$420,000 Retirement Cut: Understanding The Impact Of The New Republican Plan

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

$420,000 Retirement Cut: Understanding the Impact of the New Republican Plan

The proposed Republican plan to slash retirement benefits by a staggering $420,000 per household is sparking outrage and confusion across the nation. This significant reduction, impacting Social Security and potentially other retirement programs, has sent shockwaves through the financial security of millions of Americans, particularly those nearing retirement or already relying on these benefits. Understanding the complexities of this plan and its potential impact is crucial for everyone planning for their future.

What's in the Republican Plan? Deciphering the Details

While the specifics are still emerging and subject to change, the proposed cuts aim to address the projected long-term solvency issues facing Social Security and potentially Medicare. The $420,000 figure represents an average reduction across households over the course of retirement, a number derived from analyses of projected benefit changes under the proposed reforms. These potential changes aren't just about reducing benefits for current retirees; they also affect future generations, casting a long shadow over retirement planning for younger Americans.

The plan is likely to incorporate measures such as:

- Raising the retirement age: This would delay when individuals can start receiving benefits, potentially forcing many to work longer than planned.

- Reducing benefits for higher earners: This aims to target wealthier individuals, but the definition of "higher earner" and the specific reduction methods remain unclear, leading to uncertainty and anxiety.

- Changes to the cost-of-living adjustment (COLA): Altering the COLA formula could significantly reduce the purchasing power of retirement benefits over time, further eroding their value.

- Privatization proposals: While not explicitly stated in all versions of the plan, some Republican proposals have involved elements of privatizing parts of Social Security, introducing further risk and complexity to retirement savings.

The Impact on Different Demographics: Who Will Feel the Pinch Most?

The proposed cuts will not affect all Americans equally. Low-income individuals and minorities, who often rely more heavily on Social Security for their retirement income, are likely to be disproportionately affected. Women, who often have lower lifetime earnings and longer life expectancies, also stand to experience a more significant financial impact.

Furthermore, the plan's long-term consequences could drastically alter the retirement landscape for younger generations, forcing them to save significantly more to compensate for reduced government benefits. This shift could exacerbate existing economic inequalities and increase financial stress on individuals and families.

Navigating Uncertainty: What Can You Do?

The uncertainty surrounding the proposed Republican plan highlights the importance of proactive retirement planning. Here are some steps you can take:

- Review your retirement savings: Assess your current savings and adjust your strategy based on the potential impact of these cuts. Consider increasing contributions to your 401(k) or IRA.

- Consult a financial advisor: Seek professional advice to create a personalized retirement plan that accounts for potential changes in government benefits.

- Stay informed: Keep abreast of developments regarding the Republican plan and its potential implications for your retirement security. Follow reputable news sources and government websites for updates.

- Engage in political discourse: Contact your elected officials to voice your concerns and advocate for policies that protect retirement security.

Conclusion: A Call to Action for Retirement Security

The potential $420,000 retirement cut represents a significant threat to the financial well-being of millions of Americans. Understanding the details of this proposed plan, its potential impact on different demographics, and the steps you can take to mitigate its effects are crucial for securing a comfortable retirement. Staying informed and actively participating in the political process are essential to protecting your financial future. The time to act is now.

Keywords: Republican Retirement Plan, Social Security Cuts, Retirement Benefits, $420,000 Retirement Cut, Medicare Cuts, Retirement Planning, Financial Security, Retirement Age, COLA, Privatization, Economic Inequality, Financial Advisor.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on $420,000 Retirement Cut: Understanding The Impact Of The New Republican Plan. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

I Dont Understand You Premiere Amanda Seyfrieds Striking Black Ensemble

Jun 04, 2025

I Dont Understand You Premiere Amanda Seyfrieds Striking Black Ensemble

Jun 04, 2025 -

Ronny Mauricios Rise From Minor League Star To Mets Roster

Jun 04, 2025

Ronny Mauricios Rise From Minor League Star To Mets Roster

Jun 04, 2025 -

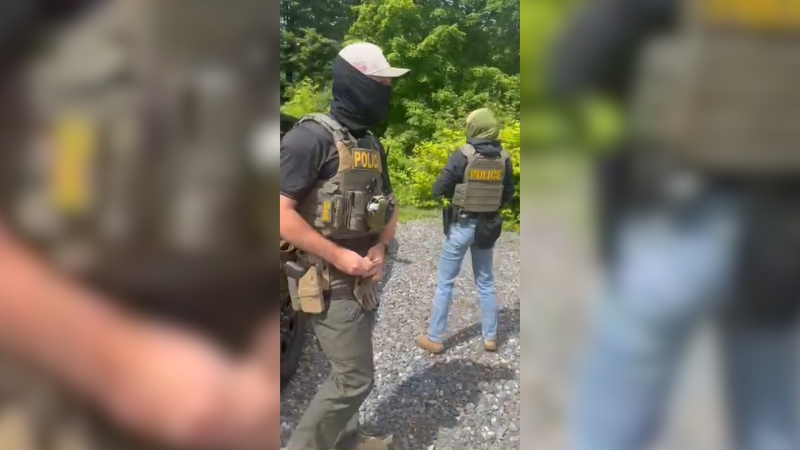

Unidentified Masked Agents Detain Gardener Local Businesses React

Jun 04, 2025

Unidentified Masked Agents Detain Gardener Local Businesses React

Jun 04, 2025 -

Dramatic Eruption Mount Etna In Italy Sends Ash And Debris Airborne

Jun 04, 2025

Dramatic Eruption Mount Etna In Italy Sends Ash And Debris Airborne

Jun 04, 2025 -

Tom Daleys Advocacy Helping Closeted Athletes Come Out

Jun 04, 2025

Tom Daleys Advocacy Helping Closeted Athletes Come Out

Jun 04, 2025

Latest Posts

-

Options Trading On Broadcom A Pre Earnings Analysis And Strategy

Jun 06, 2025

Options Trading On Broadcom A Pre Earnings Analysis And Strategy

Jun 06, 2025 -

Sources Joe Sacco To Join Team Name S Coaching Staff After Bruins Exit

Jun 06, 2025

Sources Joe Sacco To Join Team Name S Coaching Staff After Bruins Exit

Jun 06, 2025 -

Winter Fuel Payment U Turn Brings Relief To Elderly This Winter

Jun 06, 2025

Winter Fuel Payment U Turn Brings Relief To Elderly This Winter

Jun 06, 2025 -

David Quinn Back In The Nhl Joining Mike Sullivans Penguins Coaching Staff

Jun 06, 2025

David Quinn Back In The Nhl Joining Mike Sullivans Penguins Coaching Staff

Jun 06, 2025 -

Paige De Sorbos Exit From Summer House A New Chapter Begins

Jun 06, 2025

Paige De Sorbos Exit From Summer House A New Chapter Begins

Jun 06, 2025