20 Years Of Lockheed Martin Stock: Returns And Growth

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

20 Years of Lockheed Martin Stock: A Retrospective on Returns and Growth

Lockheed Martin (LMT), a name synonymous with aerospace and defense, has been a significant player in the stock market for decades. But how has investing in Lockheed Martin fared over the past 20 years? This in-depth analysis explores the company's stock performance, highlighting key growth periods, challenges overcome, and what the future might hold for LMT investors.

A Look Back at Two Decades of LMT:

The past 20 years have witnessed significant shifts in the global geopolitical landscape, directly impacting the defense industry and, consequently, Lockheed Martin's performance. Analyzing LMT stock performance over this period reveals a compelling story of both substantial growth and periods of market volatility.

Key Growth Drivers:

Several factors have contributed to Lockheed Martin's long-term stock growth:

-

Consistent Government Contracts: As a major contractor for the U.S. Department of Defense and numerous international clients, Lockheed Martin enjoys a relatively stable revenue stream, even during economic downturns. This consistent flow of contracts provides a foundation for predictable earnings and investor confidence. [Link to Lockheed Martin's investor relations page]

-

Technological Innovation: Lockheed Martin's commitment to research and development (R&D) is a significant driver of its growth. Innovation in areas such as aerospace, missile defense, and cybersecurity has consistently positioned the company at the forefront of its industry. Their work on programs like the F-35 Lightning II fighter jet exemplifies this commitment to technological advancement.

-

Strategic Acquisitions: Strategic acquisitions have also played a crucial role in expanding Lockheed Martin's capabilities and market share. These acquisitions have broadened their product portfolio and strengthened their competitive advantage.

Challenges Faced:

Despite its impressive growth, Lockheed Martin hasn't been immune to challenges:

-

Budgetary Constraints: Government budget cuts and fluctuating defense spending can significantly impact Lockheed Martin's revenue and profitability. This requires the company to constantly adapt and innovate to secure new contracts and maintain its competitive edge.

-

Geopolitical Uncertainty: Global geopolitical instability and changing international relations can impact defense spending priorities, presenting both opportunities and risks for Lockheed Martin.

-

Competition: The defense industry is highly competitive, with several major players vying for government contracts. Lockheed Martin must continually demonstrate its technological superiority and cost-effectiveness to maintain its market position.

Analyzing the Returns:

While past performance is not indicative of future results, a look at historical LMT stock data reveals significant growth over the past two decades. [Link to a reputable financial website showing LMT stock chart]. Investors should consider factors such as dividends, reinvestment, and overall market conditions when evaluating historical returns. Analyzing the stock's performance during different economic cycles can offer valuable insights into its resilience.

The Future of Lockheed Martin Stock:

Predicting the future of any stock is inherently challenging. However, Lockheed Martin's strong fundamentals, consistent innovation, and significant role in national security suggest a promising outlook. Continued investment in R&D, strategic acquisitions, and adaptation to evolving geopolitical landscapes will be crucial for future success.

Conclusion:

Over the past 20 years, Lockheed Martin stock has demonstrated remarkable growth, driven by consistent government contracts, technological innovation, and strategic acquisitions. While challenges remain, the company's strong fundamentals and position within the global defense industry suggest continued potential for growth. However, potential investors should always conduct thorough research and consider their individual risk tolerance before making any investment decisions. Remember to consult with a qualified financial advisor for personalized investment advice.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on 20 Years Of Lockheed Martin Stock: Returns And Growth. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Revealed The Story Behind Machine Gun Kellys Daughters Name Saga

Jun 22, 2025

Revealed The Story Behind Machine Gun Kellys Daughters Name Saga

Jun 22, 2025 -

Mahmoud Khalil Columbia Student Granted Bail Following Court Order

Jun 22, 2025

Mahmoud Khalil Columbia Student Granted Bail Following Court Order

Jun 22, 2025 -

Antarctic Ice Scientists Investigate Strange Signals In Ghostly Particle Experiment

Jun 22, 2025

Antarctic Ice Scientists Investigate Strange Signals In Ghostly Particle Experiment

Jun 22, 2025 -

Protest Group Palestine Action Ban Imminent Following Base Break In

Jun 22, 2025

Protest Group Palestine Action Ban Imminent Following Base Break In

Jun 22, 2025 -

Lockheed Martin Stock Investment A 20 Year Performance Review

Jun 22, 2025

Lockheed Martin Stock Investment A 20 Year Performance Review

Jun 22, 2025

Latest Posts

-

No End To Israeli Attacks No Diplomacy From Iran Foreign Minister

Jun 22, 2025

No End To Israeli Attacks No Diplomacy From Iran Foreign Minister

Jun 22, 2025 -

Pavel Durovs Will A Massive Inheritance For His Numerous Children

Jun 22, 2025

Pavel Durovs Will A Massive Inheritance For His Numerous Children

Jun 22, 2025 -

Qatar Monitors Gulf Radiation Concerns Grow After Israeli Strikes On Iranian Energy Sites

Jun 22, 2025

Qatar Monitors Gulf Radiation Concerns Grow After Israeli Strikes On Iranian Energy Sites

Jun 22, 2025 -

Assisted Dying Mps Approve Bill In Landmark Commons Vote

Jun 22, 2025

Assisted Dying Mps Approve Bill In Landmark Commons Vote

Jun 22, 2025 -

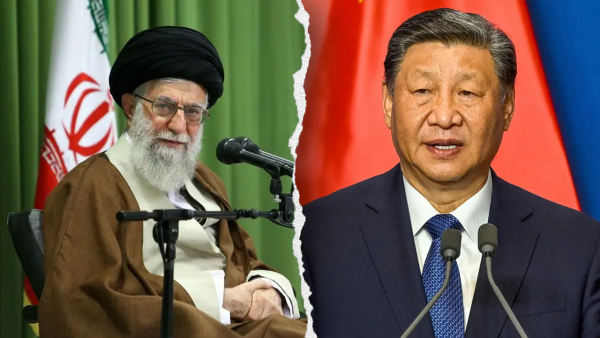

The Stakes Are High Analyzing Chinas Potential Actions In A Post Iran Conflict World

Jun 22, 2025

The Stakes Are High Analyzing Chinas Potential Actions In A Post Iran Conflict World

Jun 22, 2025