$236.55 Million Bet On Bank Of America: Two Sigma's New Position Analyzed

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

$236.55 Million Bet on Bank of America: Two Sigma's New Position Analyzed

Two Sigma Investments, the quantitative investment firm known for its data-driven strategies, has made a significant move, taking a new position in Bank of America (BAC) valued at $236.55 million. This substantial investment has sent ripples through the financial markets, prompting analysts and investors to dissect the implications of this bold play. What factors led Two Sigma to bet big on Bank of America, and what does this mean for the future of the banking giant and the broader market?

Two Sigma's Data-Driven Approach: Unpacking the Investment

Two Sigma is renowned for its sophisticated algorithms and data analysis capabilities. Unlike traditional investment firms relying on fundamental analysis, Two Sigma employs quantitative strategies, leveraging massive datasets to identify potentially profitable opportunities. This makes understanding the why behind their Bank of America investment particularly intriguing.

While Two Sigma doesn't publicly disclose its investment rationale, several factors could explain this significant bet:

-

Economic Outlook: The current economic climate, characterized by [mention current economic factors, e.g., rising interest rates, inflation concerns], may have influenced Two Sigma's decision. Bank of America, as a major player in the financial sector, stands to benefit from [mention specific benefits, e.g., higher net interest margins in a rising rate environment].

-

BAC's Financial Performance: Bank of America's recent financial performance, including [mention key performance indicators, e.g., earnings growth, loan growth, asset quality], might have signaled strong potential for future returns to Two Sigma's algorithms.

-

Undervalued Asset: Two Sigma's quantitative models may have identified Bank of America as an undervalued asset, presenting a compelling opportunity for profit. This could be based on various factors, including [mention potential factors, e.g., market sentiment, valuation multiples compared to peers].

Implications for Bank of America and the Broader Market

This substantial investment by Two Sigma carries significant implications:

-

Increased Market Confidence: The investment could boost investor confidence in Bank of America, potentially driving up its share price. Large institutional investors like Two Sigma often act as market movers, influencing the sentiment around specific stocks.

-

Sector-Wide Impact: The move could signal a positive outlook on the financial sector as a whole, potentially attracting further investment into banking stocks.

-

Long-Term Strategy: Two Sigma's investment suggests a longer-term bullish outlook on Bank of America's prospects. This long-term view reflects confidence in the bank's ability to navigate the current economic landscape and deliver strong returns over time.

Analyzing the Risk

While the potential rewards are considerable, it’s crucial to acknowledge the inherent risks involved in any investment. The banking sector is susceptible to various economic and regulatory headwinds. Factors like [mention potential risks, e.g., changes in interest rates, potential economic downturn, increased regulatory scrutiny] could impact Bank of America's performance.

Conclusion: A Significant Bet with Potential for High Returns

Two Sigma's $236.55 million investment in Bank of America represents a significant bet on the future of the financial giant and, potentially, the broader market. While the exact reasons remain undisclosed, analysis suggests a confluence of factors, including economic outlook, Bank of America's financial performance, and a potential undervaluation, likely influenced Two Sigma's data-driven algorithms. This bold move warrants close monitoring, as it could significantly impact both Bank of America's trajectory and the overall financial landscape. Investors should conduct thorough research before making any investment decisions based on this analysis.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on $236.55 Million Bet On Bank Of America: Two Sigma's New Position Analyzed. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Sustainable Gardening The Benefits Of Coffee Grounds For Lawns

May 27, 2025

Sustainable Gardening The Benefits Of Coffee Grounds For Lawns

May 27, 2025 -

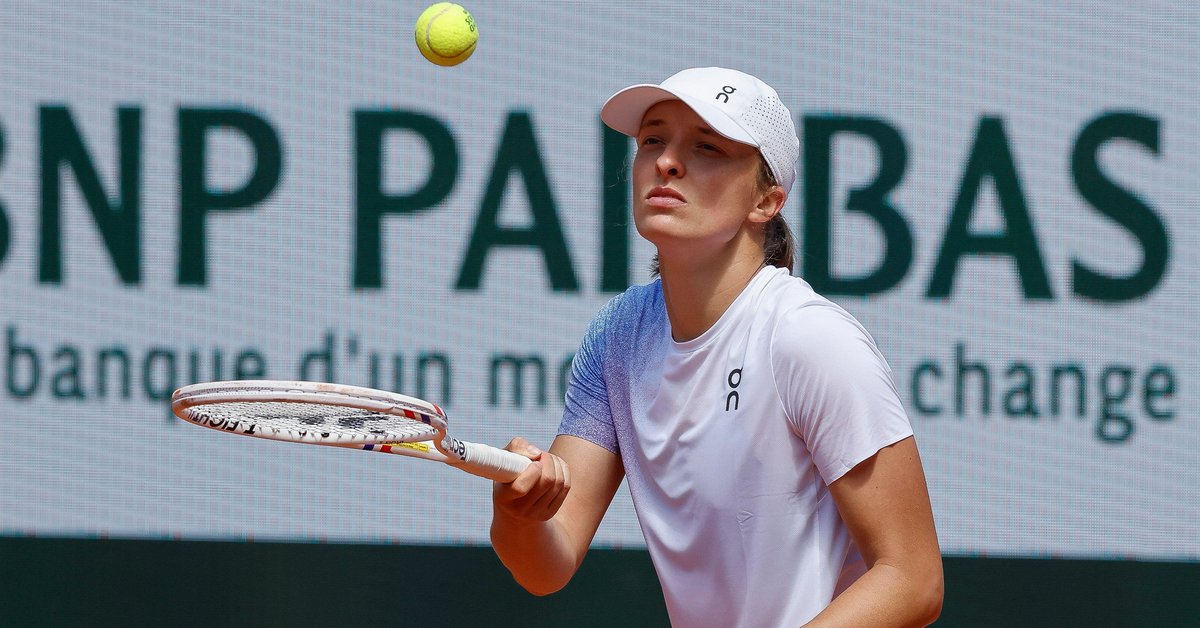

Harmonogram Roland Garros Sprawdz Kiedy Iga Swiatek Rozpoczyna Swoj Pierwszy Mecz

May 27, 2025

Harmonogram Roland Garros Sprawdz Kiedy Iga Swiatek Rozpoczyna Swoj Pierwszy Mecz

May 27, 2025 -

Deadly Russian Air Strikes Hit Kyiv Despite Major Prisoner Exchange

May 27, 2025

Deadly Russian Air Strikes Hit Kyiv Despite Major Prisoner Exchange

May 27, 2025 -

The Dawn Of Conscious Ai Ethical And Societal Challenges

May 27, 2025

The Dawn Of Conscious Ai Ethical And Societal Challenges

May 27, 2025 -

Using Coffee Grounds In The Garden A Guide To Sustainable Lawn Care

May 27, 2025

Using Coffee Grounds In The Garden A Guide To Sustainable Lawn Care

May 27, 2025

Latest Posts

-

Uche Ojeh Husband Of Today Shows Sheinelle Jones Dies From Brain Cancer

May 31, 2025

Uche Ojeh Husband Of Today Shows Sheinelle Jones Dies From Brain Cancer

May 31, 2025 -

Althea Gibsons Legacy Celebrated 2025 Us Open Theme Unveiled

May 31, 2025

Althea Gibsons Legacy Celebrated 2025 Us Open Theme Unveiled

May 31, 2025 -

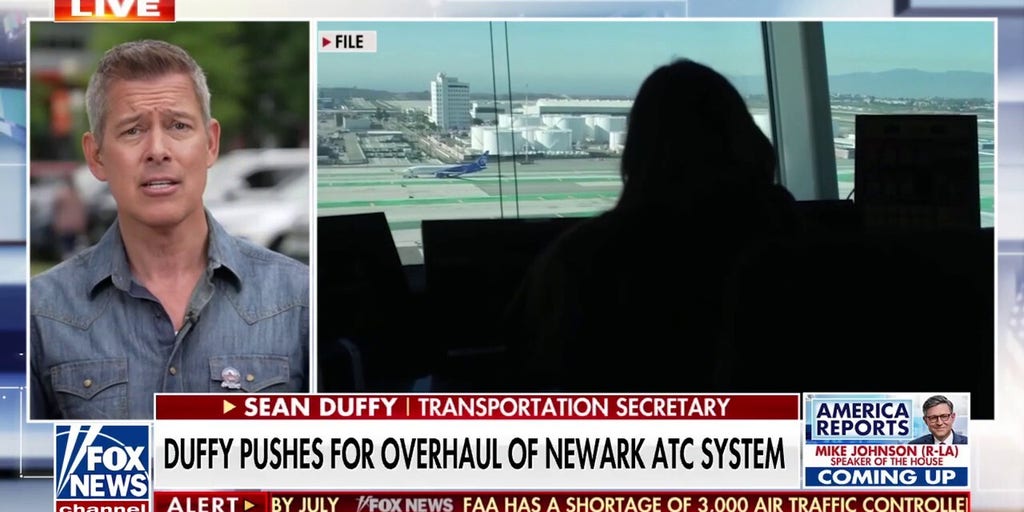

Newark Airport Delays Increase As Sec Duffy Presses For Air Traffic Control Reform

May 31, 2025

Newark Airport Delays Increase As Sec Duffy Presses For Air Traffic Control Reform

May 31, 2025 -

Analysis Kemi Badenochs Controversial Actions And The Tory Backlash

May 31, 2025

Analysis Kemi Badenochs Controversial Actions And The Tory Backlash

May 31, 2025 -

Investigating The 1000 Increase In Sbet Stock Price A Comprehensive Analysis

May 31, 2025

Investigating The 1000 Increase In Sbet Stock Price A Comprehensive Analysis

May 31, 2025