Would You Have Made Millions? 20 Years Of Lockheed Martin Stock Performance

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Would You Have Made Millions? 20 Years of Lockheed Martin Stock Performance

Investing in the defense sector can be lucrative, but is it always a sure bet? Let's examine the rollercoaster ride of Lockheed Martin stock over the past two decades and explore what it means for potential investors.

Lockheed Martin (LMT), a name synonymous with aerospace and defense, has been a mainstay on the stock market for decades. But how has its performance stacked up over the long term? Looking back 20 years provides valuable insight into the company's resilience, growth potential, and the rewards (and risks) associated with investing in a defense contractor.

A Two-Decade Journey: Charting Lockheed Martin's Stock Growth

Over the past 20 years, Lockheed Martin stock has demonstrated significant growth, although it hasn't been a consistently upward trajectory. The company's performance has been influenced by various factors, including:

- Government Contracts: Lockheed Martin's success is heavily reliant on securing lucrative government contracts. Fluctuations in defense spending, both domestically and internationally, have directly impacted its stock price.

- Technological Innovation: The company's investment in research and development, leading to advancements in areas like fighter jets (the F-35 program being a prime example), missile defense systems, and space exploration, have been key drivers of growth.

- Economic Conditions: Like any publicly traded company, Lockheed Martin's stock price is susceptible to broader economic trends, including inflation, recessionary periods, and overall market sentiment.

- Geopolitical Events: Global instability and conflicts often lead to increased demand for defense technologies, boosting Lockheed Martin's revenue and stock price. Conversely, periods of relative peace can lead to reduced demand.

Analyzing the Wins and Losses:

While the long-term picture is generally positive, investors would have experienced periods of both substantial gains and concerning dips. Analyzing specific years and events helps contextualize the overall performance:

- The Early 2000s: The post-9/11 surge in defense spending fueled significant growth.

- The Great Recession (2008-2009): Like many stocks, LMT experienced a downturn during the financial crisis.

- Recent Years: Increased global tensions and sustained demand for advanced defense systems have propelled LMT's stock to new heights.

The Million-Dollar Question: Would You Have Made Millions?

The simple answer is: it depends on when you invested and your investment strategy. Investing a lump sum 20 years ago would have yielded significant returns, but timing the market is notoriously difficult. A diversified portfolio, including LMT, would have likely outperformed a solely LMT-based investment.

Investing in the Future: Considerations for Potential Investors

Investing in Lockheed Martin, or any defense contractor, requires careful consideration. Factors to keep in mind include:

- Long-term Growth Potential: The company's consistent innovation and presence in vital defense sectors suggest continued long-term growth.

- Risk Tolerance: The defense industry is susceptible to shifts in government policy and geopolitical dynamics.

- Diversification: A diversified portfolio is crucial to mitigate risk.

Conclusion: A Solid, But Not Risk-Free, Investment

Lockheed Martin stock has demonstrated strong growth over the past 20 years, presenting a potentially lucrative investment opportunity. However, it's crucial to understand the inherent risks associated with investing in the defense sector. Thorough research, a long-term perspective, and a diversified investment strategy are key to maximizing potential returns while minimizing risk.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct your own research and consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Would You Have Made Millions? 20 Years Of Lockheed Martin Stock Performance. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

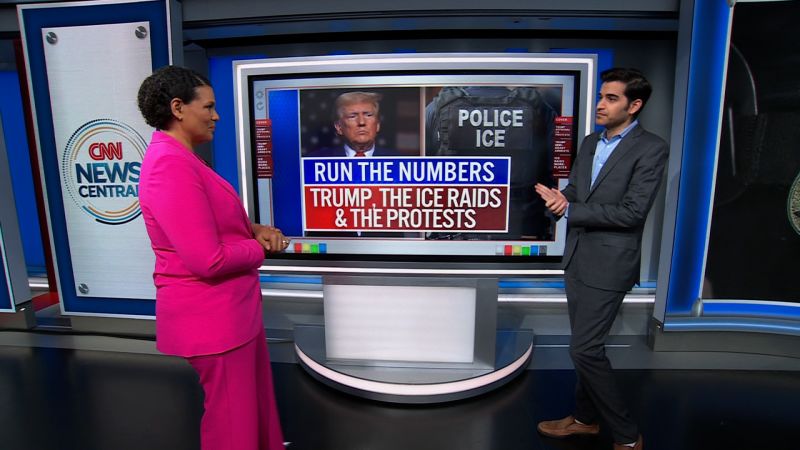

Immigration Protests Impact How Trumps Approval Rating Changed

Jun 22, 2025

Immigration Protests Impact How Trumps Approval Rating Changed

Jun 22, 2025 -

Cantor Fitzgerald Increases Lockheed Martin Stake Nyse Lmt Investment Update

Jun 22, 2025

Cantor Fitzgerald Increases Lockheed Martin Stake Nyse Lmt Investment Update

Jun 22, 2025 -

Americas Middle East Policy A Windfall For Chinas Strategic Ambitions

Jun 22, 2025

Americas Middle East Policy A Windfall For Chinas Strategic Ambitions

Jun 22, 2025 -

Will War Cost Trump The Support Of This Former Mlb Star

Jun 22, 2025

Will War Cost Trump The Support Of This Former Mlb Star

Jun 22, 2025 -

Palestine Action Facing Ban After Menwith Hill Protest

Jun 22, 2025

Palestine Action Facing Ban After Menwith Hill Protest

Jun 22, 2025

Latest Posts

-

Jaws 1975 50 Years Later Impact On Shark Conservation And Public Perception Of Attacks

Jun 22, 2025

Jaws 1975 50 Years Later Impact On Shark Conservation And Public Perception Of Attacks

Jun 22, 2025 -

The Story Behind Machine Gun Kellys Daughter Case S Name

Jun 22, 2025

The Story Behind Machine Gun Kellys Daughter Case S Name

Jun 22, 2025 -

Antarctic Ice New Data Challenges Understanding Of Ghostly Particles

Jun 22, 2025

Antarctic Ice New Data Challenges Understanding Of Ghostly Particles

Jun 22, 2025 -

Double Day Heatwave Uk To Sizzle With 33 C Temperatures

Jun 22, 2025

Double Day Heatwave Uk To Sizzle With 33 C Temperatures

Jun 22, 2025 -

Jaws Turns 50 Revisiting The Film That Changed How We See Sharks Forever

Jun 22, 2025

Jaws Turns 50 Revisiting The Film That Changed How We See Sharks Forever

Jun 22, 2025