Alabama-Based Firm Sells Bank Of America Stock: Birmingham Capital Management's Recent Trade

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Alabama-Based Firm Sells Bank of America Stock: Birmingham Capital Management's Recent Trade Sparks Investor Interest

Birmingham, AL – October 26, 2023 – Birmingham Capital Management, a prominent Alabama-based investment firm, has made headlines with its recent decision to offload a significant portion of its Bank of America (BAC) stock holdings. The move, revealed in a recent SEC filing, has sparked considerable interest amongst market analysts and individual investors alike, prompting questions about the firm's investment strategy and the future prospects of the financial giant.

The exact amount of Bank of America stock sold by Birmingham Capital Management remains undisclosed, fueling speculation about the motivations behind the trade. While the firm hasn't publicly commented on the specifics, the sale comes at a time of fluctuating market conditions and increasing uncertainty within the banking sector.

<h3>Why the Sell-Off? Analyzing Potential Factors</h3>

Several factors could have contributed to Birmingham Capital Management's decision to reduce its BAC exposure. These include:

-

Market Volatility: The current economic climate is marked by significant volatility, with interest rate hikes and inflation impacting various sectors, including finance. A strategic divestment from Bank of America might be a precautionary measure to mitigate potential risks associated with this instability. [Link to article on current market volatility]

-

Profit-Taking: After a period of growth, the firm might have decided to lock in profits from its Bank of America investment. This is a common strategy employed by investment firms to secure gains and re-allocate capital to other potentially more lucrative opportunities.

-

Shifting Investment Strategy: Birmingham Capital Management may be adjusting its overall investment portfolio, shifting its focus towards other sectors or investment vehicles deemed more promising in the current market. This realignment of assets could necessitate the sale of existing holdings, including Bank of America stock.

-

Concerns about the Banking Sector: While Bank of America remains a major player, concerns about the overall health of the banking sector could have influenced the decision. Rising interest rates and potential economic downturns can put pressure on banks' profitability.

<h3>Impact on Bank of America Stock and Investor Sentiment</h3>

The news of Birmingham Capital Management's sell-off has undoubtedly impacted investor sentiment regarding Bank of America stock. While the immediate impact might be limited, large-scale sell-offs by influential investment firms can influence market trends and potentially lead to further price fluctuations. It's crucial for investors to carefully analyze market trends and conduct thorough research before making any investment decisions based on this news.

<h3>Birmingham Capital Management: A Closer Look</h3>

Birmingham Capital Management is known for its [insert description of the firm's investment strategy and history - e.g., conservative approach, focus on value investing, etc.]. Understanding the firm's typical investment philosophy can provide further context to this recent trade. More information about Birmingham Capital Management can be found on [link to firm's website, if available].

<h3>Looking Ahead: What to Expect</h3>

The long-term effects of this sale remain to be seen. Further analysis and potential commentary from Birmingham Capital Management are needed to fully understand the reasoning behind this significant move. Investors should stay informed about market developments and consult with financial advisors before making any investment decisions.

Disclaimer: This article provides general information and does not constitute financial advice. Always consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Alabama-Based Firm Sells Bank Of America Stock: Birmingham Capital Management's Recent Trade. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Sirius Xm Stock Has Its Millionaire Making Potential Peaked

May 27, 2025

Sirius Xm Stock Has Its Millionaire Making Potential Peaked

May 27, 2025 -

Memorial Day Shopping T J Maxx Store Hours And Sales Events

May 27, 2025

Memorial Day Shopping T J Maxx Store Hours And Sales Events

May 27, 2025 -

Andriy Portnovs Killing A Look At The Unresolved Questions And Fallout

May 27, 2025

Andriy Portnovs Killing A Look At The Unresolved Questions And Fallout

May 27, 2025 -

Sirius Xm Holdings Stock Analysis Weighing The Risks And Rewards

May 27, 2025

Sirius Xm Holdings Stock Analysis Weighing The Risks And Rewards

May 27, 2025 -

Wwii Bomber Crash Four Airmen Finally Coming Home After 79 Years

May 27, 2025

Wwii Bomber Crash Four Airmen Finally Coming Home After 79 Years

May 27, 2025

Latest Posts

-

Fake Text Message From Ga Department Of Driver Services Is It A Scam

May 28, 2025

Fake Text Message From Ga Department Of Driver Services Is It A Scam

May 28, 2025 -

Thames Valley Police Man Charged In Crash That Injured Officer

May 28, 2025

Thames Valley Police Man Charged In Crash That Injured Officer

May 28, 2025 -

See Through Style Alexandra Daddarios Daring Dress Choice

May 28, 2025

See Through Style Alexandra Daddarios Daring Dress Choice

May 28, 2025 -

Are Americans Still Welcome In Canada Canadians Weigh In

May 28, 2025

Are Americans Still Welcome In Canada Canadians Weigh In

May 28, 2025 -

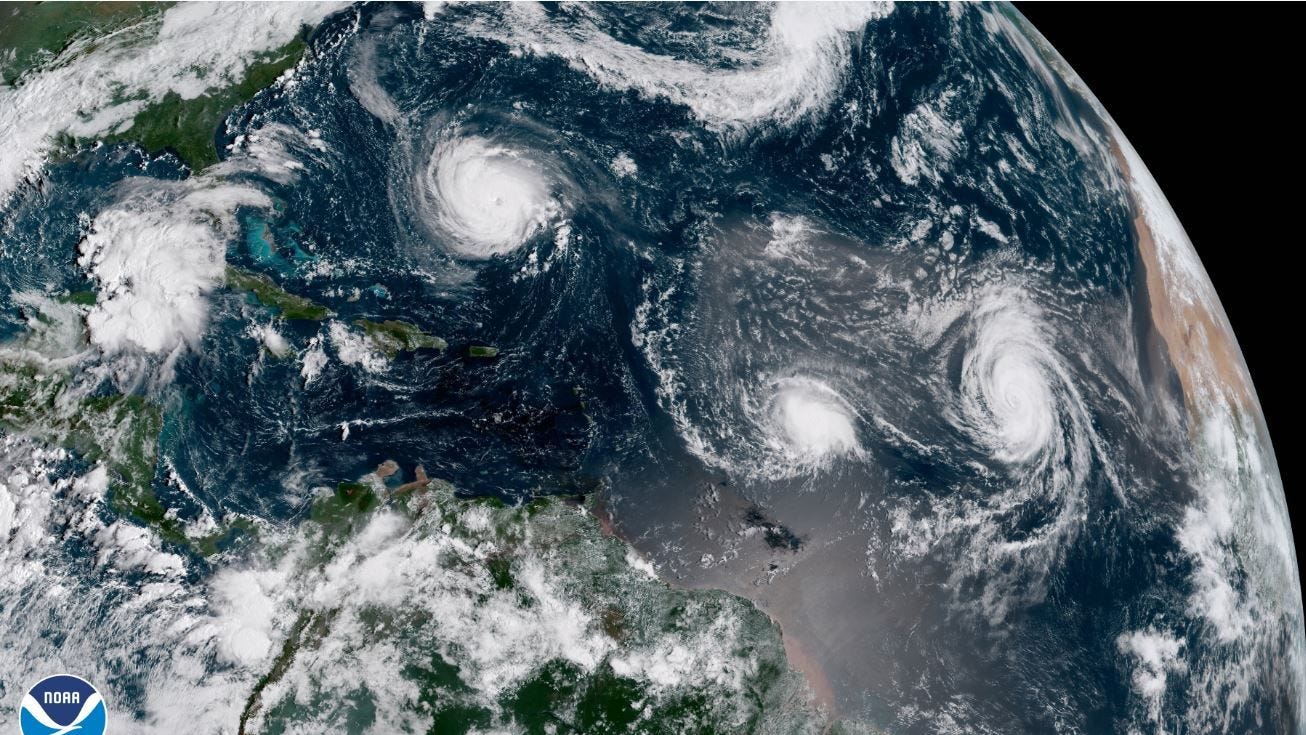

Preparing For The 2025 Hurricane Season Answers To Key Questions

May 28, 2025

Preparing For The 2025 Hurricane Season Answers To Key Questions

May 28, 2025