9 Proven Methods To Fund Your Child's Higher Education

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

9 Proven Methods to Fund Your Child's Higher Education

The soaring cost of higher education is a major concern for many parents. Tuition fees, room and board, books, and other expenses can quickly add up to a staggering amount. But don't despair! Planning ahead and exploring various funding options can significantly ease the financial burden. This article outlines nine proven methods to help you fund your child's higher education, ensuring they can pursue their dreams without crippling debt.

1. Start Saving Early with 529 Plans:

One of the most effective ways to save for college is through a 529 plan. These tax-advantaged savings plans allow you to invest money that grows tax-deferred, and withdrawals used for qualified education expenses are tax-free. Many states offer state-sponsored 529 plans with potential tax benefits for residents. Early contributions are key, as the power of compounding interest works best over longer periods. Learn more about choosing the right 529 plan .

2. Explore the Power of Custodial Accounts (UTMA/UGMA):

Uniform Transfers to Minors Act (UTMA) and Uniform Gifts to Minors Act (UGMA) accounts allow you to gift assets to your child, which can grow tax-free until withdrawn. While these aren't specifically designed for college, the funds can be used for education expenses. Consult a financial advisor to understand the tax implications and potential benefits.

3. Maximize the Benefits of Education Savings Accounts (ESAs):

Education Savings Accounts (ESAs), though less common now than 529 plans, still offer tax advantages for saving for education. Understand the eligibility requirements and contribution limits before considering this option.

4. Leverage Scholarships and Grants:

Don't underestimate the power of free money! Numerous scholarships and grants are available based on academic merit, extracurricular achievements, financial need, and other factors. Websites like Fastweb and Scholarship America are excellent resources to begin your search. Start early and apply to as many as possible.

5. Explore Federal Student Aid (FAFSA):

Completing the Free Application for Federal Student Aid (FAFSA) is crucial. This application determines your eligibility for federal grants, loans, and work-study programs. The earlier you file, the better your chances of securing aid.

6. Consider Private Student Loans:

Private student loans can help bridge the gap between financial aid and the total cost of education. However, carefully compare interest rates, repayment terms, and fees before borrowing. Prioritize federal loans first due to their typically more favorable terms.

7. Tap into Employer Tuition Reimbursement Programs:

Many employers offer tuition reimbursement programs for employees pursuing higher education. Check with your HR department to see if such a benefit is available to you.

8. Explore Work-Study Programs:

Work-study programs allow students to earn money while attending college. These programs can significantly reduce the need for borrowing and provide valuable work experience.

9. Explore Community College as a Stepping Stone:

Starting with a community college can significantly reduce the overall cost of a four-year degree. Many community colleges offer affordable tuition and transfer pathways to four-year institutions.

Conclusion:

Funding your child's higher education requires careful planning and a proactive approach. By combining several of these methods, you can create a comprehensive financial strategy that minimizes debt and maximizes the chances of your child achieving their educational goals. Remember to consult with a financial advisor to personalize a plan that best suits your individual circumstances. Start planning today to secure your child's future!

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on 9 Proven Methods To Fund Your Child's Higher Education. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Care Line Live Secures Major Investment From Accel Kkr

Jun 03, 2025

Care Line Live Secures Major Investment From Accel Kkr

Jun 03, 2025 -

Tom Daleys Support Guiding Closeted Queer Athletes

Jun 03, 2025

Tom Daleys Support Guiding Closeted Queer Athletes

Jun 03, 2025 -

Olympic Diver Tom Daley A Lifeline For Closeted Queer Athletes

Jun 03, 2025

Olympic Diver Tom Daley A Lifeline For Closeted Queer Athletes

Jun 03, 2025 -

First Time Buyer Mortgages Understanding The 31 Year Loan Landscape

Jun 03, 2025

First Time Buyer Mortgages Understanding The 31 Year Loan Landscape

Jun 03, 2025 -

When Will My Social Security Arrive In June A Complete Guide

Jun 03, 2025

When Will My Social Security Arrive In June A Complete Guide

Jun 03, 2025

Latest Posts

-

Fox News Flash Top Entertainment Headlines This Week

Aug 03, 2025

Fox News Flash Top Entertainment Headlines This Week

Aug 03, 2025 -

How Did The Manhattan Shooter Obtain A Gun Despite Past Psychiatric Holds

Aug 03, 2025

How Did The Manhattan Shooter Obtain A Gun Despite Past Psychiatric Holds

Aug 03, 2025 -

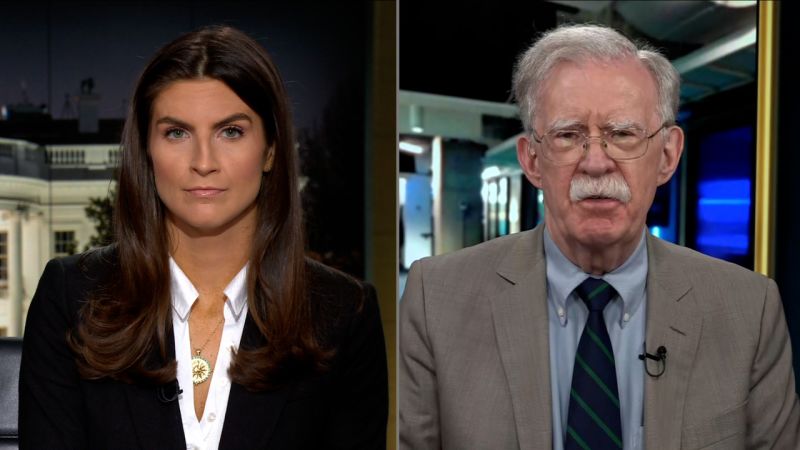

Very Risky Business Bolton Criticizes Trumps Controversial Nuclear Submarine Plan

Aug 03, 2025

Very Risky Business Bolton Criticizes Trumps Controversial Nuclear Submarine Plan

Aug 03, 2025 -

International Condemnation Mounts Following Killing Of Aid Worker In Gaza

Aug 03, 2025

International Condemnation Mounts Following Killing Of Aid Worker In Gaza

Aug 03, 2025 -

Death Of Palestinian Red Crescent Worker Israeli Strike Condemned

Aug 03, 2025

Death Of Palestinian Red Crescent Worker Israeli Strike Condemned

Aug 03, 2025