Analyzing Robinhood Stock: Reasons For Continued Investor Interest

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Analyzing Robinhood Stock: Reasons for Continued Investor Interest

Robinhood, the commission-free trading app that stormed onto the financial scene, continues to attract significant investor attention despite facing challenges. While its stock price has experienced volatility, understanding the underlying reasons for continued investor interest is crucial for anyone considering adding RH to their portfolio. This article delves into the factors driving this persistent investor engagement.

H2: The Allure of a Disruptive Fintech Player

Robinhood's initial success stemmed from its disruptive business model. By eliminating trading commissions, it democratized investing, attracting millions of new, often younger, users. This massive user base remains a key driver of investor interest. The potential for future growth within this demographic, particularly as these users build wealth and trading sophistication, is considerable. This represents a significant untapped market that traditional brokerage firms struggle to penetrate.

H2: Beyond Commission-Free Trading: Expanding Services and Revenue Streams

While commission-free trading was its initial draw, Robinhood has since diversified its offerings. The introduction of cryptocurrency trading, options trading, and cash management accounts has broadened its revenue streams and appeal to a wider range of investors. This diversification strategy is seen as a positive sign by many analysts, mitigating the reliance on a single revenue source and enhancing the company's long-term prospects.

H3: The Ongoing Push for Enhanced Features and User Experience

Robinhood continues to invest heavily in improving its platform and adding new features. This commitment to innovation and user experience is crucial in retaining existing users and attracting new ones. Improvements in the app’s functionality, educational resources, and overall user interface can contribute significantly to sustained growth and investor confidence. Competition in the fintech sector is fierce, so continuous improvement is paramount.

H2: Navigating Regulatory Hurdles and Addressing Past Controversies

Robinhood hasn't been without its controversies. Past regulatory issues and criticisms regarding its handling of certain trades have impacted investor sentiment. However, the company’s efforts to address these concerns and improve its compliance practices are being closely watched. Successfully navigating regulatory hurdles and rebuilding trust with investors will be key to long-term success and continued market confidence.

H2: Long-Term Growth Potential and Market Position

Despite its challenges, Robinhood operates in a rapidly growing market segment. The increasing adoption of online brokerage and investment platforms presents significant opportunities for long-term growth. Furthermore, its established brand recognition and substantial user base provide a strong foundation for future expansion and market share gains.

H3: Analyzing the Risks:

It’s crucial to acknowledge the inherent risks associated with investing in Robinhood stock. The company’s profitability remains a concern, and its reliance on trading activity can make its performance susceptible to market fluctuations. Furthermore, the highly competitive fintech landscape poses ongoing challenges. Thorough due diligence and a comprehensive understanding of these risks are essential for any potential investor.

H2: Conclusion: A Cautiously Optimistic Outlook

While Robinhood’s stock price reflects a complex mix of successes and setbacks, the underlying potential for growth within the fintech sector remains compelling. The company’s efforts to diversify its revenue streams, enhance its platform, and navigate regulatory challenges will significantly influence its future performance. For investors, a thorough understanding of these factors, coupled with a realistic assessment of the inherent risks, is paramount before making any investment decisions. Consider consulting with a qualified financial advisor before investing in any stock, including Robinhood.

Keywords: Robinhood, RH stock, Robinhood stock analysis, Robinhood investor interest, fintech, commission-free trading, cryptocurrency trading, options trading, stock market, investing, investment platform, regulatory compliance, financial technology, stock market trends, risk assessment.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Analyzing Robinhood Stock: Reasons For Continued Investor Interest. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Three Girls Found Dead In Washington Police Search For Father

Jun 06, 2025

Three Girls Found Dead In Washington Police Search For Father

Jun 06, 2025 -

No Feud Walton Goggins And Aimee Lou Wood Discuss White Lotus Deleted Scenes And Instagram Drama

Jun 06, 2025

No Feud Walton Goggins And Aimee Lou Wood Discuss White Lotus Deleted Scenes And Instagram Drama

Jun 06, 2025 -

Robinhood Hood Stock Market Update 6 46 Gain On June 3

Jun 06, 2025

Robinhood Hood Stock Market Update 6 46 Gain On June 3

Jun 06, 2025 -

Dramatic Rescue In North Pacific 22 Sailors Saved After Car Carrier Blaze

Jun 06, 2025

Dramatic Rescue In North Pacific 22 Sailors Saved After Car Carrier Blaze

Jun 06, 2025 -

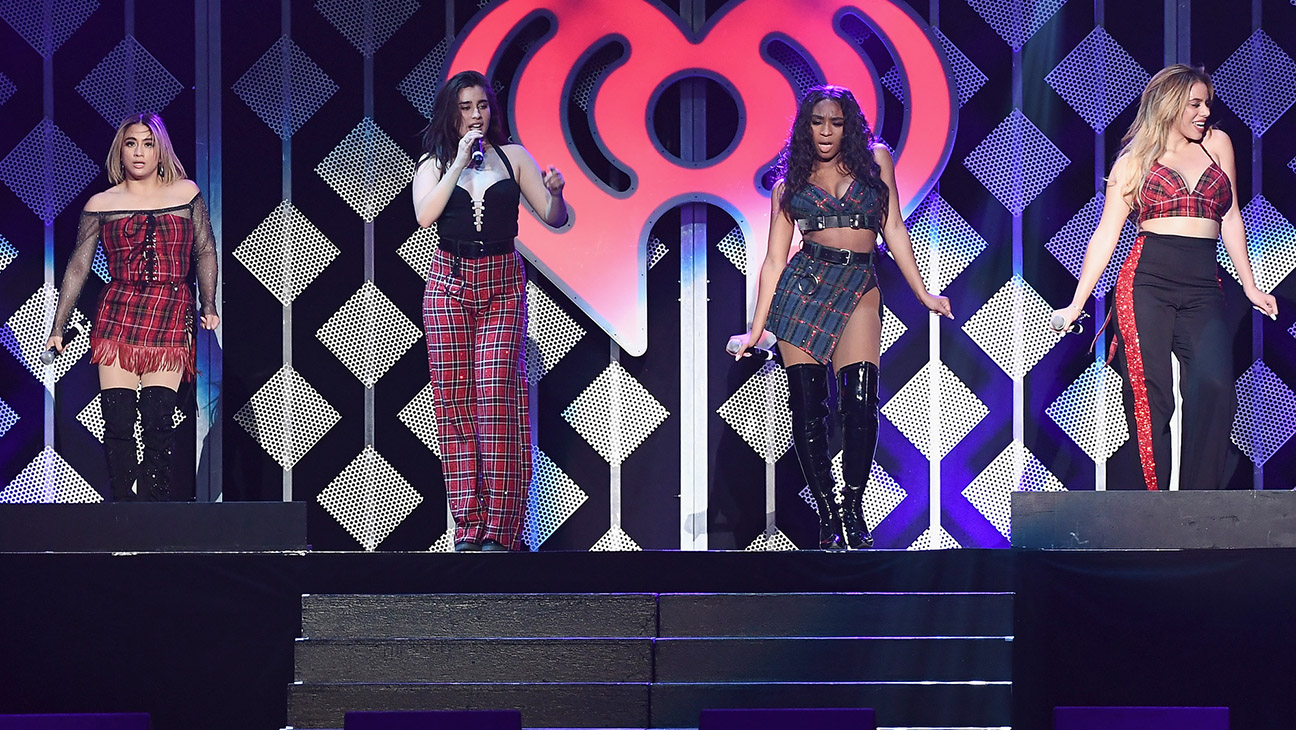

Fifth Harmony Reunion Post Camila Cabello Talks Exclusive

Jun 06, 2025

Fifth Harmony Reunion Post Camila Cabello Talks Exclusive

Jun 06, 2025

Latest Posts

-

Guilty Verdict Wisconsin Man Convicted In Killing And Dismembering Teen After First Date

Jun 06, 2025

Guilty Verdict Wisconsin Man Convicted In Killing And Dismembering Teen After First Date

Jun 06, 2025 -

Duchess Meghan Shares Adorable Pregnancy Dance Video

Jun 06, 2025

Duchess Meghan Shares Adorable Pregnancy Dance Video

Jun 06, 2025 -

Two Hostages Found Dead Israeli Military Operation In Southern Gaza Yields Grim Discovery

Jun 06, 2025

Two Hostages Found Dead Israeli Military Operation In Southern Gaza Yields Grim Discovery

Jun 06, 2025 -

Matthew Husseys Wife Pregnant Joyful News Following Camila Cabello Split

Jun 06, 2025

Matthew Husseys Wife Pregnant Joyful News Following Camila Cabello Split

Jun 06, 2025 -

Combs Trial Update Venturas Friend Takes Stand Again

Jun 06, 2025

Combs Trial Update Venturas Friend Takes Stand Again

Jun 06, 2025