Will The Fed Cut Rates By 50 Basis Points? Traders Think So

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Will the Fed Cut Rates by 50 Basis Points? Traders Think So

The whispers are growing louder on Wall Street: Could the Federal Reserve be poised for a significant 50-basis-point interest rate cut at its upcoming meeting? While the central bank has maintained a cautious stance, recent market movements strongly suggest traders are betting on a more aggressive move than previously anticipated. This article delves into the swirling speculation, examining the factors driving this belief and the potential implications for the economy.

The Market's Strong Signal:

The bond market, often considered a reliable predictor of Fed policy, is sending a clear message. The yield curve, the difference between short-term and long-term Treasury yields, has inverted significantly, a classic indicator of an impending recession. This inversion, coupled with a sharp drop in longer-term bond yields, suggests investors anticipate a substantial rate reduction to stimulate economic growth and combat potential recessionary pressures. Furthermore, the pricing of Federal Funds futures contracts reflects a high probability of a 50-basis-point cut, a sentiment not mirrored in the Fed's official communication.

Reasons Behind the Market Sentiment:

Several factors contribute to the market's expectation of a bolder Fed move:

-

Inflation Slowdown, but Still Elevated: While inflation is cooling, it remains stubbornly above the Fed's 2% target. This creates a delicate balancing act for the central bank: curb inflation without triggering a deep recession. A 50-basis-point cut could signal a pivot towards prioritizing economic growth over further inflation reduction.

-

Banking Sector Concerns: The recent banking sector turmoil, notably the collapse of Silicon Valley Bank and Signature Bank, has raised concerns about credit availability and financial stability. A significant rate cut could help alleviate stress in the banking system and encourage lending. [Link to a reputable news source discussing banking sector concerns]

-

Economic Slowdown: Several key economic indicators, such as manufacturing PMI and consumer confidence, point towards a potential economic slowdown. A larger rate cut could be seen as a preemptive measure to prevent a sharper downturn.

The Fed's Stance: A Balancing Act:

While market sentiment points towards a 50-basis-point cut, the Fed has been hesitant to commit to any specific move. Chair Jerome Powell has repeatedly emphasized the data-dependent nature of future decisions. This suggests that the Fed will carefully assess incoming economic data before making a final determination. Any announcement will likely be accompanied by nuanced language carefully balancing the need to control inflation with the desire to avoid a severe economic contraction.

Potential Implications:

A 50-basis-point rate cut could have significant implications:

-

Boosting Economic Growth: Lower interest rates could stimulate borrowing and investment, leading to increased economic activity.

-

Easing Financial Market Pressure: It could help stabilize the banking sector and reduce volatility in the financial markets.

-

Impact on Inflation: The risk, however, is that a substantial rate cut could reignite inflationary pressures. This is a key concern the Fed will be weighing carefully.

What to Watch For:

In the coming weeks, keep a close eye on the following:

- Economic data releases: Pay close attention to inflation reports, employment figures, and other key economic indicators.

- Fed speeches and communications: Any statements from Fed officials will provide valuable clues about their thinking.

- Market reactions: The market's response to economic data and Fed communication will offer insights into investor sentiment.

Conclusion:

While the possibility of a 50-basis-point rate cut is gaining momentum in the market, the Fed's final decision remains uncertain. The coming weeks will be crucial in determining the central bank's next move and its implications for the global economy. The balancing act between controlling inflation and stimulating growth will continue to shape monetary policy decisions, making this a critical period for investors and economists alike. Stay tuned for updates.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Will The Fed Cut Rates By 50 Basis Points? Traders Think So. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Excluded Parents The Impact Of School Transgender Policies On Children And Families

Sep 11, 2025

Excluded Parents The Impact Of School Transgender Policies On Children And Families

Sep 11, 2025 -

Aoc And Sanders Anti Oligarchy Efforts Scrutiny Over Luxury Hotel Expenses

Sep 11, 2025

Aoc And Sanders Anti Oligarchy Efforts Scrutiny Over Luxury Hotel Expenses

Sep 11, 2025 -

Fugitive Father Found Dead Years Of Hiding Children End In Violence

Sep 11, 2025

Fugitive Father Found Dead Years Of Hiding Children End In Violence

Sep 11, 2025 -

Pennsylvania Court Case Luigi Mangione To Stand Trial On Several Charges

Sep 11, 2025

Pennsylvania Court Case Luigi Mangione To Stand Trial On Several Charges

Sep 11, 2025 -

Robert F Kennedy Jr S Childrens Health Platform A Detailed Look

Sep 11, 2025

Robert F Kennedy Jr S Childrens Health Platform A Detailed Look

Sep 11, 2025

Latest Posts

-

Apples Latest I Phone A Deep Dive Into Specs And Innovations

Sep 11, 2025

Apples Latest I Phone A Deep Dive Into Specs And Innovations

Sep 11, 2025 -

Fugitive Father Found Dead Years Of Hiding Children End In Violence

Sep 11, 2025

Fugitive Father Found Dead Years Of Hiding Children End In Violence

Sep 11, 2025 -

New Filings Show Aocs Hotel Expenditures While Advocating Against Wealth Inequality

Sep 11, 2025

New Filings Show Aocs Hotel Expenditures While Advocating Against Wealth Inequality

Sep 11, 2025 -

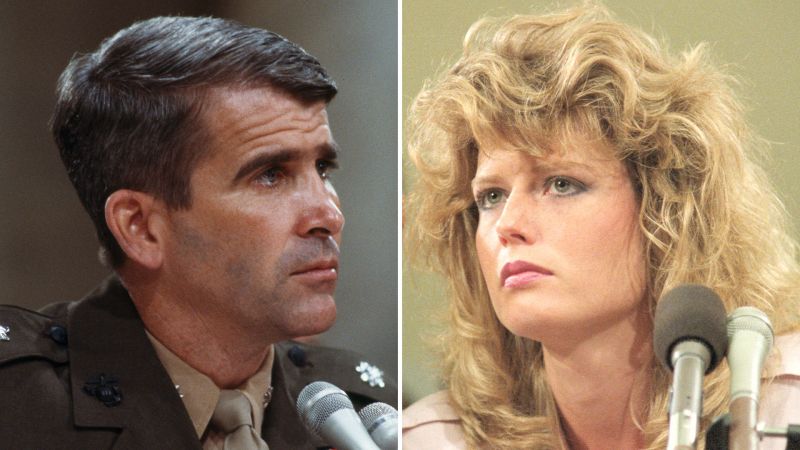

Oliver Norths Wife Fawn Hall Their Relationship Amidst The Iran Contra Controversy

Sep 11, 2025

Oliver Norths Wife Fawn Hall Their Relationship Amidst The Iran Contra Controversy

Sep 11, 2025 -

Bowen Qatars Diplomatic Efforts Collapse Following Israeli Strikes

Sep 11, 2025

Bowen Qatars Diplomatic Efforts Collapse Following Israeli Strikes

Sep 11, 2025