$9 Billion Bitcoin Dump: Is This The Beginning Of A Bear Market?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

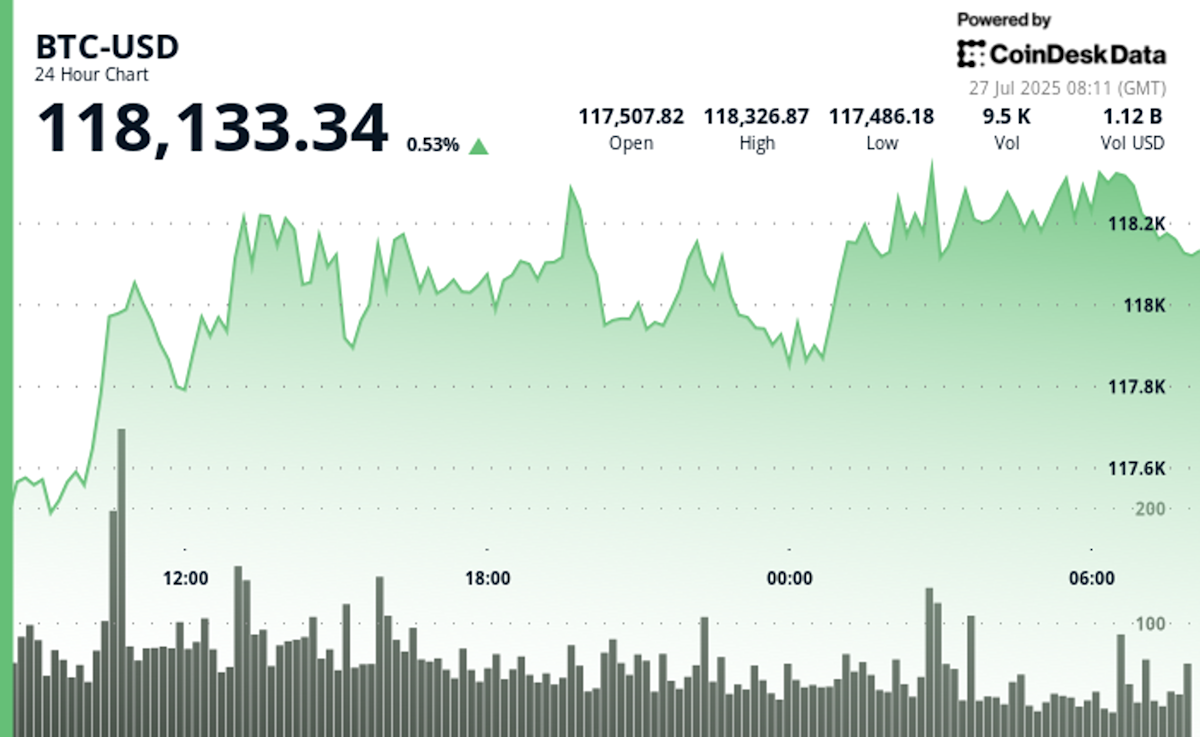

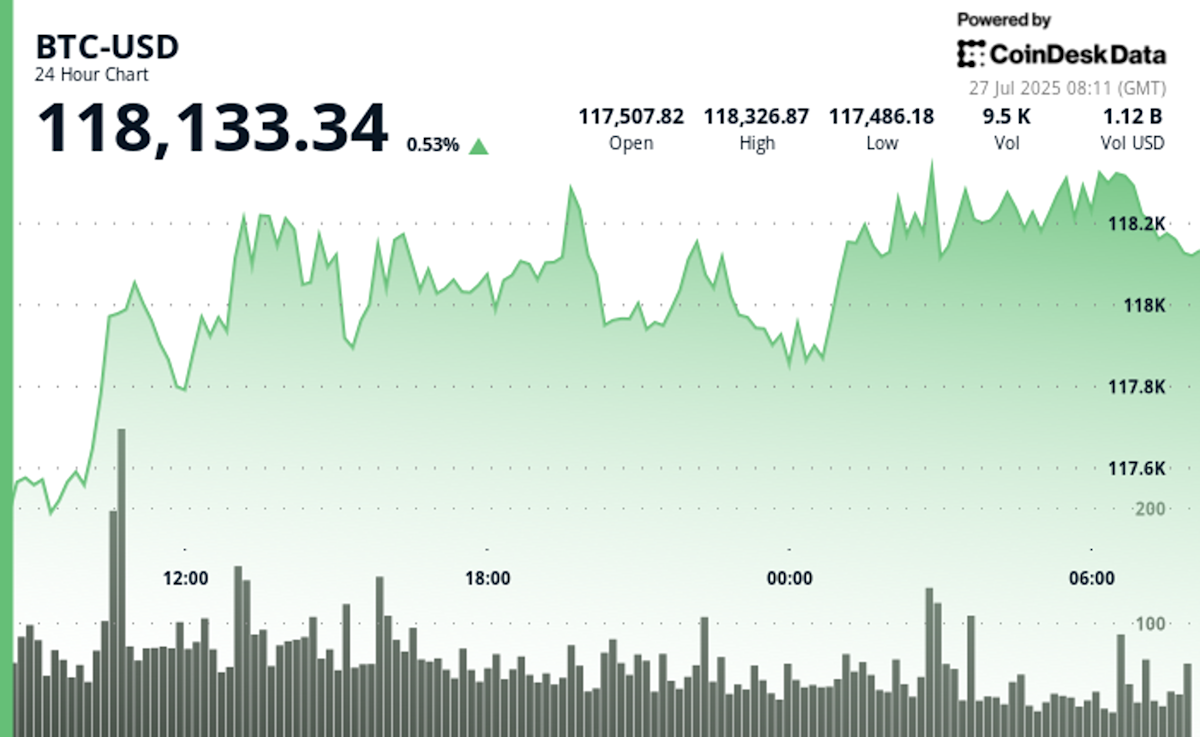

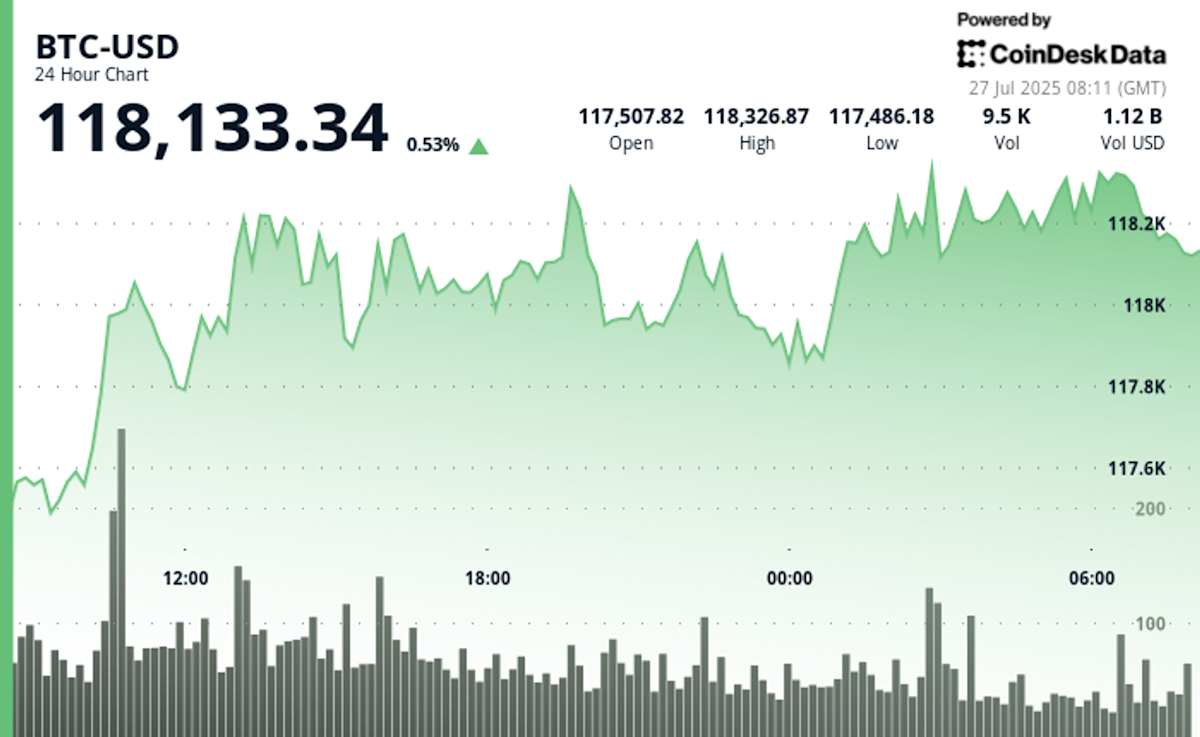

$9 Billion Bitcoin Dump: Is This the Beginning of a Bear Market?

The cryptocurrency market experienced a significant shockwave recently with a massive $9 billion Bitcoin dump, sending shockwaves through the crypto community and leaving many wondering: is this the beginning of another bear market? The sudden sell-off, which saw Bitcoin's price plummet, has reignited concerns about the volatility inherent in the crypto space. Let's delve into the details and explore the potential implications.

The $9 Billion Question: What Caused the Dump?

Pinpointing the exact cause of such a substantial sell-off is notoriously difficult in the volatile cryptocurrency market. However, several contributing factors are likely at play:

-

Profit-Taking: After a period of relative stability and even some growth, many investors may have chosen to secure profits, leading to a significant sell-off. This is a common occurrence in any market, particularly one as volatile as cryptocurrency.

-

Regulatory Uncertainty: Ongoing regulatory scrutiny and uncertainty surrounding Bitcoin and other cryptocurrencies globally continue to impact market sentiment. News and speculation about potential regulatory crackdowns can trigger significant price drops. For instance, recent pronouncements from regulatory bodies in various countries can influence investor confidence.

-

Macroeconomic Factors: The broader economic climate plays a crucial role. Inflationary pressures, rising interest rates, and concerns about a potential recession can all lead investors to move away from riskier assets like Bitcoin. This flight to safety often benefits more stable, traditional investments.

-

Whale Activity: The influence of "whales" – individuals or entities holding massive amounts of Bitcoin – cannot be ignored. A coordinated sell-off by a few large players could easily account for a significant portion of the $9 billion drop. Identifying these actors is difficult, but their impact is undeniable.

Bear Market Brewing? Analyzing the Signs

While a single event doesn't automatically signify a bear market, the $9 billion Bitcoin dump certainly raises concerns. Several indicators warrant close monitoring:

-

Technical Analysis: Chart patterns and technical indicators are being closely scrutinized by analysts. Breaking key support levels often signals further downward pressure. Experts are looking at moving averages, RSI, and other indicators to predict future price movements.

-

Market Sentiment: The overall mood within the crypto community is crucial. Fear, uncertainty, and doubt (FUD) can become self-fulfilling prophecies, driving further price declines. Monitoring social media sentiment and news coverage can provide valuable insights.

-

On-Chain Data: Analyzing on-chain metrics, such as transaction volume and the number of active addresses, can reveal underlying trends and investor behavior. These data points can help separate short-term noise from long-term trends.

What Does the Future Hold?

Predicting the future of Bitcoin is notoriously challenging. While the recent $9 billion dump is undeniably significant, it's too early to definitively declare the start of a bear market. The market's resilience and historical recovery from previous dips should be considered. However, investors should remain cautious and monitor the situation closely. Diversification, risk management, and a long-term perspective are crucial in navigating the cryptocurrency market's volatility.

Disclaimer: This article provides general information and analysis only and does not constitute financial advice. Investing in cryptocurrencies involves significant risk, and you should conduct your own research before making any investment decisions.

Call to Action: Stay informed about the latest developments in the cryptocurrency market by following reputable news sources and engaging with the crypto community responsibly. Learn more about [link to reputable crypto news source].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on $9 Billion Bitcoin Dump: Is This The Beginning Of A Bear Market?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

9 Billion Bitcoin Dump Is This The Beginning Of A Bear Market

Jul 30, 2025

9 Billion Bitcoin Dump Is This The Beginning Of A Bear Market

Jul 30, 2025 -

Jonathan Kumingas Free Agency Nba Execs Divided On Contract Offers

Jul 30, 2025

Jonathan Kumingas Free Agency Nba Execs Divided On Contract Offers

Jul 30, 2025 -

Rising Poverty Forces Families To Relinquish Beloved Pets

Jul 30, 2025

Rising Poverty Forces Families To Relinquish Beloved Pets

Jul 30, 2025 -

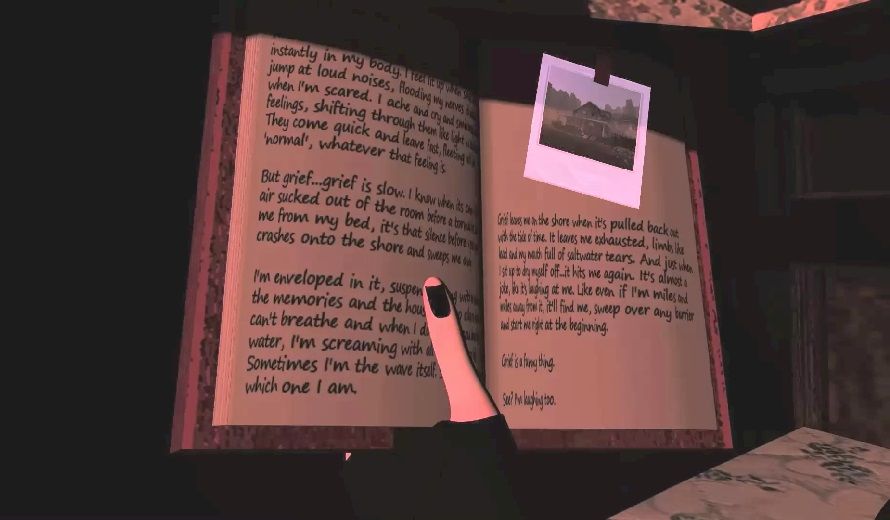

Critical Analysis Heartworms Unique Blend Of Survival Horror And Grief

Jul 30, 2025

Critical Analysis Heartworms Unique Blend Of Survival Horror And Grief

Jul 30, 2025 -

Ice Cube And Eva Longorias War Of The Worlds Remake Prime Video Release Date Announced

Jul 30, 2025

Ice Cube And Eva Longorias War Of The Worlds Remake Prime Video Release Date Announced

Jul 30, 2025

Latest Posts

-

Fatal Police Shooting In West Little River Community Demands Answers After Video Release

Jul 31, 2025

Fatal Police Shooting In West Little River Community Demands Answers After Video Release

Jul 31, 2025 -

Increased Affordable Housing In Illinois Examining The Role Of Federal Housing Credit Expansion

Jul 31, 2025

Increased Affordable Housing In Illinois Examining The Role Of Federal Housing Credit Expansion

Jul 31, 2025 -

Prime Video Sets Release Date For Ice Cube And Eva Longorias War Of The Worlds

Jul 31, 2025

Prime Video Sets Release Date For Ice Cube And Eva Longorias War Of The Worlds

Jul 31, 2025 -

Fatal Midtown Manhattan Shooting Nypd Officer And Suspect Dead

Jul 31, 2025

Fatal Midtown Manhattan Shooting Nypd Officer And Suspect Dead

Jul 31, 2025 -

Fdas Loss Dr Vinay Prasad Departs Amidst Sarepta And Vaccine Conflicts

Jul 31, 2025

Fdas Loss Dr Vinay Prasad Departs Amidst Sarepta And Vaccine Conflicts

Jul 31, 2025