Year-Long Farm Inheritance Tax Delay Proposed By MPs

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

<h1>Year-Long Farm Inheritance Tax Delay Proposed by MPs to Ease Rural Financial Strain</h1>

The crippling impact of inheritance tax on family farms has prompted a significant intervention proposal from a cross-party group of MPs. They're advocating for a year-long delay in inheritance tax payments for farms and other agricultural businesses facing immediate financial hardship. This move aims to alleviate the pressure on rural communities struggling with rising costs and volatile market conditions. The proposal, if enacted, could significantly impact succession planning for countless farming families across the country.

<h2>The Urgent Need for Reform: A Crushing Tax Burden</h2>

For generations, family farms have been the backbone of rural economies. However, the current inheritance tax system is increasingly putting these vital businesses under immense strain. The often-substantial tax bills levied upon the death of a farmer can leave successors facing impossible choices: sell off parts of the farm to pay the tax, potentially jeopardizing its long-term viability, or struggle under a mountain of debt. This isn't just a financial problem; it's a threat to food security, rural employment, and the preservation of our agricultural heritage.

Many farmers argue that the current system fails to account for the unique nature of agricultural assets. Unlike easily liquidated investments, farmland often requires years to generate sufficient income to cover such large tax liabilities. This inherent illiquidity is a key factor driving the current crisis. The proposed one-year delay offers a crucial breathing space, allowing families to restructure their finances and explore alternative funding options without the immediate threat of forced sales.

<h3>Key Features of the Proposed Delay:</h3>

- Targeted Relief: The delay would specifically benefit farms and agricultural businesses facing demonstrable financial hardship, ensuring that the relief is directed where it's most needed.

- Streamlined Application Process: MPs are pushing for a simplified application process to avoid bureaucratic hurdles and ensure quick access to the much-needed respite.

- Transparency and Accountability: Clear guidelines and oversight mechanisms would be vital to ensure the scheme's integrity and prevent potential abuse.

<h2>Impact on Rural Communities and the Wider Economy</h2>

The repercussions of farm closures extend far beyond individual families. These closures contribute to rural depopulation, impacting local economies and essential services. The loss of agricultural expertise and the fragmentation of land holdings further jeopardize the long-term sustainability of food production. The proposed delay is not simply a measure of financial relief; it's an investment in the future of rural Britain.

<h2>The Path Forward: Lobbying and Public Support</h2>

The MPs involved are actively lobbying the government to include this proposal in upcoming legislation. Public support is crucial to the success of this campaign. Citizens concerned about the future of farming and rural communities can contact their MPs to voice their support for this vital initiative. Supporting organizations like the [link to relevant farming advocacy group] are also actively campaigning for change and offer further information and resources.

<h2>Beyond the Delay: Long-Term Solutions Needed</h2>

While the year-long delay offers immediate relief, it's essential to acknowledge that this is not a long-term solution. The current inheritance tax system requires fundamental reform to ensure the long-term viability of family farms and the sustainability of rural communities. This could include more nuanced valuation methods for agricultural land or the introduction of agricultural relief schemes tailored to the unique challenges faced by farmers. A holistic approach addressing both short-term needs and long-term sustainability is critical for the future of British agriculture.

Call to Action: Contact your MP today and urge them to support the proposed one-year delay on inheritance tax for struggling farms. Let's work together to protect the future of our agricultural heritage and rural communities.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Year-Long Farm Inheritance Tax Delay Proposed By MPs. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Assisted Dying New Bill Amendments Head To Uk Parliament

May 18, 2025

Assisted Dying New Bill Amendments Head To Uk Parliament

May 18, 2025 -

Jeffrey Dean Morgan On Destination X The Walking Dead And More

May 18, 2025

Jeffrey Dean Morgan On Destination X The Walking Dead And More

May 18, 2025 -

Trump Administrations Border Policy Under Fire Aocs Challenge And The Official Response Cnn

May 18, 2025

Trump Administrations Border Policy Under Fire Aocs Challenge And The Official Response Cnn

May 18, 2025 -

Man Arrested And Charged Following Fires Near Keir Starmers Residences

May 18, 2025

Man Arrested And Charged Following Fires Near Keir Starmers Residences

May 18, 2025 -

Ukraine Peace Talks Us Urges Trump And Putins Participation For Resolution

May 18, 2025

Ukraine Peace Talks Us Urges Trump And Putins Participation For Resolution

May 18, 2025

Latest Posts

-

Cassies Testimony The Pivotal Role In Diddys Trial

May 18, 2025

Cassies Testimony The Pivotal Role In Diddys Trial

May 18, 2025 -

Cassinos Online Com Slots Brasileiros Ganhe Giros Gratis

May 18, 2025

Cassinos Online Com Slots Brasileiros Ganhe Giros Gratis

May 18, 2025 -

Government Announces Eu Agreement And Winter Fuel Policy Reversal

May 18, 2025

Government Announces Eu Agreement And Winter Fuel Policy Reversal

May 18, 2025 -

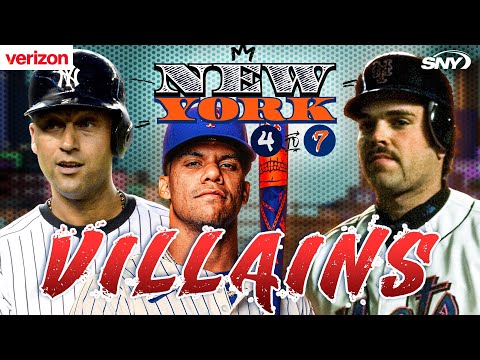

The Subway Series Most Hated Mets And Yankees Players

May 18, 2025

The Subway Series Most Hated Mets And Yankees Players

May 18, 2025 -

Exclusive Interview Jeffrey Dean Morgan On Destination X And Future Projects

May 18, 2025

Exclusive Interview Jeffrey Dean Morgan On Destination X And Future Projects

May 18, 2025