Winners And Losers: Analyzing The Impact Of The "Big, Beautiful Bill"

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Winners and Losers: Unpacking the Impact of the Inflation Reduction Act

The Inflation Reduction Act (IRA), often dubbed the "Big, Beautiful Bill" by its proponents, has become a focal point of political and economic debate since its passage. While hailed by the Biden administration as a landmark achievement, its real-world impact is complex and multifaceted, creating both winners and losers across various sectors. This analysis delves into the key beneficiaries and those potentially facing negative consequences.

H2: Clean Energy's Big Win: A Boost for Green Jobs and Innovation

The IRA's most significant impact is undoubtedly its investment in clean energy. Billions of dollars are earmarked for tax credits and incentives aimed at accelerating the transition to renewable energy sources. This translates to:

-

Winners: Renewable energy companies, from solar panel manufacturers to wind turbine producers, stand to gain significantly. The act fosters job creation in the burgeoning green sector, boosting employment opportunities in manufacturing, installation, and maintenance. This also includes a significant investment in domestic manufacturing, reducing reliance on foreign sources.

-

Potential Losers: The fossil fuel industry faces increased pressure. While the IRA doesn't explicitly ban fossil fuels, the incentives for renewables could gradually diminish the competitiveness of traditional energy sources. This transition might lead to job losses in certain regions heavily reliant on fossil fuel industries, although the administration has emphasized retraining programs to mitigate this effect.

H2: Healthcare's Shifting Landscape: Lower Costs or Limited Access?

The IRA also includes provisions impacting healthcare costs for millions of Americans. Negotiating drug prices for Medicare and extending Affordable Care Act subsidies are key elements.

-

Winners: Seniors on Medicare will see lower prescription drug costs, potentially saving significant amounts on medications. Lower-income individuals benefiting from ACA subsidies will also see more affordable healthcare access.

-

Potential Losers: Pharmaceutical companies face pressure on their profit margins due to the drug price negotiation element. Concerns have also been raised about potential limitations on drug development and innovation if profit margins are severely impacted. Further, some analysts argue that the long-term effects on the healthcare market remain uncertain and could potentially lead to reduced access to certain medications or treatments.

H2: Tax Implications: A Mixed Bag for Individuals and Corporations

The IRA introduces a range of tax changes impacting both individuals and corporations. Understanding the specifics is crucial.

-

Winners: Individuals making under $400,000 annually are eligible for various tax credits and incentives related to clean energy investments and healthcare. Certain businesses investing in renewable energy infrastructure also benefit from significant tax breaks.

-

Potential Losers: Corporations facing new minimum tax rates could see their profits reduced. High-income earners may find certain deductions limited, impacting their overall tax liability.

H2: The Economic Outlook: Stimulus vs. Inflation

The IRA’s long-term impact on inflation and economic growth remains a subject of ongoing debate among economists. Some argue that the investments in clean energy and healthcare will stimulate economic activity and create jobs, while others worry about the potential for increased government spending to fuel inflation further. Independent economic analyses offer varying projections, highlighting the complexity of accurately predicting the bill's overall effect. [Link to relevant economic analysis from a reputable source].

H2: Conclusion: A Balancing Act

The Inflation Reduction Act represents a bold attempt to address multiple pressing challenges facing the US economy. While some sectors clearly benefit from its provisions, others face potential headwinds. Careful monitoring of its implementation and its long-term impact is essential to fully understand the winners and losers in this ambitious piece of legislation. The ongoing debate underscores the complex interplay between economic policy, social equity, and environmental sustainability. Further research and analysis are needed to fully assess the long-term ramifications of this transformative bill.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Winners And Losers: Analyzing The Impact Of The "Big, Beautiful Bill". We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Brize Norton Airbase Four Charged With Security Violation

Jul 05, 2025

Brize Norton Airbase Four Charged With Security Violation

Jul 05, 2025 -

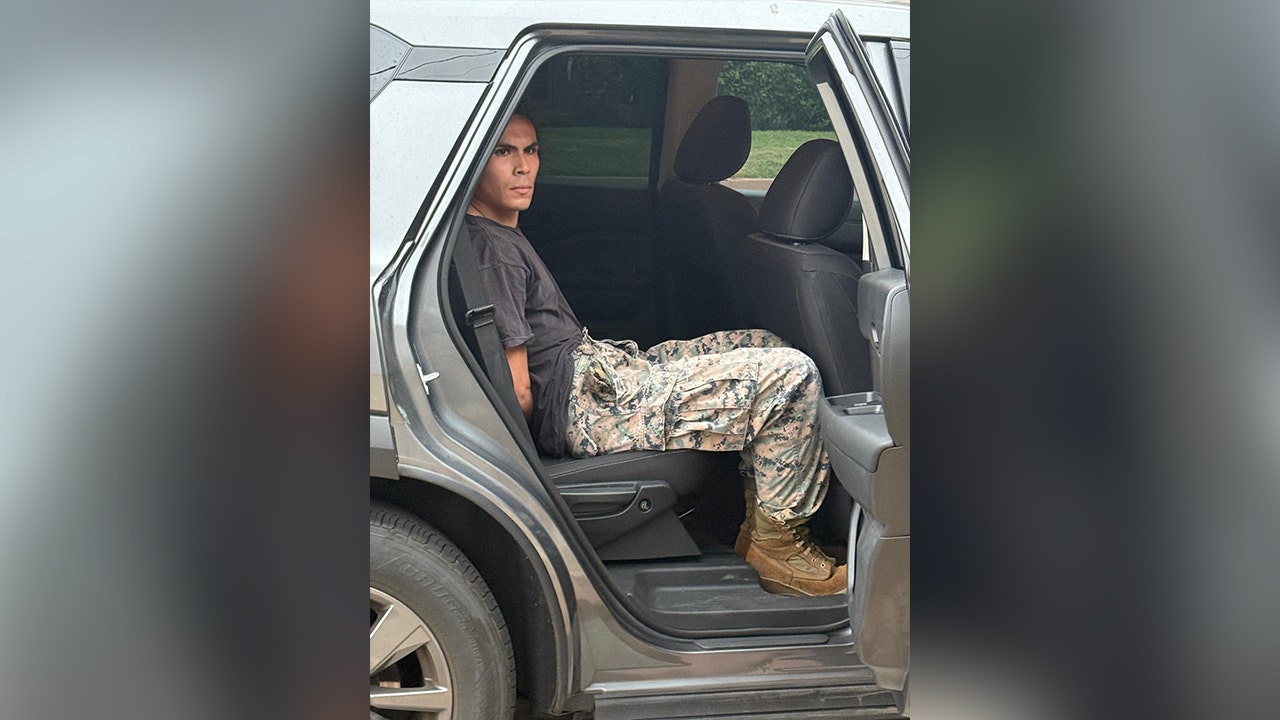

Federal Charges Filed Against Viral Anti Ice Supply Figure

Jul 05, 2025

Federal Charges Filed Against Viral Anti Ice Supply Figure

Jul 05, 2025 -

International Friendly Australia And Panama Womens Football Match Live Stream

Jul 05, 2025

International Friendly Australia And Panama Womens Football Match Live Stream

Jul 05, 2025 -

Examining The Limitations Of Doctor In Your Pocket Apps After Recent Tragedy

Jul 05, 2025

Examining The Limitations Of Doctor In Your Pocket Apps After Recent Tragedy

Jul 05, 2025 -

Tim Burtons Next Project An Animated Film Script On The Horizon

Jul 05, 2025

Tim Burtons Next Project An Animated Film Script On The Horizon

Jul 05, 2025

Latest Posts

-

Bayer Goldman Sachs Steigert Kursziel Und Erhoeht Bewertung

Jul 05, 2025

Bayer Goldman Sachs Steigert Kursziel Und Erhoeht Bewertung

Jul 05, 2025 -

Examining The Limitations Of Doctor In Your Pocket Apps After Recent Tragedy

Jul 05, 2025

Examining The Limitations Of Doctor In Your Pocket Apps After Recent Tragedy

Jul 05, 2025 -

Smuggling And The Black Market Examining The Uks Illegal Cigarette Problem

Jul 05, 2025

Smuggling And The Black Market Examining The Uks Illegal Cigarette Problem

Jul 05, 2025 -

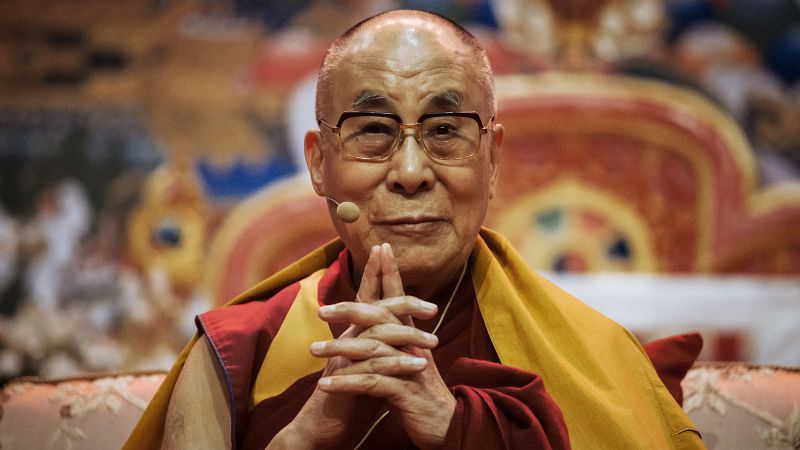

Dalai Lamas Final Showdown Beijing And The Question Of Reincarnation At 90

Jul 05, 2025

Dalai Lamas Final Showdown Beijing And The Question Of Reincarnation At 90

Jul 05, 2025 -

Stay Safe Carson Citys Updated Fire Restriction Guidelines

Jul 05, 2025

Stay Safe Carson Citys Updated Fire Restriction Guidelines

Jul 05, 2025