Analyzing Coca-Cola (KO): Should You Invest Now?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Analyzing Coca-Cola (KO): Should You Invest Now?

Coca-Cola (KO), a name synonymous with refreshment and global reach, has been a staple in many investment portfolios for decades. But with market volatility and shifting consumer preferences, the question remains: is now the right time to invest in this iconic beverage giant? This in-depth analysis delves into Coca-Cola's current financial standing, future prospects, and potential risks to help you make an informed investment decision.

Coca-Cola's Strong Fundamentals: A Deep Dive

Coca-Cola boasts a remarkably resilient business model. Its diverse portfolio, including flagship brands like Coca-Cola, Sprite, and Fanta, alongside a growing portfolio of sparkling and still waters, ensures a broad appeal across various demographics. This diversification mitigates risk associated with relying on a single product.

-

Consistent Revenue Growth: Despite economic fluctuations, Coca-Cola consistently generates strong revenue streams. This stability is largely due to its global presence and the enduring popularity of its core products. [Link to Coca-Cola's Investor Relations page for financial reports].

-

Strong Brand Recognition: The Coca-Cola brand enjoys unparalleled global recognition and loyalty. This brand equity is a significant asset, providing a competitive advantage in a crowded beverage market.

-

Efficient Distribution Network: The company's vast and efficient distribution network ensures its products reach consumers worldwide, enhancing its market penetration and profitability.

-

Dividend History: Coca-Cola has a long and consistent history of paying dividends, making it attractive to income-seeking investors. This reliable dividend payout is a key factor for many considering KO as a long-term investment. [Link to a reputable financial resource detailing KO's dividend history].

Navigating the Challenges: Headwinds Facing Coca-Cola

While the fundamentals remain strong, Coca-Cola faces several challenges:

-

Shifting Consumer Preferences: Growing health consciousness and a preference for healthier alternatives are impacting demand for sugary drinks. Coca-Cola is actively addressing this by expanding its portfolio to include healthier options, but this transition takes time.

-

Competition: The beverage industry is highly competitive, with both established players and new entrants vying for market share. This necessitates continuous innovation and marketing efforts to maintain brand dominance.

-

Economic Uncertainty: Global economic instability and inflation can affect consumer spending, potentially impacting sales volume.

Should You Invest in Coca-Cola (KO) Now?

The decision of whether to invest in Coca-Cola depends on your individual investment goals and risk tolerance. For long-term investors seeking a relatively stable and dividend-paying stock, Coca-Cola can be a compelling option. However, investors seeking rapid growth may find other opportunities more appealing.

Factors to Consider:

-

Your Investment Timeline: Are you a long-term or short-term investor? Coca-Cola is generally considered a long-term investment.

-

Risk Tolerance: Are you comfortable with moderate levels of risk? While Coca-Cola is relatively stable, it's not immune to market fluctuations.

-

Diversification: Does Coca-Cola fit within your overall portfolio diversification strategy? It's crucial to avoid over-concentration in any single stock.

Conclusion:

Coca-Cola remains a powerful brand with a strong track record. Its consistent revenue generation, global reach, and dividend history are attractive to investors. However, the evolving consumer landscape and competitive pressures require careful consideration. Conduct thorough research and consult with a financial advisor before making any investment decisions. Remember, this analysis is for informational purposes only and is not financial advice.

Keywords: Coca-Cola, KO, stock, investment, dividend, beverage, analysis, financial, market, growth, risk, competition, consumer preferences, investor, portfolio, diversification.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Analyzing Coca-Cola (KO): Should You Invest Now?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Analysis Why Warren Buffett Sold These Two Prominent Us Investments

Jun 05, 2025

Analysis Why Warren Buffett Sold These Two Prominent Us Investments

Jun 05, 2025 -

Broadcom Stock Avgo Trajectory Assessing Trader Sentiment After Earnings

Jun 05, 2025

Broadcom Stock Avgo Trajectory Assessing Trader Sentiment After Earnings

Jun 05, 2025 -

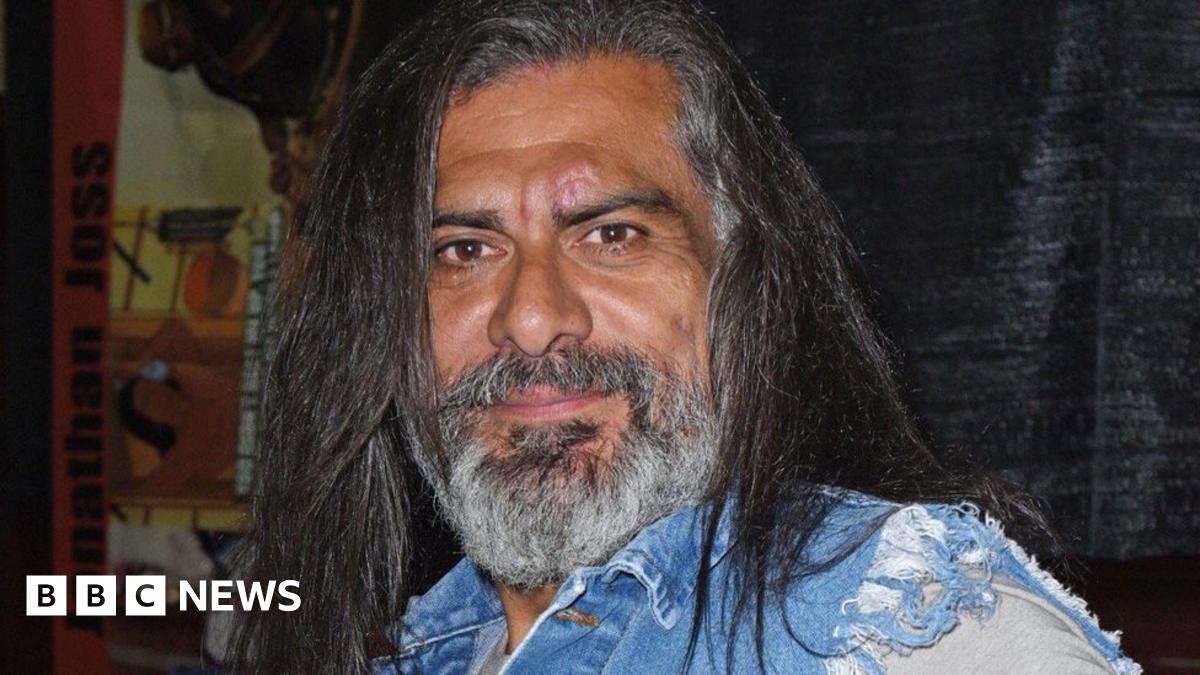

Confirmed Jonathan Joss John Redcorn In King Of The Hill Dies In Shooting

Jun 05, 2025

Confirmed Jonathan Joss John Redcorn In King Of The Hill Dies In Shooting

Jun 05, 2025 -

Blake Lively And Justin Baldoni Settle Lawsuit Two Claims Withdrawn

Jun 05, 2025

Blake Lively And Justin Baldoni Settle Lawsuit Two Claims Withdrawn

Jun 05, 2025 -

Penn State And Nfl Legends Jersey Why It Earned A Spot At The Smithsonian

Jun 05, 2025

Penn State And Nfl Legends Jersey Why It Earned A Spot At The Smithsonian

Jun 05, 2025

Latest Posts

-

Indian Clinical Trials Examining The Impact Of Mangoes On Blood Sugar Levels

Aug 17, 2025

Indian Clinical Trials Examining The Impact Of Mangoes On Blood Sugar Levels

Aug 17, 2025 -

Hong Kong Media And The Intensifying Us China Power Struggle

Aug 17, 2025

Hong Kong Media And The Intensifying Us China Power Struggle

Aug 17, 2025 -

The Ukrainian Peoples Struggle For Peace And Sovereignty

Aug 17, 2025

The Ukrainian Peoples Struggle For Peace And Sovereignty

Aug 17, 2025 -

Can Topshop Reclaim Its Place As A High Street Fashion Icon

Aug 17, 2025

Can Topshop Reclaim Its Place As A High Street Fashion Icon

Aug 17, 2025 -

Battlefield 6 Beta Review A Deep Dive Into Multiplayer Gameplay

Aug 17, 2025

Battlefield 6 Beta Review A Deep Dive Into Multiplayer Gameplay

Aug 17, 2025