$5B+ Poured Into Bitcoin ETFs: What's Behind The Investment Boom?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

$5 Billion+ Poured into Bitcoin ETFs: What's Behind the Investment Boom?

The cryptocurrency market is buzzing. Over $5 billion has flooded into Bitcoin exchange-traded funds (ETFs) in recent months, marking a significant surge in institutional and retail investor interest. This unprecedented influx raises a crucial question: what's fueling this investment boom? Is it a fleeting trend, or a sign of Bitcoin's growing acceptance as a legitimate asset class?

The Rise of Regulated Bitcoin Access:

A key driver behind the Bitcoin ETF investment boom is the increasing availability of regulated investment vehicles. The approval of the first Bitcoin futures ETF in the US in 2021 paved the way for more sophisticated and accessible products. Now, investors can gain Bitcoin exposure through regulated channels, mitigating some of the risks associated with directly holding cryptocurrency. This regulated access attracts institutional investors, who often have strict guidelines about where they can allocate capital. The enhanced regulatory clarity reduces compliance headaches and encourages broader participation.

Spot Bitcoin ETFs on the Horizon?:

The current surge is further fueled by anticipation surrounding the potential approval of a spot Bitcoin ETF. While futures-based ETFs offer exposure to Bitcoin's price movements, a spot ETF would allow direct investment in Bitcoin itself. This would likely unlock even greater capital inflows, making Bitcoin more accessible to a wider range of investors, including those seeking direct ownership. The SEC's ongoing review of several spot Bitcoin ETF applications keeps the market on edge, generating considerable buzz and driving investment. .

Beyond Regulation: Other Contributing Factors:

Beyond regulatory developments, several other factors contribute to the Bitcoin ETF investment boom:

-

Inflation Hedge: Many investors view Bitcoin as a potential hedge against inflation, particularly in times of economic uncertainty. Its limited supply and decentralized nature appeal to those seeking protection from traditional fiat currency devaluation.

-

Institutional Adoption: Increased institutional adoption of Bitcoin, from companies like MicroStrategy to BlackRock's involvement in Bitcoin ETF applications, signals growing confidence in Bitcoin's long-term viability as an asset. This legitimizes Bitcoin in the eyes of many investors.

-

Technological Advancements: Ongoing developments within the Bitcoin ecosystem, such as the Lightning Network, aim to improve scalability and transaction speeds, making Bitcoin more user-friendly and efficient. These advancements boost investor confidence.

-

Growing Public Awareness: Despite its volatility, Bitcoin's mainstream awareness has grown considerably. Increased media coverage and educational resources have helped demystify the asset class, leading to broader understanding and participation.

Risks and Considerations:

While the investment boom is exciting, it's crucial to acknowledge the risks associated with Bitcoin investment. Its volatility is well-documented, and investors should proceed with caution. Diversification is key to mitigating risk within any investment portfolio. .

The Future of Bitcoin ETFs:

The significant influx of capital into Bitcoin ETFs suggests a growing acceptance of Bitcoin as a viable asset class. The potential approval of spot Bitcoin ETFs could further accelerate this trend, potentially reshaping the landscape of the financial markets. While uncertainty remains, the current investment boom paints a compelling picture of Bitcoin's increasing integration into the mainstream financial system. The coming months will be crucial in determining whether this trend is sustainable or merely a temporary surge. However, the sheer volume of investment speaks volumes about the evolving perception of this pioneering cryptocurrency.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on $5B+ Poured Into Bitcoin ETFs: What's Behind The Investment Boom?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Stock Market Surge Six Day Win For S And P 500 As Wall Street Ignores Moodys

May 21, 2025

Stock Market Surge Six Day Win For S And P 500 As Wall Street Ignores Moodys

May 21, 2025 -

Official Statement President Biden Receives Prostate Cancer Diagnosis

May 21, 2025

Official Statement President Biden Receives Prostate Cancer Diagnosis

May 21, 2025 -

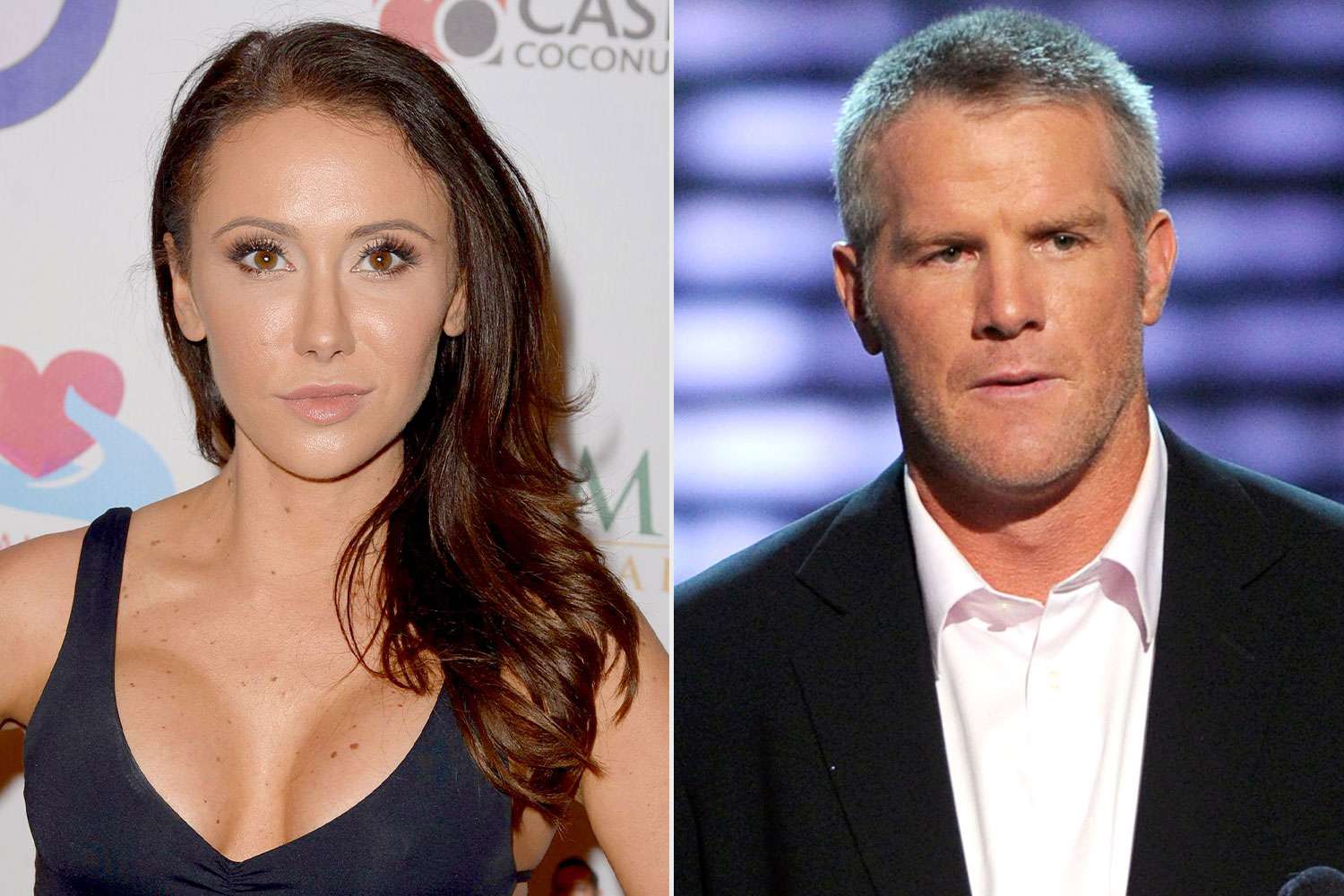

The Brett Favre Jenn Sterger Scandal Years Later A Reckoning

May 21, 2025

The Brett Favre Jenn Sterger Scandal Years Later A Reckoning

May 21, 2025 -

10 Minutes Of Unpiloted Flight Lufthansa Addresses Co Pilot Incident

May 21, 2025

10 Minutes Of Unpiloted Flight Lufthansa Addresses Co Pilot Incident

May 21, 2025 -

What Is Driving The Increase In Femicide Examining The Complexities

May 21, 2025

What Is Driving The Increase In Femicide Examining The Complexities

May 21, 2025

Latest Posts

-

160 Japanese Firms Compete In Nature Conservation For Enhanced Corporate Value Cross Industry Best Practices

May 21, 2025

160 Japanese Firms Compete In Nature Conservation For Enhanced Corporate Value Cross Industry Best Practices

May 21, 2025 -

2025s Best And Safest Sunscreens A Family Guide To Sun Protection

May 21, 2025

2025s Best And Safest Sunscreens A Family Guide To Sun Protection

May 21, 2025 -

Safe Sunscreen For Families In 2025 Expert Recommendations And Reviews

May 21, 2025

Safe Sunscreen For Families In 2025 Expert Recommendations And Reviews

May 21, 2025 -

Ny Ag Jamess Trump Litigation Strategy Amidst Doj Real Estate Probe

May 21, 2025

Ny Ag Jamess Trump Litigation Strategy Amidst Doj Real Estate Probe

May 21, 2025 -

Severe Storm Risk Overnight North Carolina Braces For Heavy Rain

May 21, 2025

Severe Storm Risk Overnight North Carolina Braces For Heavy Rain

May 21, 2025