the US economy. While recent data shows a slight cooling, inflation remains stubbornly above the Federal Reserve's target of 2%. This persistent inflationary pressure puts immense pressure on the Fed to act decisively. A 0.5% cut could be seen as a forceful attempt to stimulate economic growth and cool down prices. However, this strategy carries considerable risk.

The Risk of Fueling Inflation Further

One of the key concerns surrounding a 0.5% rate cut is the potential to exacerbate inflationary pressures. A significant reduction in interest rates could inject more money into the economy, potentially leading to increased demand and further price increases. This is a delicate balancing act for the Federal Reserve, requiring a careful assessment of the current economic landscape. The Fed's actions will need to consider not only the immediate impact but also the long-term consequences on inflation and economic stability.

Market Reaction and Trader Sentiment

The markets are clearly reflecting the uncertainty surrounding the potential rate cut. Volatility is elevated, with traders actively adjusting their positions based on the latest economic indicators and statements from Federal Reserve officials. Futures contracts and options markets are providing a glimpse into the prevailing sentiment, indicating a significant level of uncertainty. Some traders are betting on a 0.5% cut, while others believe a smaller adjustment, or even no change at all, is more likely.

What the Experts Say:

Economists are divided on the likelihood of a 0.5% cut. Some argue that the persistent inflation necessitates a bolder move, while others caution against the potential risks of overstimulating the economy. Many analysts are pointing to the upcoming employment reports and inflation data as crucial factors that will likely influence the Federal Reserve's decision. Following these key economic indicators closely is vital for anyone trying to predict the Fed's next move.

The Bottom Line: Uncertainty Reigns

The question of whether the Fed will cut rates by 0.5% remains unanswered. The decision hinges on a complex interplay of economic factors, including inflation, employment, and overall economic growth. While a significant cut could provide a much-needed boost to the economy, it also carries significant risks. Traders and investors are left to weigh the odds, closely monitoring economic data and Federal Reserve communications for clues. The coming weeks will be crucial in determining the ultimate course of action.

Keywords: Federal Reserve, interest rate cut, 0.5% rate cut, inflation, economic growth, monetary policy, traders, market reaction, economic indicators, Fed decision, interest rates, financial markets.

Call to Action (subtle): Stay informed about the latest developments by regularly checking reputable financial news sources.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Will The Fed Cut Rates By 0.5%? Traders Weigh The Odds. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Apples September Event I Phone Air I Phone 17 Specs And Wearable Tech Deep Dive

Sep 11, 2025

Apples September Event I Phone Air I Phone 17 Specs And Wearable Tech Deep Dive

Sep 11, 2025 -

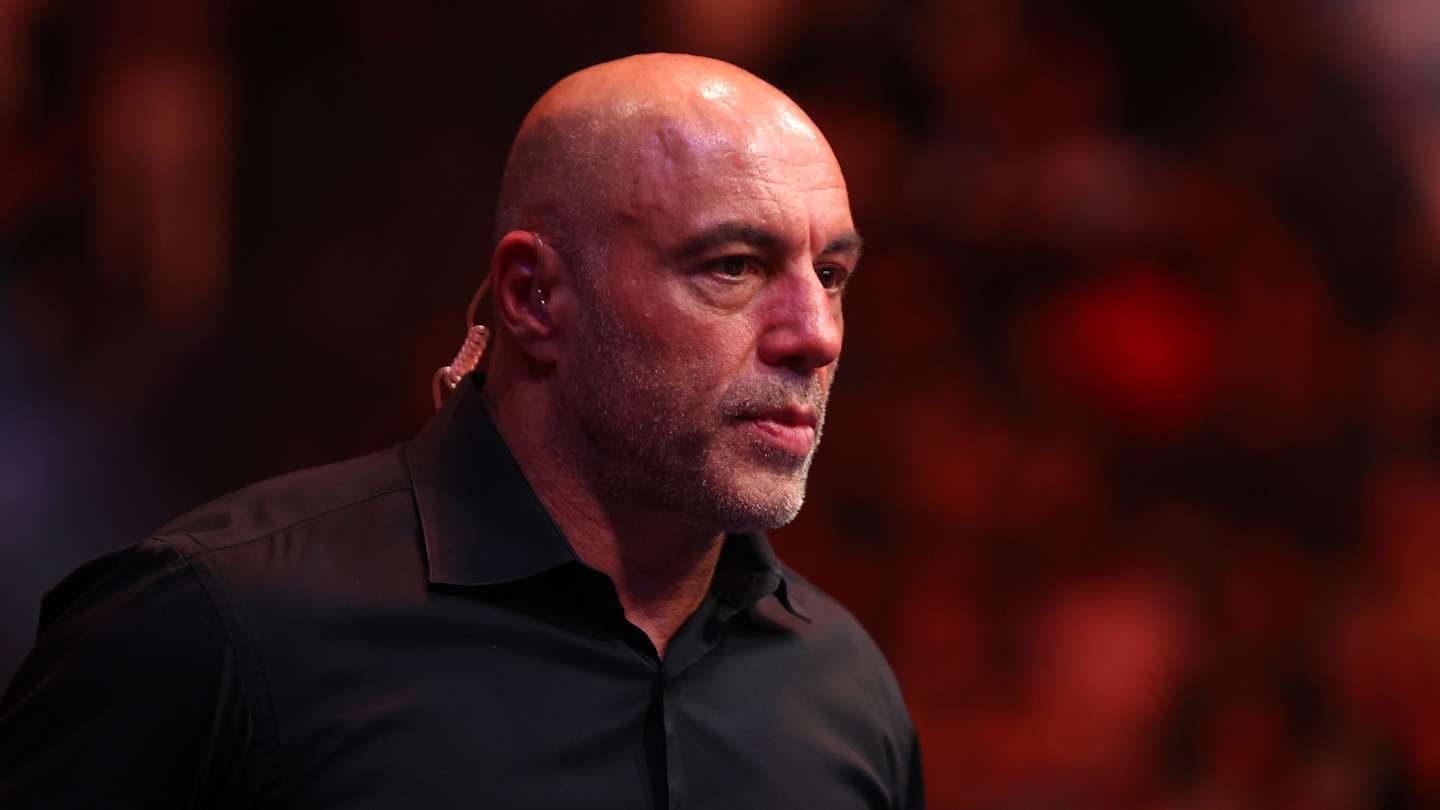

Joe Rogans Unpopular Opinion Re Evaluating Khabib Nurmagomedovs Career

Sep 11, 2025

Joe Rogans Unpopular Opinion Re Evaluating Khabib Nurmagomedovs Career

Sep 11, 2025 -

Labour Leader Starmer Holds Talks With Israeli President Herzog At Downing Street

Sep 11, 2025

Labour Leader Starmer Holds Talks With Israeli President Herzog At Downing Street

Sep 11, 2025 -

Apples I Phone 17 And I Phone Air A Deep Dive Into The New Lineup

Sep 11, 2025

Apples I Phone 17 And I Phone Air A Deep Dive Into The New Lineup

Sep 11, 2025 -

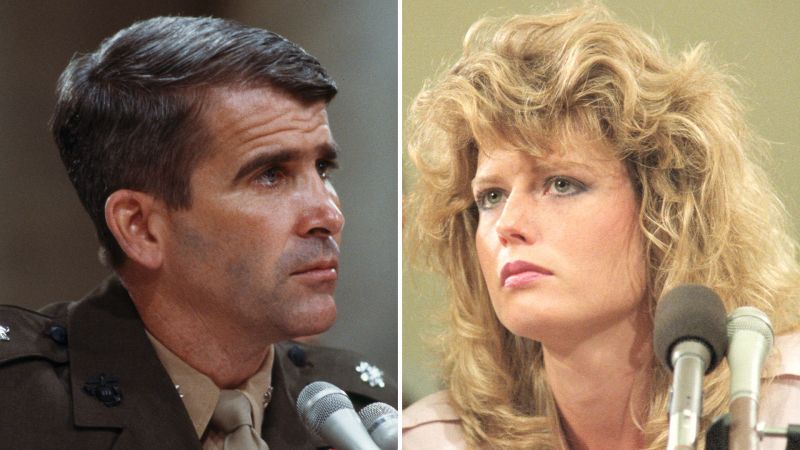

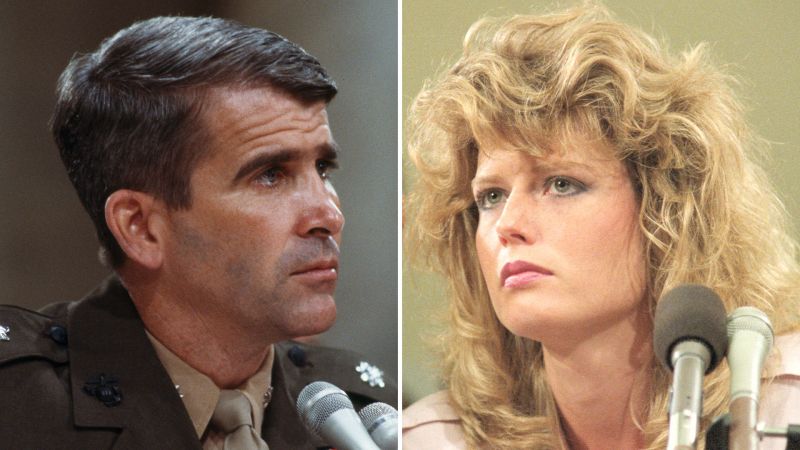

Fawn Hall Key Figure In Iran Contra Marries Oliver North

Sep 11, 2025

Fawn Hall Key Figure In Iran Contra Marries Oliver North

Sep 11, 2025

Latest Posts

-

Apples Latest I Phone A Deep Dive Into Specs And Innovations

Sep 11, 2025

Apples Latest I Phone A Deep Dive Into Specs And Innovations

Sep 11, 2025 -

Fugitive Father Found Dead Years Of Hiding Children End In Violence

Sep 11, 2025

Fugitive Father Found Dead Years Of Hiding Children End In Violence

Sep 11, 2025 -

New Filings Show Aocs Hotel Expenditures While Advocating Against Wealth Inequality

Sep 11, 2025

New Filings Show Aocs Hotel Expenditures While Advocating Against Wealth Inequality

Sep 11, 2025 -

Oliver Norths Wife Fawn Hall Their Relationship Amidst The Iran Contra Controversy

Sep 11, 2025

Oliver Norths Wife Fawn Hall Their Relationship Amidst The Iran Contra Controversy

Sep 11, 2025 -

Bowen Qatars Diplomatic Efforts Collapse Following Israeli Strikes

Sep 11, 2025

Bowen Qatars Diplomatic Efforts Collapse Following Israeli Strikes

Sep 11, 2025