Amazon (AMZN) Stock: A Momentum Play? Here's The Analysis.

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Amazon (AMZN) Stock: A Momentum Play? Here's the Analysis.

Amazon (AMZN) stock has experienced a rollercoaster ride in recent years, leaving investors questioning whether it's a worthwhile investment. While the tech giant faces ongoing challenges, analysts are divided on whether its current upward trajectory represents sustainable momentum or a temporary surge. This in-depth analysis explores the key factors influencing AMZN's stock price and helps determine if it's a smart addition to your portfolio.

The Current Market Sentiment:

Positive sentiment surrounding Amazon is fueled by several factors. The recent resurgence in e-commerce, coupled with the growth of Amazon Web Services (AWS), has boosted investor confidence. AWS, in particular, continues to dominate the cloud computing market, providing a reliable stream of revenue and profits. This is a critical point for many analysts who see AWS as the core strength driving future growth.

However, concerns remain. Inflation, rising interest rates, and a potential economic slowdown cast a shadow on the overall market, and Amazon is not immune. The company's recent layoffs and cost-cutting measures underscore the challenges it's navigating.

Key Factors Affecting AMZN Stock Price:

- AWS Growth: The continued expansion of AWS is arguably the most significant driver of AMZN's stock price. Its market dominance and potential for future growth are major attractions for investors. Further expansion into emerging markets will be a key indicator to watch.

- E-commerce Performance: While facing competition from other major players, Amazon's e-commerce business remains a significant revenue generator. Its ability to adapt to changing consumer behavior and maintain market share will heavily influence its future performance. Consider the impact of factors like supply chain disruptions and changing consumer spending habits.

- Advertising Revenue: Amazon's advertising business is rapidly growing, presenting another significant revenue stream. Its integration with its e-commerce platform offers a powerful advertising ecosystem. Future growth in this sector will be crucial for overall stock valuation.

- Profitability: While revenue growth is impressive, consistent and growing profitability is essential for long-term investor confidence. Amazon's ability to manage costs and improve margins will be a key factor in determining future stock performance. Look for updates on operating margins and net income.

- Competition: Intense competition from companies like Walmart, Target, and other e-commerce giants presents a significant challenge. Amazon's ability to innovate and maintain a competitive edge is vital.

Is AMZN a Momentum Play?

Whether Amazon is currently a momentum play depends on your investment horizon and risk tolerance. The short-term outlook is uncertain due to macroeconomic headwinds. However, the long-term prospects, driven by AWS growth and the potential of its other business segments, remain promising for many analysts.

Analyzing the Risks:

- Economic Slowdown: A significant economic downturn could negatively impact both AWS and e-commerce revenue.

- Increased Competition: The competitive landscape is intense, and maintaining market share will require significant investment and innovation.

- Regulatory Scrutiny: Amazon faces regulatory scrutiny across various markets, which could impact its operations and profitability.

Conclusion:

Amazon's stock price is a complex interplay of numerous factors. While the recent upward trend suggests momentum, investors need to carefully consider the risks and long-term prospects before making an investment decision. Thorough due diligence, including examining financial statements and industry analysis, is crucial. Consult a financial advisor before making any investment choices. The information presented here is for informational purposes only and should not be construed as financial advice.

Further Research:

For more in-depth analysis, consider exploring resources like financial news websites (e.g., [link to a reputable financial news site]), SEC filings ([link to SEC EDGAR database]), and independent research reports. Remember to always conduct thorough research before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Amazon (AMZN) Stock: A Momentum Play? Here's The Analysis.. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Bucks Gamble Is Doc Rivers Enough To Keep Giannis In Milwaukee

May 28, 2025

Bucks Gamble Is Doc Rivers Enough To Keep Giannis In Milwaukee

May 28, 2025 -

Are Americans Welcome In Canada Examining The Recent Boycott Movement

May 28, 2025

Are Americans Welcome In Canada Examining The Recent Boycott Movement

May 28, 2025 -

Hedge Fund Two Sigma Takes Large Position In Bank Of America Bac

May 28, 2025

Hedge Fund Two Sigma Takes Large Position In Bank Of America Bac

May 28, 2025 -

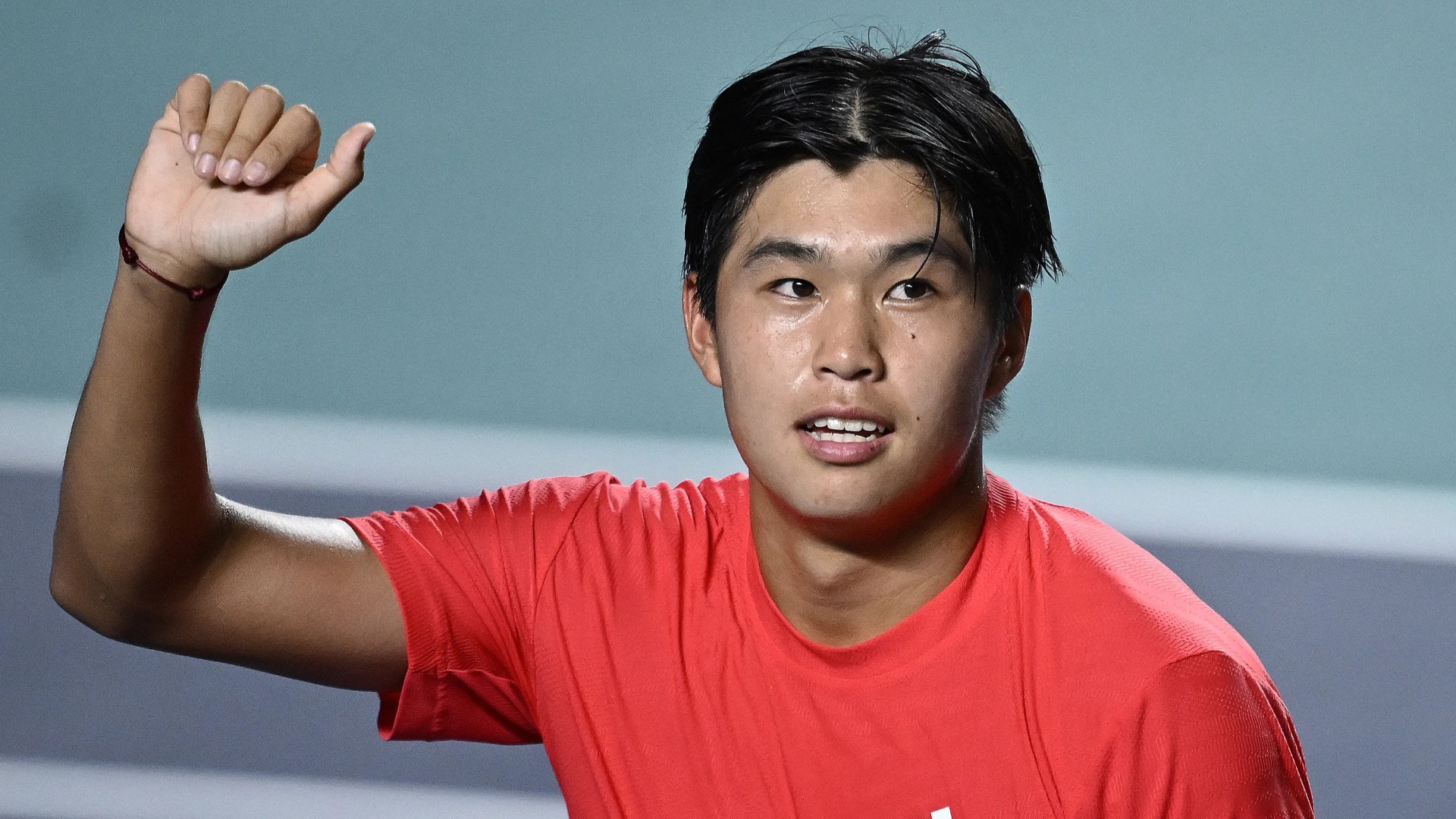

A Mothers Legacy Us Tennis Phenom Aims To Defeat World No 3

May 28, 2025

A Mothers Legacy Us Tennis Phenom Aims To Defeat World No 3

May 28, 2025 -

Record Breaking Everest Expedition Fuels Debate On Anesthetic Gas Use In Mountaineering

May 28, 2025

Record Breaking Everest Expedition Fuels Debate On Anesthetic Gas Use In Mountaineering

May 28, 2025

Latest Posts

-

Tornado Warning Durbin Crossing And Liberty Pines Academy Impacted

Jun 01, 2025

Tornado Warning Durbin Crossing And Liberty Pines Academy Impacted

Jun 01, 2025 -

Historic Data Center Growth Tests Georgia Powers Grid Capacity Forecasts

Jun 01, 2025

Historic Data Center Growth Tests Georgia Powers Grid Capacity Forecasts

Jun 01, 2025 -

More Pardons For Convicted Republicans Trumps Latest Actions

Jun 01, 2025

More Pardons For Convicted Republicans Trumps Latest Actions

Jun 01, 2025 -

Wilkes Barre Road Work Schedule Water Main Installation Impacts Traffic

Jun 01, 2025

Wilkes Barre Road Work Schedule Water Main Installation Impacts Traffic

Jun 01, 2025 -

Court Hearing Russell Brands Not Guilty Plea To Rape And Assault

Jun 01, 2025

Court Hearing Russell Brands Not Guilty Plea To Rape And Assault

Jun 01, 2025