Air Canada's $500 Million Share Buyback: Preliminary Results Announced

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Air Canada's $500 Million Share Buyback: Preliminary Results Show Strong Investor Confidence

Air Canada (AC.TO) has announced preliminary results for its substantial $500 million normal course issuer bid (NCIB) share buyback program, signaling strong confidence in the company's future prospects. The program, launched earlier this year, aimed to repurchase up to 25 million of its outstanding common shares, representing a significant investment in its own equity. While the full details are yet to be released, early indications suggest a robust uptake, reflecting positive investor sentiment.

This move underscores Air Canada's commitment to enhancing shareholder value and comes at a time of significant recovery within the airline industry following the challenges posed by the COVID-19 pandemic. The buyback program is a strategic maneuver designed to boost earnings per share and potentially increase the share price.

What does this mean for investors?

The preliminary results of Air Canada's share buyback program are a positive sign for several reasons:

- Increased Shareholder Value: By reducing the number of outstanding shares, the company increases the value of each remaining share, potentially benefiting existing shareholders.

- Demonstrates Confidence: The significant investment in its own stock demonstrates Air Canada's belief in its future financial performance and growth potential.

- Potential for Increased Share Price: Buyback programs often lead to increased demand for the stock, potentially driving up the share price. This is particularly relevant given Air Canada's ongoing recovery.

Analyzing Air Canada's Financial Health:

The success of the share buyback program is intertwined with Air Canada's overall financial health. The airline has been working diligently to navigate the post-pandemic landscape, focusing on operational efficiency and cost-cutting measures. Recent financial reports will provide further insight into the company's performance and ability to sustain such a large buyback. Analysts will be closely examining key metrics such as:

- Revenue Growth: Examining the growth in passenger numbers and associated revenue is crucial in understanding Air Canada's recovery trajectory.

- Operating Costs: Monitoring the airline's efficiency in managing operating costs, including fuel and labor, is vital to assess its profitability.

- Debt Levels: Air Canada's debt load, incurred during the pandemic, will continue to be a key factor in assessing its financial stability.

Looking Ahead:

Air Canada's commitment to its share buyback program demonstrates a positive outlook for the future. The complete results will provide a clearer picture of the program's success and its impact on shareholder value. Investors are advised to stay informed about the company's upcoming financial reports and announcements for a comprehensive understanding of its financial performance and strategic direction. This significant investment, coupled with ongoing recovery efforts, suggests a promising path forward for the airline. Further analysis will be needed to determine the long-term effects of this buyback program on Air Canada's stock price and overall investor confidence.

Keywords: Air Canada, share buyback, NCIB, $500 million, investor confidence, stock repurchase, AC.TO, airline industry recovery, shareholder value, earnings per share, financial performance, stock price, revenue growth, operating costs, debt levels, financial reports.

Call to Action: Stay informed about Air Canada's financial news by following reputable financial news sources and the company's investor relations page. Consider consulting with a financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Air Canada's $500 Million Share Buyback: Preliminary Results Announced. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Ausar Thompson Drafted By Mavericks Le Brons Perspective And Future Implications

Jun 26, 2025

Ausar Thompson Drafted By Mavericks Le Brons Perspective And Future Implications

Jun 26, 2025 -

Analysis Air Canadas 500 Million Share Buyback And Its Impact On Stock Price

Jun 26, 2025

Analysis Air Canadas 500 Million Share Buyback And Its Impact On Stock Price

Jun 26, 2025 -

International Tensions Rise Uk Deploys Nuclear Jets Trump Uses Profanity

Jun 26, 2025

International Tensions Rise Uk Deploys Nuclear Jets Trump Uses Profanity

Jun 26, 2025 -

End Of Testimony Prosecution And Defense Conclude Cases In Diddy Trial

Jun 26, 2025

End Of Testimony Prosecution And Defense Conclude Cases In Diddy Trial

Jun 26, 2025 -

Irans Supreme Leader Missing Khameneis Absence Sparks Concerns And Rumors

Jun 26, 2025

Irans Supreme Leader Missing Khameneis Absence Sparks Concerns And Rumors

Jun 26, 2025

Latest Posts

-

Iran Crisis Trump Confirms Putin Offered Help According To Cnn

Jun 26, 2025

Iran Crisis Trump Confirms Putin Offered Help According To Cnn

Jun 26, 2025 -

Cnn On Iran Pro Government Demonstrators Reject Ceasefire As Solution

Jun 26, 2025

Cnn On Iran Pro Government Demonstrators Reject Ceasefire As Solution

Jun 26, 2025 -

Historic Night The Weeknds Empower Field Performance In Pictures

Jun 26, 2025

Historic Night The Weeknds Empower Field Performance In Pictures

Jun 26, 2025 -

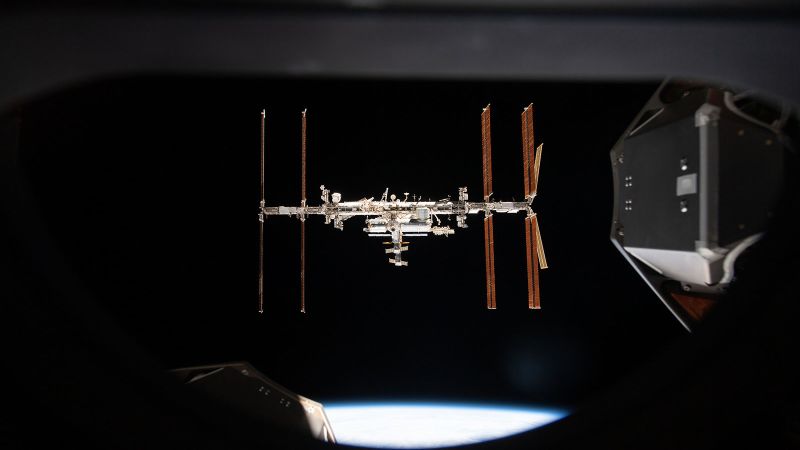

Four Astronauts Embark On Iss Mission As Nasa Battles Unidentified Leak

Jun 26, 2025

Four Astronauts Embark On Iss Mission As Nasa Battles Unidentified Leak

Jun 26, 2025 -

Exclusive Us Military Action In Iran Failed To Damage Nuclear Facilities

Jun 26, 2025

Exclusive Us Military Action In Iran Failed To Damage Nuclear Facilities

Jun 26, 2025