Alabama-Based Firm Divests Bank Of America Holdings: Birmingham Capital Management's Recent Sale

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Alabama-Based Firm Divests Bank of America Holdings: Birmingham Capital Management's Strategic Sale

Birmingham, AL – October 26, 2023 – Birmingham Capital Management (BCM), a prominent Alabama-based investment firm, has announced the divestment of its significant holdings in Bank of America (BAC). This strategic move, revealed in a recent SEC filing, has sparked considerable interest within the financial community, prompting questions about BCM's future investment strategy and the broader implications for Bank of America's stock performance.

The exact size of BCM's holdings and the sale price remain undisclosed, fueling speculation among market analysts. However, sources familiar with the matter suggest the divestment represents a substantial portion of BCM's portfolio. This decision comes at a time of significant market volatility and uncertainty, leading many to analyze the underlying reasons for this strategic shift.

Why the Divestment? Unpacking Birmingham Capital Management's Decision

While BCM has not publicly commented on the specifics of the sale, several factors could have contributed to this decision. These include:

-

Market Conditions: The current economic climate, marked by inflation and rising interest rates, has created a challenging environment for investors. BCM may have chosen to divest from Bank of America to reallocate capital into sectors perceived as less vulnerable to economic downturns.

-

Portfolio Diversification: BCM may be seeking to diversify its investment portfolio, reducing its exposure to a single, albeit major, financial institution. This is a standard practice among investment firms aiming to mitigate risk.

-

Profit-Taking: Given Bank of America's relatively strong performance in recent years, BCM might have decided to secure profits by selling its holdings at what it deems a favorable price point.

-

Shifting Investment Strategy: The divestment might signal a broader shift in BCM's investment strategy. The firm may be focusing on different sectors or investment vehicles that align better with its long-term goals.

Implications for Bank of America and the Broader Market

The impact of BCM's sale on Bank of America's stock price remains to be seen. While the divestment of a large holding could theoretically trigger a slight downward pressure, analysts suggest the impact will likely be minimal given Bank of America's overall market capitalization and trading volume. However, the move underscores the ongoing adjustments and reassessments taking place within the financial sector in response to current macroeconomic conditions.

This event highlights the dynamic nature of the investment world and the constant need for firms to adapt to evolving market forces. BCM’s decision serves as a case study for other investment firms navigating uncertainty and the importance of strategic portfolio management.

What's Next for Birmingham Capital Management?

Following this significant divestment, investors and analysts are closely watching Birmingham Capital Management's future moves. Will they reinvest the proceeds into similar financial institutions or explore alternative asset classes? The firm’s next steps will provide valuable insights into its evolving investment philosophy and offer a compelling narrative for market observers. Further updates and information are expected in the coming weeks.

Keywords: Birmingham Capital Management, Bank of America, BAC, Investment Firm, Alabama, Stock Market, Divestment, Portfolio Management, SEC Filing, Market Volatility, Economic Uncertainty, Investment Strategy, Financial News

Related Articles: (Links to relevant articles about market volatility, Bank of America performance, or other news related to BCM, if available)

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Alabama-Based Firm Divests Bank Of America Holdings: Birmingham Capital Management's Recent Sale. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Eleven Dead Four Identified Closure For Families After Wwii Bomber Crash

May 28, 2025

Eleven Dead Four Identified Closure For Families After Wwii Bomber Crash

May 28, 2025 -

Emotional Goodbye Rafael Nadal Honored At Roland Garros

May 28, 2025

Emotional Goodbye Rafael Nadal Honored At Roland Garros

May 28, 2025 -

Alabama Based Firm Divests Bank Of America Holdings Birmingham Capital Managements Recent Sale

May 28, 2025

Alabama Based Firm Divests Bank Of America Holdings Birmingham Capital Managements Recent Sale

May 28, 2025 -

Harvard Vs Trump A Graduates Perspective On Institutional Choice

May 28, 2025

Harvard Vs Trump A Graduates Perspective On Institutional Choice

May 28, 2025 -

A Critical Look At Harvard My Perspective And The Trump Comparison

May 28, 2025

A Critical Look At Harvard My Perspective And The Trump Comparison

May 28, 2025

Latest Posts

-

Israeli Hostages Grueling Account Torture And Captivity Under Hamas

May 30, 2025

Israeli Hostages Grueling Account Torture And Captivity Under Hamas

May 30, 2025 -

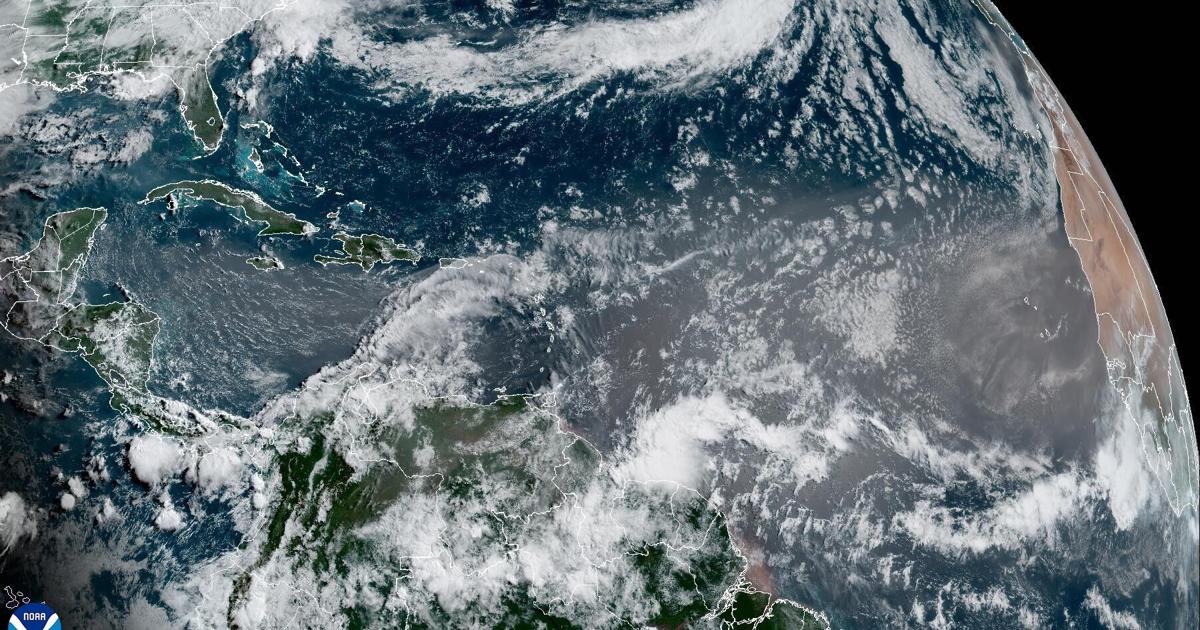

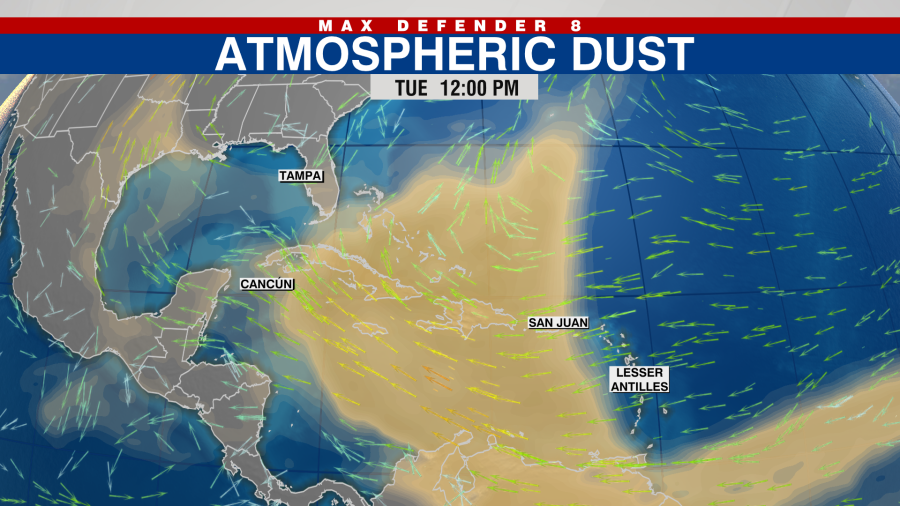

Louisiana Sunset Spectacle Saharan Dust Plume Forecast

May 30, 2025

Louisiana Sunset Spectacle Saharan Dust Plume Forecast

May 30, 2025 -

Kemi Badenoch Facing Criticism Total Disaster Claim Rocks Conservative Party

May 30, 2025

Kemi Badenoch Facing Criticism Total Disaster Claim Rocks Conservative Party

May 30, 2025 -

Saharan Dust Storm Florida Impact And Health Concerns

May 30, 2025

Saharan Dust Storm Florida Impact And Health Concerns

May 30, 2025 -

West Bank Settlements Israel Announces Substantial Expansion

May 30, 2025

West Bank Settlements Israel Announces Substantial Expansion

May 30, 2025